PNC Bank 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

5A

SSET

Q

UALITY

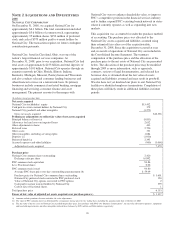

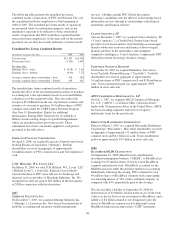

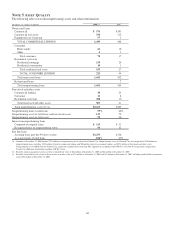

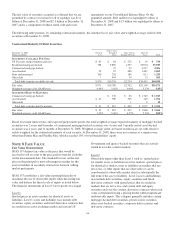

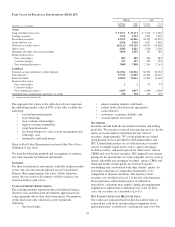

The following table sets forth nonperforming assets and related information:

December 31 - dollars in millions 2008 (a) 2007

Nonaccrual loans

Commercial $ 576 $193

Commercial real estate 766 212

Equipment lease financing 97 3

TOTAL COMMERCIAL LENDING 1,439 408

Consumer

Home equity 66 16

Other 41

Total consumer 70 17

Residential real estate

Residential mortgage 139 26

Residential construction 14 1

Total residential real estate 153 27

TOTAL CONSUMER LENDING 223 44

Total nonaccrual loans 1,662 452

Restructured loans 2

Total nonperforming loans 1,662 454

Foreclosed and other assets

Commercial lending 34 23

Consumer 11 8

Residential real estate 458 10

Total foreclosed and other assets 503 41

Total nonperforming assets (b) (c) $2,165 $495

Nonperforming loans to total loans .95% .66%

Nonperforming assets to total loans and foreclosed assets 1.23 .72

Nonperforming assets to total assets .74 .36

Interest on nonperforming loans

Computed on original terms $ 115 $51

Recognized prior to nonperforming status 60 32

Past due loans

Accruing loans past due 90 days or more $3,259 $136

As a percentage of total loans 1.86% .20%

(a) Amounts at December 31, 2008 include $722 million of nonperforming assets related to National City. Nonperforming assets of National City are comprised of $250 million of

nonperforming loans, including $154 million related to commercial lending and $96 million related to consumer lending, and $472 million of foreclosed and other assets.

Nonperforming assets added with the National City acquisition excluded those loans that PNC impaired in accordance with SOP 03-3. See Note 6 Certain Loans Acquired in a

Transfer for additional information regarding SOP 03-3 loans.

(b) Excludes equity management assets carried at estimated fair value of $42 million at December 31, 2008 and $4 million at December 31, 2007.

(c) Excludes loans held for sale carried at lower of cost or market value of $78 million at December 31, 2008 and $25 million at December 31, 2007, including troubled debt restructured

assets of $5 million at December 31, 2008.

105