PNC Bank 2008 Annual Report Download - page 134

Download and view the complete annual report

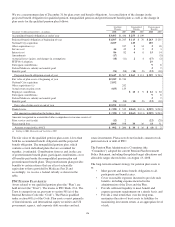

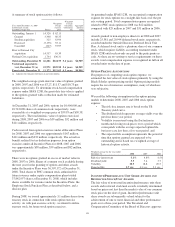

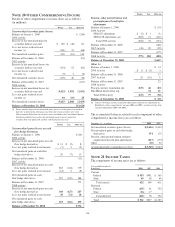

Please find page 134 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.by the plan may be matched annually based on Global

Investment Servicing performance levels. Participants must be

employed as of December 31 of each year to receive this

annual contribution. The performance-based employer

matching contribution will be made primarily in shares of

PNC common stock held in treasury, except in the case of

those participants who have exercised their diversification

election rights to have their matching portion in other

investments available within the plan. Mandatory employer

contributions to this plan are made in cash and include

employer basic and transitional contributions. Employee-

directed contributions are invested in a number of investment

options available under the plan, including a PNC common

stock fund and several BlackRock mutual funds, at the

direction of the employee. Employee benefits expense for this

plan was $11 million in 2008, $10 million in 2007 and $9

million in 2006. We measured employee benefits expense as

the fair value of the shares and cash contributed to the plan.

We also maintain a nonqualified supplemental savings plan

for certain employees.

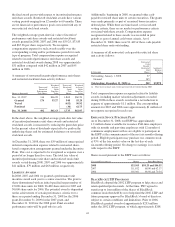

We also maintain a defined contribution plan for National City

legacy employees. Substantially all National City legacy

employees are eligible to contribute a portion of their pretax

compensation to the plan. PNC may make contributions to the

plan for employees with one or more years of service in the

form of company common stock in varying amounts

depending on participant contribution levels. PNC reserves the

right to terminate or make plan changes at any time.

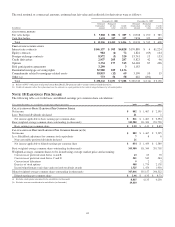

N

OTE

16 S

TOCK

-B

ASED

C

OMPENSATION

P

LANS

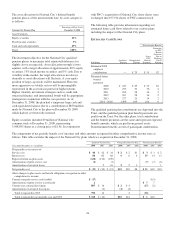

We have long-term incentive award plans (“Incentive Plans”)

that provide for the granting of incentive stock options,

nonqualified stock options, stock appreciation rights, incentive

shares/performance units, restricted stock, restricted share

units, other share-based awards and dollar-denominated

awards to executives and, other than incentive stock options,

to non-employee directors. Certain Incentive Plan awards may

be paid in stock, cash or a combination of stock and cash. We

grant a substantial portion of our stock-based compensation

awards during the first quarter of the year. As of

December 31, 2008, no stock appreciation rights were

outstanding.

N

ONQUALIFIED

S

TOCK

O

PTIONS

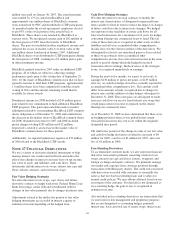

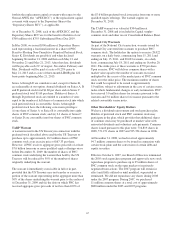

Options are granted at exercise prices not less than the market

value of common stock on the grant date. Generally, options

granted since 1999 become exercisable in installments after

the grant date. Options granted prior to 1999 are mainly

exercisable 12 months after the grant date. No option may be

exercisable after 10 years from its grant date. Payment of the

option exercise price may be in cash or shares of common

stock at market value on the exercise date. The exercise price

may be paid in previously owned shares.

Generally, options granted under the Incentive Plans vest

ratably over a three-year period as long as the grantee remains

an employee or, in certain cases, retires from PNC. For all

options granted prior to the adoption of SFAS 123R, we

recognized compensation expense over the three-year vesting

period. If an employee retired prior to the end of the three-

year vesting period, we accelerated the expensing of all

unrecognized compensation costs at the retirement date. As

required under SFAS 123R, we recognize compensation

expense for options granted to retirement-eligible employees

after January 1, 2006 during the first twelve months

subsequent to the grant, in accordance with the service period

provisions of the options.

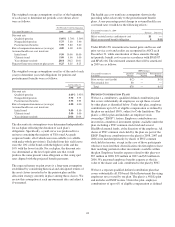

During the third quarter of 2008, we granted approximately

one million options to certain senior executives. While these

options generally contain the same terms and conditions as

previous option grants, cliff vesting will occur on or after the

third anniversary from the grant date if the market price of

PNC stock exceeds the grant date price by 20% or more over a

specified time period. These options were approved by the

Personnel and Compensation Committee of the Board of

Directors. The grant date fair value was $6.59 per option.

O

PTIONS

I

SSUED FOR

S

TERLING

A

CQUISITION

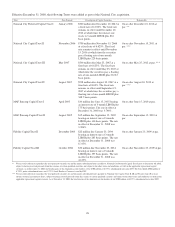

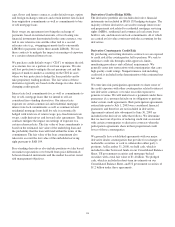

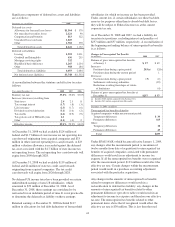

On April 4, 2008, in connection with the closing of the

Sterling acquisition, we issued 325,489 PNC stock options

upon conversion of all outstanding and unexercised Sterling

options at that date. Of the total options issued, 159,676 were

issued as nonqualified stock options, and the remaining

165,813 were issued as incentive stock options. These PNC

options carry generally the same terms and conditions as the

original Sterling options. Per the merger agreement, all

outstanding options were deemed fully vested at the

acquisition date. Accordingly, no ongoing stock option

expense will be recognized for these options. The purchase

price consideration for the Sterling acquisition included

approximately $3.3 million related to these options.

O

PTIONS

I

SSUED FOR

N

ATIONAL

C

ITY

A

CQUISITION

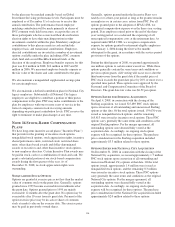

On December 31, 2008, in connection with the closing of the

National City acquisition, we issued approximately 1.7 million

PNC stock options upon conversion of all outstanding and

unexercised National City options at that date. Of the total

options issued, approximately 1.4 million were issued as

nonqualified stock options, and the remaining 0.3 million

were issued as incentive stock options. These PNC options

carry generally the same terms and conditions as the original

National City options. Per the merger agreement, all

outstanding options were deemed fully vested at the

acquisition date. Accordingly, no ongoing stock option

expense will be recognized for these options. The purchase

price consideration for the National City acquisition included

approximately $2.0 million related to these options.

130