PNC Bank 2008 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

amount of unrecognized tax benefit related to permanent

differences because a portion of those unrecognized benefits

relate to state tax matters.

It is reasonably possible that the liability for uncertain tax

positions could increase or decrease in the next twelve months

due to completion of tax authorities’ exams or the expiration

of statutes of limitations. Management estimates that the

liability for uncertain tax positions could decrease by $5

million within the next twelve months.

The consolidated federal income tax returns of The PNC

Financial Services Group, Inc. and subsidiaries through 2003

have been audited by the Internal Revenue Service and we

have resolved all disputed matters through the IRS appeals

division. The Internal Revenue Service is currently examining

the 2004 through 2006 consolidated federal income tax returns

of The PNC Financial Services Group, Inc. and subsidiaries.

The consolidated federal income tax returns of National City

Corporation and subsidiaries through 2004 have been audited

by the Internal Revenue Service and we have reached

agreement in principle on resolution of all disputed matters

through the IRS appeals division. However, because the

agreement is still subject to execution of a closing agreement

we have not treated it as effectively settled. The Internal

Revenue Service is currently examining the 2005 through

2007 consolidated federal income tax returns of National City

Corporation and subsidiaries, and we expect the 2008 federal

income tax return to begin being audited as soon as it is filed.

New York, New Jersey, Maryland and New York City are

principally where we were subject to state and local income

tax prior to our acquisition of National City. The state of New

York is currently in the process of closing the 2002 to 2004

audit and will begin auditing the years 2005 and 2006. New

York City is currently auditing 2004 and 2005. However,

years 2002 and 2003 remain subject to examination by New

York City pending completion of the New York state audit.

Through 2006, BlackRock is included in our New York and

New York City combined tax filings and constituted most of

the tax liability. Years subsequent to 2004 remain subject to

examination by New Jersey and years subsequent to 2005

remain subject to examination by Maryland.

National City was principally subject to state and local income

tax in California, Florida, Illinois, Indiana, and Missouri.

Audits currently in process for these states include: California

(2003-2004), Illinois (2004-2006) and Missouri (2003-2005).

We will now also be principally subject to tax in those states.

In the ordinary course of business we are routinely subject to

audit by the taxing authorities of these states and at any given

time a number of audits will be in process.

Our policy is to classify interest and penalties associated with

income taxes as income taxes. At January 1, 2008, we had

accrued $91 million of interest related to tax positions, most of

which related to our cross-border leasing transactions. The

total accrued interest and penalties at December 31, 2008 was

$164 million. While the leasing related interest decreased with

a payment to the IRS, the $73 million net increase primarily

resulted from our acquisition of National City.

N

OTE

22 S

UMMARIZED

F

INANCIAL

I

NFORMATION OF

B

LACK

R

OCK

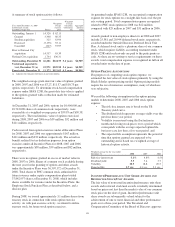

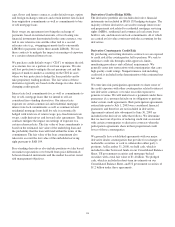

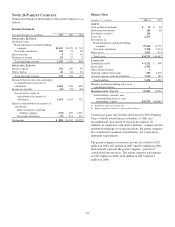

As required by SEC Regulation S-X, summarized

consolidated financial information of BlackRock follows (in

millions).

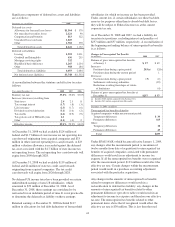

December 31 2008 2007

Total assets $19,924 $22,561

Total liabilities $ 7,367 $10,387

Non-controlling interest 491 578

Stockholders’ equity 12,066 11,596

Total liabilities, non-controlling interest and

stockholders’ equity $19,924 $22,561

Year ended December 31 2008 2007

Total revenue $ 5,064 $ 4,845

Total expenses 3,471 3,551

Operating income 1,593 1,294

Non-operating income (expense) (574) 529

Income before income taxes and

non-controlling interest 1,019 1,823

Income taxes 388 464

Non-controlling interest (155) 364

Net income $ 786 $ 995

N

OTE

23 R

EGULATORY

M

ATTERS

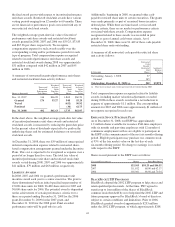

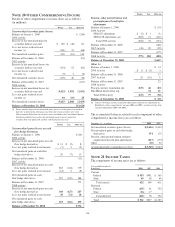

We are subject to the regulations of certain federal and state

agencies and undergo periodic examinations by such

regulatory authorities.

The access to and cost of funding new business initiatives

including acquisitions, the ability to pay dividends, the level

of deposit insurance costs, and the level and nature of

regulatory oversight depend, in large part, on a financial

institution’s capital strength. The minimum US regulatory

capital ratios are 4% for tier 1 risk-based, 8% for total risk-

based and 4% for leverage. However, regulators may require

higher capital levels when particular circumstances warrant.

To qualify as “well capitalized,” regulators require banks to

maintain capital ratios of at least 6% for tier 1 risk-based, 10%

for total risk-based and 5% for leverage. At December 31,

2008 and December 31, 2007, each of our domestic bank

subsidiaries met the “well capitalized” capital ratio

requirements.

140