PNC Bank 2008 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and aided and abetted the BAE defendants’ breaches of

fiduciary duties. In September 2008, the United States District

Court for the District of Columbia granted the motions of all

defendants to dismiss the plaintiff’s complaint. Plaintiff has

appealed to the United States Court of Appeals for the District

of Columbia Circuit. As it relates to PNC, plaintiff is seeking

unquantified monetary damages (including punitive damages),

an accounting, interest, attorneys’ fees and other expenses. As

a result of our acquisition of Riggs, PNC may be responsible

for indemnifying the Allbrittons in connection with this

lawsuit.

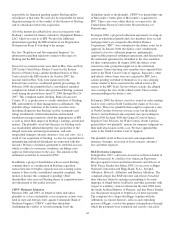

Regulatory and Governmental Inquiries

As a result of the regulated nature of our business and that of a

number of our subsidiaries, particularly in the banking and

securities areas, we and our subsidiaries are the subject of

investigations and other forms of regulatory inquiry, in some

cases as part of regulatory reviews of specified activities at

multiple industry participants. Among the areas in which there

is currently significant regulatory interest are practices in the

mutual fund and mortgage lending businesses. Several of our

subsidiaries have received requests for information and other

inquiries from governmental and regulatory authorities in

these areas.

In June 2008, National City was notified that the Chicago

Regional Office of the SEC is conducting an informal

investigation of National City. The SEC has requested that

National City provide the SEC with documents concerning,

among other things, its loan underwriting experience,

allowance for loan losses, marketing practices, dividends,

bank regulatory matters and the sale of First Franklin

Financial Corporation.

The SEC is conducting a non-public investigation into the EFI

situation at Sterling. The United States Attorney’s Office for

the Eastern District of Pennsylvania is also investigating the

EFI situation.

Our practice is to cooperate fully with regulatory and

governmental investigations, audits and other inquiries,

including those described above. Such investigations, audits

and other inquiries may lead to remedies such as fines,

restitution or alterations in our business practices.

Other

In addition to the proceedings or other matters described

above, PNC and persons to whom we may have

indemnification obligations, in the normal course of business,

are subject to various other pending and threatened legal

proceedings in which claims for monetary damages and other

relief are asserted. We do not anticipate, at the present time,

that the ultimate aggregate liability, if any, arising out of such

other legal proceedings will have a material adverse effect on

our financial position. However, we cannot now determine

whether or not any claims asserted against us or others to

whom we may have indemnification obligations, whether in

the proceedings or other matters specifically described above

or otherwise, will have a material adverse effect on our results

of operations in any future reporting period.

See Note 25 Commitments and Guarantees for additional

information regarding the Visa indemnification and our

obligation to provide indemnification to current and former

officers, directors, employees and agents of PNC and

companies we have acquired, including National City.

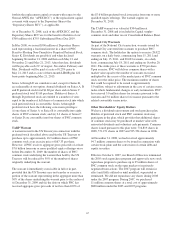

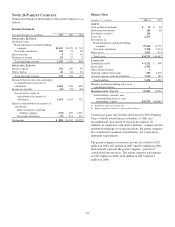

N

OTE

25 C

OMMITMENTS AND

G

UARANTEES

E

QUITY

F

UNDING AND

O

THER

C

OMMITMENTS

Our unfunded commitments at December 31, 2008 included

private equity investments of $540 million and other

investments of $178 million.

S

TANDBY

L

ETTERS OF

C

REDIT

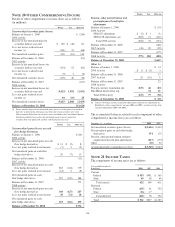

We issue standby letters of credit and have risk participations

in standby letters of credit and bankers’ acceptances issued by

other financial institutions, in each case to support obligations

of our customers to third parties, such as remarketing

programs for customers’ variable rate demand notes. Net

outstanding standby letters of credit totaled $10.3 billion at

December 31, 2008.

If the customer fails to meet its financial or performance

obligation to the third party under the terms of the contract or

there is a need to support a remarketing program, then upon

the request of the guaranteed party, we would be obligated to

make payment to them. The standby letters of credit and risk

participations in standby letters of credit and bankers’

acceptances outstanding on December 31, 2008 had terms

ranging from less than one year to 14 years. The aggregate

maximum amount of future payments PNC could be required

to make under outstanding standby letters of credit and risk

participations in standby letters of credit and bankers’

acceptances was $13.7 billion at December 31, 2008, of which

$5.1 billion support remarketing programs.

Assets valued as of December 31, 2008 of approximately $.9

billion secured certain specifically identified standby letters of

credit. Approximately $3.4 billion in recourse provisions from

third parties was also available for this purpose as of

December 31, 2008. In addition, a portion of the remaining

standby letters of credit and letter of credit risk participations

issued on behalf of specific customers is also secured by

collateral or guarantees that secure the customers’ other

obligations to us. The carrying amount of the liability for our

obligations related to standby letters of credit and risk

participations in standby letters of credit and bankers’

acceptances was $119 million at December 31, 2008.

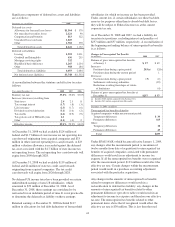

S

TANDBY

B

OND

P

URCHASE

A

GREEMENTS AND

O

THER

L

IQUIDITY

F

ACILITIES

We enter into standby bond purchase agreements to support

municipal bond obligations. At December 31, 2008, the

146