PNC Bank 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

an immediate 50 basis points parallel decrease in interest

rates. Comparable amounts at December 31, 2007 were 2.8

years and 2.5 years, respectively.

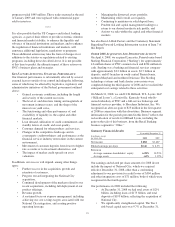

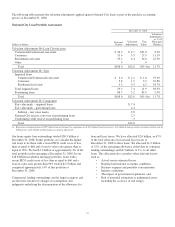

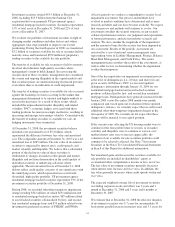

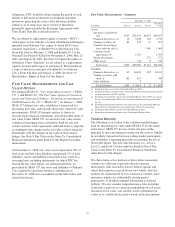

Loans Held For Sale

December 31 - in millions 2008 2007

Commercial mortgage $2,158 $2,116

Residential mortgage 1,962 117

Education 1,525

Other 246 169

Total $4,366 $3,927

The acquisition of National City added approximately $2.2

billion of loans held for sale, primarily 1-4 family conforming

residential mortgages. The residential mortgage loans held for

sale will be accounted for at fair value.

PNC adopted SFAS 159 beginning January 1, 2008 and

elected to account for certain commercial mortgage loans held

for sale at fair value. The balance of these assets was $1.4

billion at December 31, 2008. We stopped originating these

types of loans during the first quarter of 2008. We intend to

continue pursuing opportunities to reduce our commercial

mortgage loans held for sale position at appropriate prices. We

sold and/or securitized $.6 billion of commercial mortgage

loans held for sale carried at fair value in 2008. Losses of

$197 million on commercial mortgage loans held for sale, net

of hedges, were included in other noninterest income for 2008

compared with gains of $3 million in 2007. Net interest

income on commercial mortgage loans held for sale was $76

million in 2008 compared with $15 million in 2007. The

non-cash losses reflected illiquid market conditions which

began in the latter part of 2007.

We previously classified substantially all of our education

loans as loans held for sale as we sold education loans to

issuers of asset-backed paper when the loans were placed into

repayment status. During 2008, the secondary markets for

education loans have been impacted by liquidity issues similar

to those for other asset classes. In February 2008, given this

outlook and the economic and customer relationship value

inherent in this product, we transferred these loans at lower of

cost or market value from held for sale to the loan portfolio.

We did not sell education loans during the remainder of 2008

and do not anticipate sales of these transferred loans in the

foreseeable future.

F

UNDING AND

C

APITAL

S

OURCES

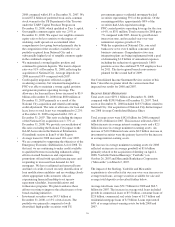

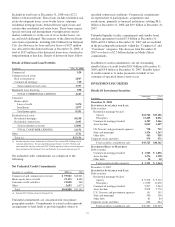

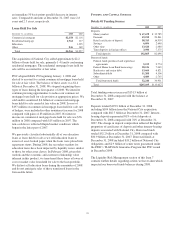

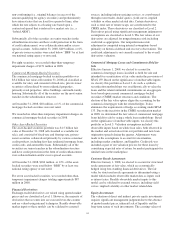

Details Of Funding Sources

December 31 - in millions 2008 2007

Deposits

Money market $ 67,678 $ 32,785

Demand 43,212 20,861

Retail certificates of deposit 58,315 16,939

Savings 6,056 2,648

Other time 13,620 2,088

Time deposits in foreign offices 3,984 7,375

Total deposits 192,865 82,696

Borrowed funds

Federal funds purchased and repurchase

agreements 5,153 9,774

Federal Home Loan Bank borrowings 18,126 7,065

Bank notes and senior debt 13,664 6,821

Subordinated debt 11,208 4,506

Other 4,089 2,765

Total borrowed funds 52,240 30,931

Total $245,105 $113,627

Total funding sources increased $131.5 billion at

December 31, 2008 compared with the balance at

December 31, 2007.

Deposits totaled $192.9 billion at December 31, 2008,

including $104 billion from the National City acquisition,

compared with $82.7 billion at December 31, 2007. Interest-

bearing deposits represented 81% of total deposits at

December 31, 2008 compared with 76% at December 31,

2007. The change in deposit composition reflected the higher

proportion of certificates of deposit and other interest-bearing

deposits associated with National City. Borrowed funds

totaled $52.2 billion at December 31, 2008 compared with

$30.9 billion at December 31, 2007. Borrowed funds at

December 31, 2008 included $18.2 billion of National City

obligations and $2.9 billion of senior notes guaranteed under

the FDIC’s TLGP-Debt Guarantee Program that PNC issued

in December 2008.

The Liquidity Risk Management section of this Item 7

contains further details regarding actions we have taken which

impacted our borrowed funds balances during 2008.

35