PNC Bank 2008 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.forth in the replacement capital covenant with respect to the

Normal APEX (the “APEX RCC”) or the replacement capital

covenant with respect to the Depositary Shares (the

“Depositary Shares RCC”), as applicable.

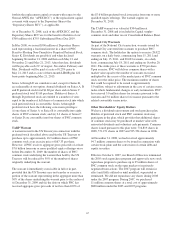

As of December 31, 2008, each of the APEX RCC and the

Depositary Shares RCC are for the benefit of holders of our

$700 million of 6.875% Subordinated Notes Due 2019.

In May 2008, we issued $500 million of Depositary Shares,

each representing a fractional interest in a share of PNC

Fixed-to-Floating Non-Cumulative Perpetual Preferred Stock,

Series K. Dividends are payable if and when declared

beginning November 21, 2008 and then each May 21 and

November 21 until May 21, 2013. After that date, dividends

will be payable each 21st of August, November, February and

May. Dividends will be paid at a rate of 8.25% prior to

May 21, 2013 and at a rate of three-month LIBOR plus 422

basis points beginning May 21, 2013.

Series A through D are cumulative and, except for Series B,

are redeemable at our option. Annual dividends on Series A, B

and D preferred stock total $1.80 per share and on Series C

preferred stock total $1.60 per share. Holders of Series A

through D preferred stock are entitled to a number of votes

equal to the number of full shares of common stock into which

such preferred stock is convertible. Series A through D

preferred stock have the following conversion privileges:

(i) one share of Series A or Series B is convertible into eight

shares of PNC common stock; and (ii) 2.4 shares of Series C

or Series D are convertible into four shares of PNC common

stock.

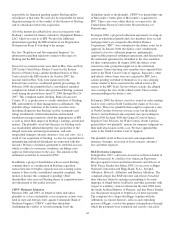

TARP Warrant

A warrant issued to the US Treasury in connection with the

preferred stock described above enables the US Treasury to

purchase up to approximately 16.9 million shares of PNC

common stock at an exercise price of $67.33 per share.

However, if PNC receives aggregate gross proceeds of at least

$7.6 billion from one or more qualified equity offerings on or

before December 31, 2009, the number of shares of PNC

common stock underlying the warrant then held by the US

Treasury will be reduced by 50% of the number of shares

originally underlying the warrant.

The warrant is immediately exercisable in full or in part,

provided that the US Treasury may not transfer or exercise a

portion of the warrant representing in the aggregate more than

50% of the shares underlying the warrant prior to the earlier of

(i) December 31, 2009 and (ii) the date on which PNC has

received aggregate gross proceeds of not less than 100% of

the $7.6 billion preferred stock issue price from one or more

qualified equity offerings. The warrant expires on

December 31, 2018.

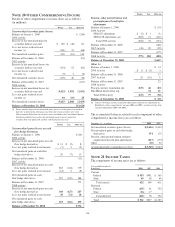

The TARP warrant was valued at $304 million at

December 31, 2008 and is included in Capital surplus-

common stock and other on our Consolidated Balance Sheet.

National City Warrants

As part of the National City transaction, warrants issued by

National City converted into warrants to purchase PNC

common stock. The holder has the option to exercise 28,022

warrants, on a daily basis, commencing June 15, 2011 and

ending on July 15, 2011, and 28,023 warrants, on a daily

basis, commencing July 18, 2011 and ending on October 20,

2011. The strike price of these warrants is $750 per share.

Upon exercise, PNC will deliver common shares with a

market value equal to the number of warrants exercised

multiplied by the excess of the market price of PNC common

stock over the strike price. The maximum number of shares

that could be required to be issued is approximately

5.0 million, subject to adjustment in the case of certain events,

make-whole fundamental changes or early termination. PNC

has reserved 5.0 million shares for issuance pursuant to the

warrants and 3.6 million shares for issuance pursuant to the

related convertible senior notes.

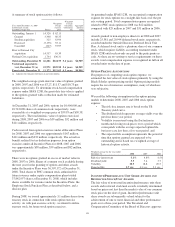

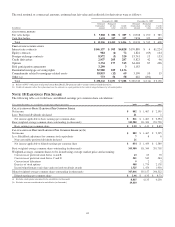

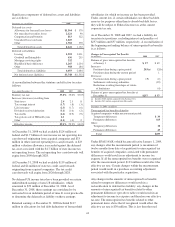

Other Shareholders’ Equity Matters

We have a dividend reinvestment and stock purchase plan.

Holders of preferred stock and PNC common stock may

participate in the plan, which provides that additional shares

of common stock may be purchased at market value with

reinvested dividends and voluntary cash payments. Common

shares issued pursuant to this plan were: 716,819 shares in

2008, 571,271 shares in 2007 and 535,394 shares in 2006.

At December 31, 2008, we had reserved approximately

94.7 million common shares to be issued in connection with

certain stock plans and the conversion of certain debt and

equity securities.

Effective October 4, 2007, our Board of Directors terminated

the 2005 stock repurchase program and approved a new stock

repurchase program to purchase up to 25 million shares of

PNC common stock on the open market or in privately

negotiated transactions. The 2007 program will remain in

effect until fully utilized or until modified, superseded or

terminated. We did not repurchase any shares during 2008

under the 2007 program. During 2007, we purchased

11 million common shares at a total cost of approximately

$800 million under the 2005 and 2007 programs.

137