PNC Bank 2008 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

12 D

EPOSITS

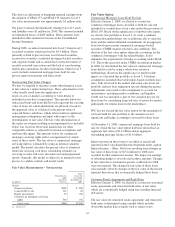

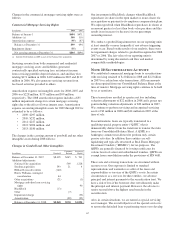

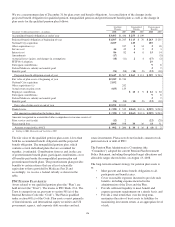

The aggregate amount of time deposits with a denomination of

$100,000 or more was $26.8 billion at December 31, 2008 and

$14.8 billion at December 31, 2007.

Total time deposits of $75.9 billion at December 31, 2008

have contractual maturities for the years 2009 through 2014

and thereafter as follows:

• 2009: $44.9 billion,

• 2010: $12.8 billion,

• 2011: $4.9 billion,

• 2012: $7.7 billion,

• 2013: $1.3 billion, and

• 2014 and thereafter: $4.3 billion.

N

OTE

13 B

ORROWED

F

UNDS

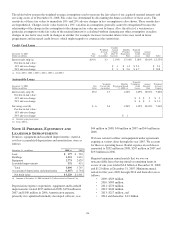

Bank notes at December 31, 2008 totaling $1.0 billion have

interest rates ranging from 2.75% to 5.70% with

approximately $500 million maturing in 2009. Senior and

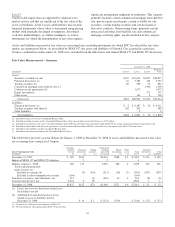

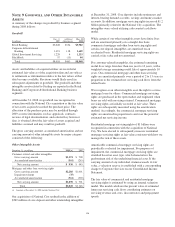

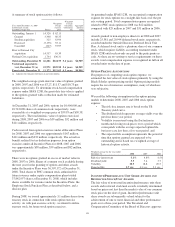

subordinated notes consisted of the following:

December 31, 2008

Dollars in millions Outstanding Stated Rate Maturity

Senior $12,622 .23 – 5.50% 2009 – 2047

Subordinated

Junior 2,898 2.77 – 10.18% 2028 – 2068

All other 8,310 2.35 – 9.65% 2009 – 2019

Total subordinated 11,208

Total senior and

subordinated $23,830

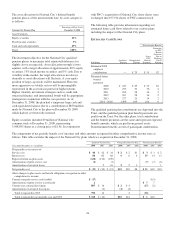

Included in outstandings for the senior and subordinated notes

in the table above are basis adjustment increases of $81

million and $551 million, respectively, related to fair value

accounting hedges as of December 31, 2008.

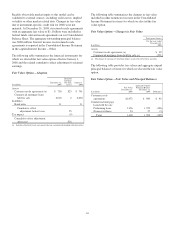

In December 2008, we issued the following senior notes

totaling $2.9 billion under the FDIC’s Temporary Liquidity

Guarantee Program-Debt Guarantee Program:

• $2 billion of fixed rate senior notes due June 2012.

These notes pay interest semiannually at a fixed rate

of 2.3%.

• $500 million of fixed rate senior notes due June

2011. These notes pay interest semiannually at a

fixed rate of 1.875%.

• $400 million of floating rate senior notes due June

2011. Interest will be reset quarterly to 3-month

LIBOR plus 28 basis points and interest will be paid

quarterly.

Each of these series of senior notes is guaranteed by the FDIC

and is backed by the full faith and credit of the United States

of America through June 30, 2012.

Total borrowed funds of $52.2 billion at December 31, 2008

have scheduled or anticipated repayments for the years 2009

through 2014 and thereafter as follows:

• 2009: $18.6 billion,

• 2010: $9.4 billion,

• 2011: $5.2 billion,

• 2012: $4.8 billion,

• 2013: $4.0 billion, and

• 2014 and thereafter: $10.2 billion.

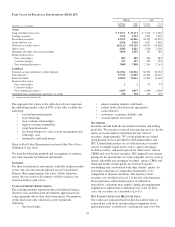

Included in borrowed funds are FHLB borrowings of $18.1

billion at December 31, 2008, $9.0 billion of which are

collateralized by a blanket lien on residential mortgage and

other real estate-related loans and mortgage-backed and

treasury securities and $224 million are collateralized by

pledged mortgage-backed and treasury securities. The

remaining $8.9 billion, assumed in the National City

acquisition, are collateralized by a blanket lien on residential

mortgage and home equity loans and mortgage-backed

securities. FHLB advances of $5.1 billion have scheduled

maturities of less than one year. The remainder of the FHLB

borrowings have balances that will mature from 2010 – 2030,

with interest rates ranging from 0% – 7.33%.

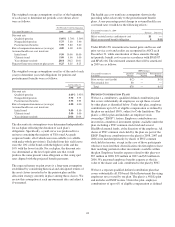

As part of the National City acquisition, PNC assumed

liability for the conversion of $1.4 billion of convertible senior

notes. Interest on these notes is payable semiannually at a

fixed rate of 4.0%. The maturity date of these notes is

February 1, 2011. PNC may not redeem these notes prior to

their maturity date. Holders may convert the notes, at their

option, prior to November 15, 2010 under certain

circumstances, including (i) if the trading price of the notes is

less than a defined threshold measured against the market

value of PNC common stock, (ii) any time after March 31,

2008, if the market price of PNC common stock exceeds

130% of the conversion price of the notes in effect on the last

trading day of the immediately preceding calendar quarter, or

(iii) upon the occurrence of certain specific events. After

November 15, 2010, the holders may convert their notes at

any time through the third scheduled trading date preceding

the maturity date. The initial conversion rate equals 2.0725

shares per $1,000 face value of notes. The conversion rate will

be subject to adjustment for stock splits, stock dividends, cash

dividends in excess of certain thresholds, stock repurchases

where the price exceeds market values, and certain other

events. Upon conversion, PNC will pay cash equal to the

principal balance of the notes and may issue shares of its

common stock for any conversion value, determined over a

40 day observation period, that exceeds the principal balance

of the notes being converted. The maximum number of net

common shares that PNC may be required to issue is

3.6 million shares, subject to potential adjustment in the case

of certain events, make-whole fundamental changes, or early

termination.

121