PNC Bank 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The following were issued in 2007:

• SFAS 141(R), “Business Combinations”

• SFAS 160, “Accounting and Reporting of

Noncontrolling Interests in Consolidated Financial

Statements, an Amendment of ARB No. 51”

• SEC Staff Accounting Bulletin No. 109

• FIN 46(R) 7, “Application of FASB Interpretation

No. 46(R) to Investment Companies”

• FSP FIN 48-1, “Definition of Settlement in FASB

Interpretation (“FIN”) No. 48”

• SFAS 159

The following were issued in 2006 with an effective date in

2008:

• SFAS 157

• The Emerging Issues Task Force (“EITF”) of the

FASB issued EITF Issue 06-4, “Accounting for

Deferred Compensation and Postretirement Benefit

Aspects of Endorsement Split-Dollar Life Insurance

Arrangements”

S

TATUS

O

F

D

EFINED

B

ENEFIT

P

ENSION

P

LAN

We have a noncontributory, qualified defined benefit pension

plan (“plan” or “pension plan”) covering eligible employees.

Benefits are derived from a cash balance formula based on

compensation levels, age and length of service. Pension

contributions are based on an actuarially determined amount

necessary to fund total benefits payable to plan participants.

Consistent with our investment strategy, plan assets are

primarily invested in equity investments and fixed income

instruments. Plan fiduciaries determine and review the plan’s

investment policy.

We calculate the expense associated with the pension plan in

accordance with SFAS 87, “Employers’ Accounting for

Pensions,” and we use assumptions and methods that are

compatible with the requirements of SFAS 87, including a

policy of reflecting trust assets at their fair market value. On

an annual basis, we review the actuarial assumptions related to

the pension plan, including the discount rate, the rate of

compensation increase and the expected return on plan assets.

The discount rate and compensation increase assumptions do

not significantly affect pension expense. However, the expected

long-term return on assets assumption does significantly affect

pension expense. The expected long-term return on plan assets

for determining net periodic pension cost for 2008 was 8.25%,

unchanged from 2007. Under current accounting rules, the

difference between expected long-term returns and actual

returns is accumulated and amortized to pension expense over

future periods. Each one percentage point difference in actual

return compared with our expected return causes expense in

subsequent years to change by up to $7 million as the impact is

amortized into results of operations.

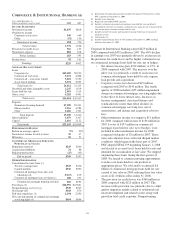

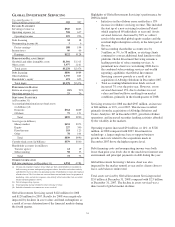

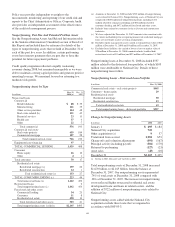

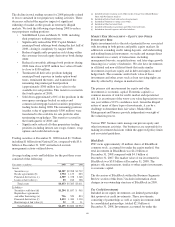

The table below reflects the estimated effects on pension

expense of certain changes in annual assumptions, using 2009

estimated expense as a baseline.

Change in Assumption

Estimated

Increase to 2009

Pension

Expense

(In millions)

.5% decrease in discount rate (a)

.5% decrease in expected long-term return

on assets $16

.5% increase in compensation rate $ 2

(a) De minimis.

We currently estimate a pretax pension expense of $124

million in 2009 compared with a pretax benefit of $32 million

in 2008. The 2009 values and sensitivities shown above

include the qualified defined benefit plan maintained by

National City that we merged into the PNC plan as of

December 31, 2008. The expected increase in pension cost is

attributable not only to the National City acquisition, but also

to the significant variance between 2008 actual investment

returns and long-term expected returns.

Our pension plan contribution requirements are not

particularly sensitive to actuarial assumptions. Investment

performance has the most impact on contribution requirements

and will drive the amount of permitted contributions in future

years. Also, current law, including the provisions of the

Pension Protection Act of 2006, sets limits as to both

minimum and maximum contributions to the plan. We expect

that the minimum required contributions under the law will be

zero for 2009.

We maintain other defined benefit plans that have a less

significant effect on financial results, including various

nonqualified supplemental retirement plans for certain

employees. See Note 15 Employee Benefit Plans in the Notes

To Consolidated Financial Statements in Item 8 of this Report

for additional information.

R

ISK

M

ANAGEMENT

We encounter risk as part of the normal course of our business

and we design risk management processes to help manage

these risks. This Risk Management section first provides an

overview of the risk measurement, control strategies, and

monitoring aspects of our corporate-level risk management

processes. Following that discussion is an analysis of the risk

management process for what we view as our primary areas of

risk: credit, operational, liquidity, and market. The discussion

of market risk is further subdivided into interest rate, trading,

and equity and other investment risk areas. Our use of

financial derivatives as part of our overall asset and liability

risk management process is also addressed within the Risk

Management section of this Item 7. In appropriate places

within this section, historical performance is also addressed.

58