PNC Bank 2008 Annual Report Download - page 30

Download and view the complete annual report

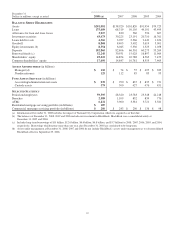

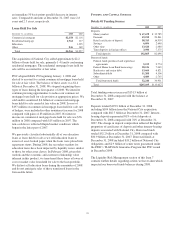

Please find page 30 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2008 compared with 6.8% at December 31, 2007. We

issued $7.6 billion of preferred stock and a common

stock warrant to the US Department of the Treasury

under the TARP Capital Purchase Program on

December 31, 2008, which qualified as Tier 1 capital.

• Our tangible common equity ratio was 2.9% at

December 31, 2008. We expect our tangible common

equity ratio to be less sensitive to the impact of

widening credit spreads on accumulated other

comprehensive loss going forward primarily due to

the composition of the securities available for sale

portfolio acquired from National City and a

substantially higher level of tangible common equity

in the combined company.

• We maintained a strong liquidity position and

continued to generate deposits. The loan to deposit

ratio was 91% at December 31, 2008, reflecting the

acquisition of National City. Average deposits for

2008 increased 10% compared with 2007.

• Credit quality migration reflected a rapidly

weakening economy, but remained manageable as

PNC was able to maintain a strong capital position

and generate positive operating leverage. The

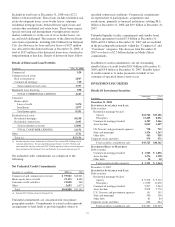

allowance for loan and lease losses increased to $3.9

billion at December 31, 2008 from $830 million at

December 31, 2007 primarily as a result of the

National City acquisition and related conforming

credit adjustment. The ratio of allowance for loan and

lease losses to total loans was strengthened to 2.23%

at December 31, 2008 compared with 1.21% at

December 31, 2007. This ratio excluding the impact

of the National City acquisition was 1.77% at

December 31, 2008. We provide a reconciliation of

this ratio excluding the National City impact to the

GAAP-basis ratio in the Statistical Information

(Unaudited) section in Item 8 of this Report.

• Average loans for 2008 increased 16% over 2007.

• We are committed to supporting the objectives of the

Emergency Economic Stabilization Act of 2008. To

that end, we are continuing to make credit available

to qualified borrowers including enhanced calling

efforts on small businesses and corporations,

promotions offered with special financing rates and

responding to increased loan demand for first

mortgages. We have reaffirmed and renewed loans

and lines of credit, focused on early identification of

loan modification candidates and are working closely

where appropriate with customers who are

experiencing financial hardship to set up new

repayment schedules, loan modifications and

forbearance programs. We plan to enhance these

efforts over time to improve the effectiveness of our

broad-reaching initiatives.

• Investment securities were $43.5 billion at

December 31, 2008, or 15% of total assets. The

portfolio was primarily comprised of well-

diversified, high quality securities with US

government agency residential mortgage-backed

securities representing 53% of the portfolio. Of the

remaining portfolio, approximately 80% of the

securities had AAA-equivalent ratings.

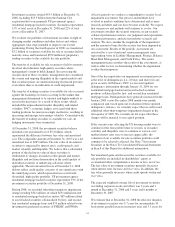

• PNC created positive operating leverage for the year

of 4%, or $351 million. Total revenue for 2008 grew

7% compared with 2007, driven by growth in net

interest income, and exceeded year-over-year

noninterest expense growth of 3%.

• With the acquisition of National City, our retail

banks now serve over 6 million consumer and

business customers. Comprehensive two-year

integration plans are being implemented with a goal

of eliminating $1.2 billion of annualized expenses,

including the reduction of approximately 5,800

positions across the combined 59,595 employee base

by 2011. The first regional branch conversion is

planned for the second half of 2009.

Our Consolidated Income Statement Review section of this

Item 7 describes in greater detail the various items that

impacted our results for 2008 and 2007.

B

ALANCE

S

HEET

H

IGHLIGHTS

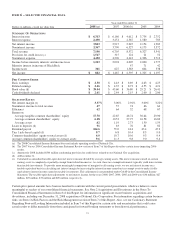

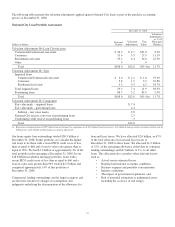

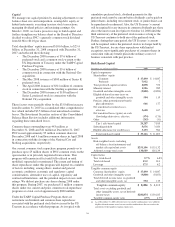

Total assets were $291.1 billion at December 31, 2008

compared with $138.9 billion at December 31, 2007. Total

assets at December 31, 2008 included $133.7 billion related to

National City. Our acquisition of National City did not impact

our 2008 Average Consolidated Balance Sheet.

Total average assets were $142.0 billion for 2008 compared

with $123.4 billion for 2007. This increase reflected a $16.5

billion increase in average interest-earning assets and a $2.1

billion increase in average noninterest-earning assets. An

increase of $10.2 billion in loans and a $6.2 billion increase in

investment securities were the primary factors for the increase

in average interest-earning assets.

The increase in average noninterest-earning assets for 2008

reflected an increase in average goodwill of $1.6 billion

primarily related to the acquisition of Sterling on April 4,

2008, Yardville National Bancorp (“Yardville”) on

October 26, 2007 and Mercantile Bankshares Corporation

(“Mercantile”) on March 2, 2007.

The impact of the Sterling, Yardville and Mercantile

acquisitions is also reflected in our year-over-year increases in

average total loans, average securities available for sale and

average total deposits as described further below.

Average total loans were $72.7 billion for 2008 and $62.5

billion for 2007. The increase in average total loans included

growth in commercial loans of $5.5 billion, consumer loans of

$2.8 billion, commercial real estate loans of $1.7 billion and

residential mortgage loans of $.5 billion. Loans represented

64% of average interest-earning assets for both 2008 and

2007.

26