PNC Bank 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

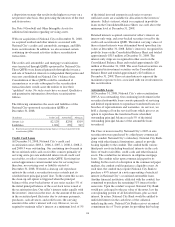

liquidity. As of December 31, 2008, the conduit has never

experienced any difficulty in accessing the commercial paper

markets. Our acquired commitment declines commensurate

with the unpaid principal balance of the automobile loans

securitized by National City. The commitment amount, which

totaled approximately $115 million at December 31, 2008,

represents our maximum exposure to the conduit. This

commitment expires in December 2009 but may be renewed

annually for an additional 12 months by mutual agreement of

the parties.

Retained interests acquired consisted of an interest-only strip

and asset-backed securities issued by the automobile

securitization QSPE. The interest-only strip and asset-backed

securities are recognized in other assets and investment

securities, respectively, on the Consolidated Balance Sheet

and their initial carrying value was determined based upon

their fair value at the date of acquisition. At December 31,

2008, the fair value of the interest-only strip and retained

asset-backed securities totaled approximately $9 million and

$15 million, respectively. These retained interests represent

the maximum exposure to loss associated with our

involvement in this securitization.

Jumbo Mortgages

At December 31, 2008, National City’s jumbo mortgage

securitization series 2008-1 was outstanding. Our continuing

involvement in the securitized mortgage loans consists

primarily of servicing and limited requirements to repurchase

transferred loans for breaches of representations and

warranties. As servicer, we hold a cleanup call repurchase

option when the outstanding principal balances of the

transferred loans reach 5% of the initial outstanding principal

balance of the mortgage loans securitized.

SBA Loans

We have no continuing involvement in the SBA loans

securitized by National City. The SBA loans were sold

servicing released and National City was not the sponsor of

the securitization’s special purpose entity.

Retained interests acquired consisted solely of interest-only

strips. These retained interests are recognized in other assets

on the Consolidated Balance Sheet, totaled approximately $3

million at December 31, 2008, and represent the maximum

exposure to loss associated with our involvement in this

securitization. The initial carrying value of these retained

interests was determined based upon their fair value at the

date of acquisition.

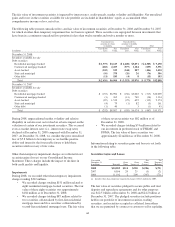

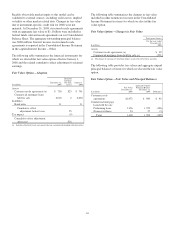

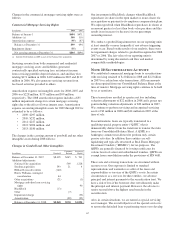

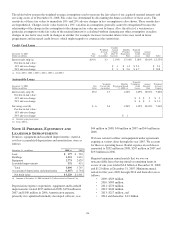

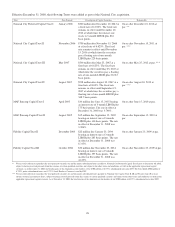

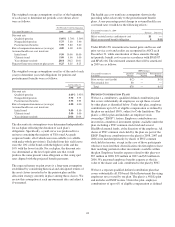

The following is a summary of owned and securitized loans,

which are managed on a combined basis.

December 31, 2008

In Millions

Principal

Balance

Loans Past Due 30

Days or More

Loans managed

Credit card $3,731 $177

Automobile 289 13

Jumbo mortgages 866 78

SBA 118 8

Total loans managed $5,004 $276

Less: Loans securitized

Credit card $1,824 $ 73

Automobile 250 9

Jumbo mortgages 319 5

SBA 118 8

Total loans securitized $2,511 $ 95

Less: Loans held for securitization

Jumbo mortgages $ 9 $ 4

Loans held in portfolio $2,484 $177

119