PNC Bank 2008 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184

|

|

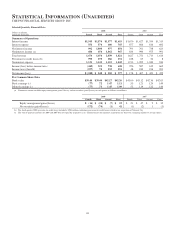

S

TATISTICAL

I

NFORMATION

(U

NAUDITED

)

THE PNC FINANCIAL SERVICES GROUP, INC.

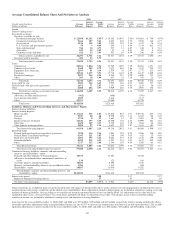

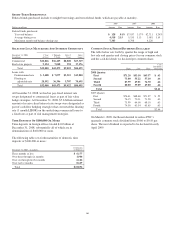

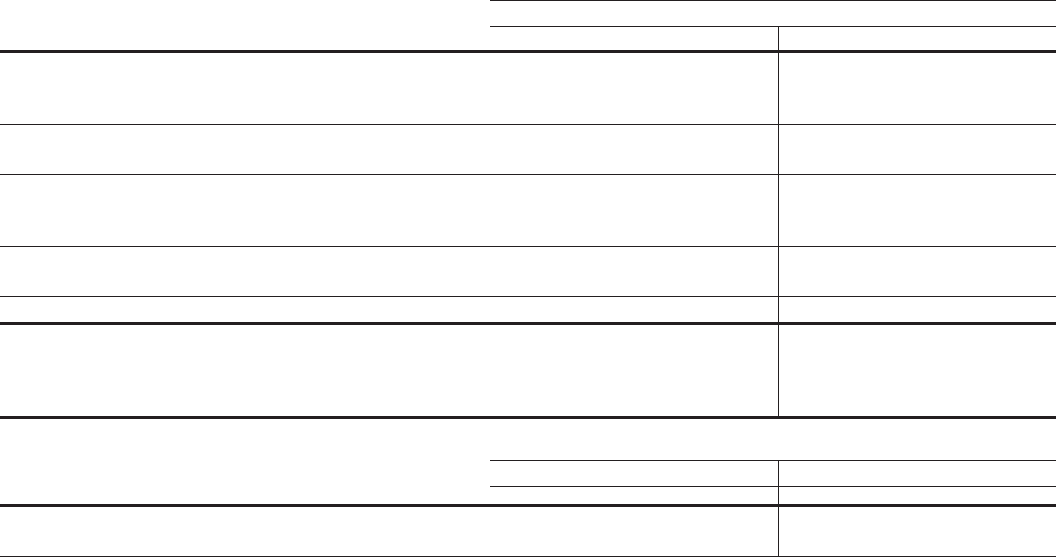

Selected Quarterly Financial Data

Dollars in millions,

except per share data

2008 2007

Fourth Third Second First Fourth Third Second First

Summary of Operations

Interest income $1,543 $1,574 $1,577 $1,619 $1,670 $1,627 $1,554 $1,315

Interest expense 551 574 600 765 877 866 816 692

Net interest income 992 1,000 977 854 793 761 738 623

Noninterest income (a) 684 654 1,062 967 834 990 975 991

Total revenue 1,676 1,654 2,039 1,821 1,627 1,751 1,713 1,614

Provision for credit losses (b) 990 190 186 151 188 65 54 8

Noninterest expense 1,131 1,142 1,115 1,042 1,213 1,099 1,040 944

Income (loss) before income taxes (445) 322 738 628 226 587 619 662

Income taxes (benefit) (197) 74 233 251 48 180 196 203

Net income (loss) $ (248) $ 248 $ 505 $ 377 $ 178 $ 407 $ 423 $ 459

Per Common Share Data

Book value $39.44 $39.44 $42.17 $42.26 $43.60 $43.12 $42.36 $42.63

Basic earnings (c) (.77) .72 1.47 1.11 .53 1.21 1.24 1.49

Diluted earnings (c) (.77) .71 1.45 1.09 .52 1.19 1.22 1.46

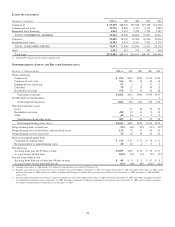

(a) Noninterest income included equity management gains /(losses) and net securities gains/(losses) in each quarter as follows (in millions):

2008 2007

Fourth Third Second First Fourth Third Second First

Equity management gains/(losses) $ (16) $ (24) $ (7) $ 23 $21$47$ 2$32

Net securities gains/(losses) (172) (74) (1) 41 (1) (2) 1 (3)

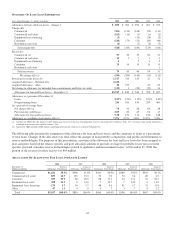

(b) The fourth quarter 2008 provision for credit losses included a $504 million conforming provision for credit losses related to our acquisition of National City.

(c) The sum of quarterly amounts for 2008 and 2007 does not equal the respective year’s amount because the quarterly calculations are based on a changing number of average shares.

155