PNC Bank 2008 Annual Report Download - page 94

Download and view the complete annual report

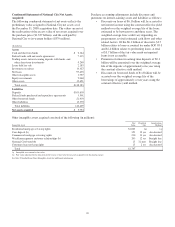

Please find page 94 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.cash flows using assumptions as to discount rates, interest

rates, prepayment speeds, credit losses and servicing costs, if

applicable.

Our loan sales and securitizations are generally structured

without recourse to us and with no restrictions on the retained

interests with the exception of loan sales to certain US

government chartered entities.

When we are obligated for loss-sharing or recourse in a sale,

our policy is to record such liabilities at fair value upon

closing of the transaction based on the guidance contained in

FIN 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees

of Indebtedness of Others,” or as a contingent liability

recognized at inception of the guarantee under SFAS 5,

“Accounting for Contingencies.”

We originate, sell and service mortgage loans under the

Federal National Mortgage Association (“FNMA”) Delegated

Underwriting and Servicing (“DUS”) program. Under the

provisions of the DUS program, we participate in a loss-

sharing arrangement with FNMA. We participate in a similar

program with the Federal Home Loan Mortgage Corporation

(“FHLMC”). Refer to Note 25 Commitments and Guarantees

for more information about our obligations related to sales of

loans under these programs.

In securitization transactions, we classify securities retained as

debt securities available for sale or other assets, depending on

the form of the retained interest. Retained interests that are

subject to prepayment risk are reviewed on a quarterly basis

for impairment. If the fair value of the retained interests is

below its carrying amount and the decline is determined to be

other than temporary, then the decline is reflected as a charge

in other noninterest income.

L

OANS HELD FOR SALE

We designate loans and related unfunded loan commitments

as held for sale when we have a positive intent to sell them.

We transfer loans to the loans held for sale category at the

lower of cost or fair market value. At the time of transfer,

write-downs on the loans and related unfunded loan

commitments are recorded as charge-offs or as a reduction in

the liability for unfunded commitments. We establish a new

cost basis upon transfer except for certain residential and

commercial mortgages held for sale discussed below. Any

subsequent lower of cost or market adjustment is determined

on an individual loan and unfunded loan commitment basis

and is recognized as a valuation allowance with any charges

included in other noninterest income. Gains or losses on the

sale of these loans and/or related unfunded loan commitments

are included in other noninterest income when realized.

Effective January 1, 2008, we adopted SFAS 159, “The Fair

Value Option for Financial Assets and Financial Liabilities –

Including an amendment of FASB Statement No. 115”, and

elected to fair value certain commercial mortgage loans held

for sale. Under SFAS 159, changes in the fair value of these

loans are measured and recorded in other noninterest income

each period. See Note 8 Fair Value for additional information.

Also, we elected fair value for residential real estate loans held

for sale or securitization acquired from National City.

Interest income with respect to loans held for sale classified as

performing is accrued based on the principal amount

outstanding at a constant effective yield.

In certain circumstances, loans designated as held for sale may

be transferred to the loan portfolio based on a change in

strategy. We transfer these loans to the portfolio at the lower

of cost or fair market value; however, any loans designated

under SFAS 159 will remain at fair value.

N

ONPERFORMING

A

SSETS

Nonperforming assets include:

• Nonaccrual loans,

• Troubled debt restructurings, and

• Foreclosed assets.

Measurement of delinquency and past due status are based on

the contractual terms of each loan.

A loan acquired and accounted for under SOP 03-3 is reported

as an accruing loan and a performing asset as long as the

remaining future expected undiscounted cash flows exceed the

carrying value of the loan.

We generally classify commercial loans as nonaccrual when

we determine that the collection of interest or principal is

doubtful or when a default of interest or principal has existed

for 90 days or more and the loans are not well-secured or in

the process of collection. When the accrual of interest is

discontinued, any accrued but uncollected interest previously

included in net interest income is reversed. We charge off

small business commercial loans less than $1 million at 120

days after transfer to nonaccrual status. We charge off other

nonaccrual loans based on the facts and circumstances of the

individual loans.

Subprime mortgage loans for first liens with a loan to value

ratio of greater than 90% and second liens are classified as

nonaccrual at 90 days past due.

Most consumer loans and lines of credit, not secured by

residential real estate, are charged off after 120 to 180 days

past due. Generally, they are not placed on non-accrual status.

Home equity installment loans and lines of credit, as well as

residential mortgage loans, that are well secured by residential

real estate are classified as nonaccrual at 180 days past due or

if a partial write-down has occurred, consistent with

regulatory guidance. These loans are considered well secured

if the fair market value of the property, less 15% to cover

90