PNC Bank 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

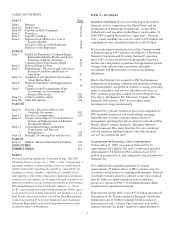

TABLE OF CONTENTS

PART I Page

Item 1 Business. 2

Item 1A Risk Factors. 10

Item 1B Unresolved Staff Comments. 17

Item 2 Properties. 17

Item 3 Legal Proceedings. 17

Item 4 Submission of Matters to a Vote of

Security Holders.

Executive Officers of the Registrant

Directors of the Registrant

17

18

18

PART II

Item 5 Market for Registrant’s Common Equity,

Related Stockholder Matters and Issuer

Purchases of Equity Securities. 19

Common Stock Performance Graph 20

Item 6 Selected Financial Data. 21

Item 7 Management’s Discussion and Analysis of

Financial Condition and Results of

Operations 23

Item 7A Quantitative and Qualitative Disclosures

About Market Risk. 79

Item 8 Financial Statements and Supplementary

Data. 79

Item 9 Changes in and Disagreements With

Accountants on Accounting and

Financial Disclosure. 162

Item 9A Controls and Procedures. 162

Item 9B Other Information. 162

PART III

Item 10 Directors, Executive Officers and

Corporate Governance. 162

Item 11 Executive Compensation. 163

Item 12 Security Ownership of Certain Beneficial

Owners and Management and Related

Stockholder Matters. 163

Item 13 Certain Relationships and Related

Transactions, and Director

Independence. 165

Item 14 Principal Accounting Fees and Services. 165

PART IV

Item 15 Exhibits, Financial Statement Schedules. 165

SIGNATURES 167

EXHIBIT INDEX E-1

PART I

Forward-Looking Statements: From time to time, The PNC

Financial Services Group, Inc. (“PNC” or the “Corporation”)

has made and may continue to make written or oral forward-

looking statements regarding our outlook or expectations for

earnings, revenues, expenses, capital levels, liquidity levels,

asset quality or other future financial or business performance,

strategies or expectations, or the impact of legal, regulatory or

supervisory matters on our business operations or performance.

This Annual Report on Form 10-K (the “Report” or “Form

10-K”) also includes forward-looking statements. With respect

to all such forward- looking statements, you should review our

Risk Factors discussion in Item 1A and our Risk Management,

Critical Accounting Policies and Judgments, and Cautionary

Statement Regarding Forward-Looking Information sections

included in Item 7 of this Report.

ITEM

1–

BUSINESS

BUSINESS OVERVIEW

We are one of the largest diversified

financial services companies in the United States and are

headquartered in Pittsburgh, Pennsylvania. As described

further below and elsewhere in this Report, on December 31,

2008, PNC acquired National City Corporation (“National

City”), nearly doubling our assets to a total of $291 billion and

expanding our total consolidated deposits to $193 billion.

We were incorporated under the laws of the Commonwealth

of Pennsylvania in 1983 with the consolidation of Pittsburgh

National Corporation and Provident National Corporation.

Since 1983, we have diversified our geographical presence,

business mix and product capabilities through internal growth,

strategic bank and non-bank acquisitions and equity

investments, and the formation of various non-banking

subsidiaries.

Prior to the National City acquisition, PNC had businesses

engaged in retail banking, corporate and institutional banking,

asset management, and global investment servicing, providing

many of its products and services nationally and others in

PNC’s primary geographic markets located in Pennsylvania,

New Jersey, Washington, DC, Maryland, Virginia, Ohio,

Kentucky and Delaware. PNC also provided certain

investment servicing internationally.

National City’s primary businesses prior to its acquisition by

PNC included commercial and retail banking, mortgage

financing and servicing, consumer finance and asset

management, operating through an extensive network in Ohio,

Florida, Illinois, Indiana, Kentucky, Michigan, Missouri,

Pennsylvania and Wisconsin. National City also conducted

selected consumer lending businesses and other financial

services on a nationwide basis.

A

CQUISITION

O

F

N

ATIONAL

C

ITY

C

ORPORATION

On December 31, 2008, we acquired National City for

approximately $6.1 billion. The total consideration included

approximately $5.6 billion of PNC common stock, $150

million of preferred stock, and cash paid to warrant holders by

National City.

We completed the acquisition primarily by issuing

approximately 95 million shares of PNC common stock. In

accordance with purchase accounting methodologies, National

City Bank’s balance sheet was adjusted to fair value at which

time the bank was under-capitalized from a regulatory

perspective. However, PNC’s Consolidated Balance Sheet

remained well-capitalized and liquid.

Following the closing, PNC received $7.6 billion from the US

Department of the Treasury under the Emergency Economic

Stabilization Act of 2008 in exchange for the issuance of

preferred stock and a warrant. These proceeds were used to

enhance National City Bank’s regulatory capital position to

2