PNC Bank 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The decline in total trading revenue for 2008 primarily related

to losses sustained in our proprietary trading activities. These

decreases reflected the negative impact of significant

widening of market credit spreads in extremely illiquid

markets. We took the following steps during 2008 to reduce

our proprietary trading positions:

• Sold Hilliard Lyons on March 31, 2008, including

their proprietary trading positions;

• Significantly reduced the PNC Capital Markets

municipal bond arbitrage book during the first half of

2008, closing it completely by August 2008;

• Reduced significantly proprietary risk taking within

the customer-focused equity derivatives book during

2008;

• Reduced convertible arbitrage book positions during

2008 from close to $225 million face value of bonds

to close to $100 million;

• Terminated all derivative positions hedging

municipal bond exposure in tender option bond

trusts, terminated the trusts, and transferred the

remaining long municipal bond position

(approximately $300 million face value) to the

available for sale portfolio. This transfer occurred in

the fourth quarter of 2008;

• Sold down approximately 80% of the positions in the

non-agency mortgage-backed securities and

commercial mortgage-backed securities proprietary

trading books during 2008. The remaining positions

(market value of approximately $300 million) were

transferred to the available for sale portfolio after

terminating swap hedges. This transfer occurred in

the fourth quarter of 2008; and

• Significantly reduced all other proprietary trading

positions including interest rate swaps, futures, swap

options and credit default swaps.

Trading securities at December 31, 2008 totaled $1.7 billion,

including $1 billion from National City, compared with $3.6

billion at December 31, 2007 and reflected our risk

management actions outlined above.

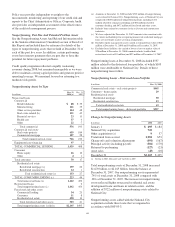

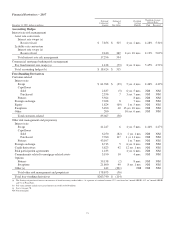

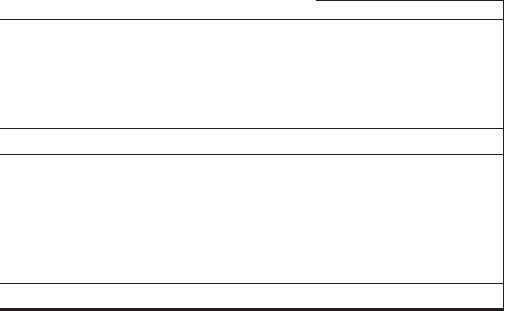

Average trading assets and liabilities for the past three years

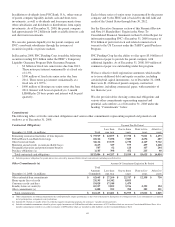

consisted of the following:

Year ended - in millions 2008 2007 2006

Assets

Securities (a) $2,387 $2,708 $1,712

Resale agreements (b) 1,794 1,133 623

Financial derivatives (c) 2,389 1,378 1,148

Loans at fair value (c) 83 166 128

Total assets $6,653 $5,385 $3,611

Liabilities

Securities sold short (d) $1,294 $1,657 $ 965

Repurchase agreements

and other borrowings (e) 756 520 833

Financial derivatives (f) 2,423 1,384 1,103

Borrowings at fair value (f) 22 39 31

Total liabilities $4,495 $3,600 $2,932

(a) Included in Interest-earning assets-Other on the Average Consolidated Balance

Sheet And Net Interest Analysis.

(b) Included in Federal funds sold and resale agreements.

(c) Included in Noninterest-earning assets-Other.

(d) Included in Other borrowed funds.

(e) Included in Repurchase agreements and Other borrowed funds.

(f) Included in Accrued expenses and other liabilities.

M

ARKET

R

ISK

M

ANAGEMENT

–E

QUITY

A

ND

O

THER

I

NVESTMENT

R

ISK

Equity investment risk is the risk of potential losses associated

with investing in both private and public equity markets. In

addition to extending credit, taking deposits, and underwriting

and trading financial instruments, we make and manage direct

investments in a variety of transactions, including

management buyouts, recapitalizations, and later-stage growth

financings in a variety of industries. We also have investments

in affiliated and non-affiliated funds that make similar

investments in private equity and in debt and equity-oriented

hedge funds. The economic and/or book value of these

investments and other assets such as loan servicing rights are

directly affected by changes in market factors.

The primary risk measurement for equity and other

investments is economic capital. Economic capital is a

common measure of risk for credit, market and operational

risk. It is an estimate of the worst-case value depreciation over

one year within a 99.9% confidence level. Given the illiquid

nature of many of these types of investments, it can be a

challenge to determine their fair values. Market Risk

Management and Finance provide independent oversight of

the valuation process.

Various PNC business units manage our private equity and

other investment activities. Our businesses are responsible for

making investment decisions within the approved policy limits

and associated guidelines.

BlackRock

PNC owns approximately 43 million shares of BlackRock

common stock, accounted for under the equity method. Our

total investment in BlackRock was $4.2 billion at

December 31, 2008 compared with $4.1 billion at

December 31, 2007. The market value of our investment in

BlackRock was $5.8 billion at December 31, 2008. The

primary risk measurement, similar to other equity investments,

is economic capital.

The discussion of BlackRock within the Business Segments

Review section of this Item 7 includes information about

changes in our ownership structure of BlackRock in 2009.

Tax Credit Investments

Included in our equity investments are limited partnerships

that sponsor tax credit investments. These investments,

consisting of partnerships as well as equity investments held

by consolidated partnerships, totaled $2.3 billion at

December 31, 2008. Investments accounted for under the

68