PNC Bank 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

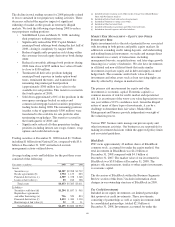

Loans held for sale also included education loans held for sale

of $1.5 billion at December 31, 2007 and $1.3 billion at

December 31, 2006. Gains on sales of education loans totaled

$24 million in 2007 and $33 million for 2006. These gains are

reflected in the other noninterest income line item in our

Consolidated Income Statement and in the results of the Retail

Banking business segment.

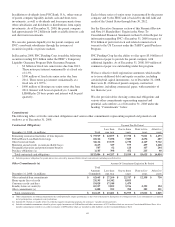

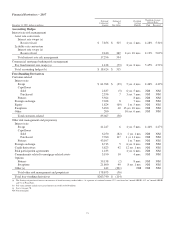

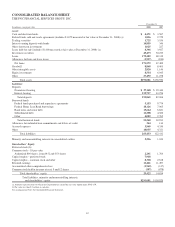

Asset Quality

Total nonperforming assets at December 31, 2007 increased

$311 million, to $495 million, compared with December 31,

2006. Nonperforming loans, the largest component of

nonperforming assets, increased $294 million, to $454

million, at December 31, 2007 compared with December 31,

2006. Of this increase in nonperforming loans, $192 million

occurred during the fourth quarter of 2007. The increase was

primarily due to higher nonaccrual commercial real estate

loans primarily related to residential real estate development

exposure. At December 31, 2007, our largest nonperforming

asset was approximately $20 million and our average

nonperforming loan associated with commercial lending was

approximately $0.5 million.

The ratio of nonperforming assets to total assets rose to .36%

at December 31, 2007 compared with .18% at December 31,

2006. The allowance for loan and lease losses was $830

million and represented 1.21% of total loans and 183% of

nonperforming loans at December 31, 2007. The comparable

amounts were $560 million, 1.12% and 350%, respectively, at

December 31, 2006.

Goodwill and Other Intangible Assets

The sum of goodwill and other intangible assets increased

$5.5 billion at December 31, 2007 compared with the prior

year end, to $9.6 billion. We added $4.7 billion of goodwill

and other intangible assets in connection with the Mercantile

acquisition. In addition, our acquisitions of ARCS, Yardville

and Albridge collectively added $.9 billion of goodwill and

other intangible assets during 2007.

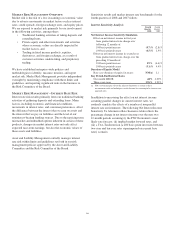

Funding Sources

Total funding sources were $113.6 billion at December 31,

2007 and $81.3 billion at December 31, 2006. Funding

sources increased $32.3 billion in the comparison as total

deposits increased $16.4 billion and total borrowed funds

increased $15.9 billion. Our acquisition of Mercantile added

$12.5 billion of deposits and $2.1 billion of borrowed funds.

The Yardville acquisition resulted in $2.0 billion of deposits.

During the first quarter of 2007 we issued borrowings to fund

the $2.1 billion cash portion of the Mercantile acquisition. The

remaining increase in borrowed funds was the result of growth

in loans and securities and the need to fund other net changes

in our balance sheet. During the second half of 2007 we

substantially increased Federal Home Loan Bank borrowings,

which provided us with additional liquidity at relatively

attractive rates.

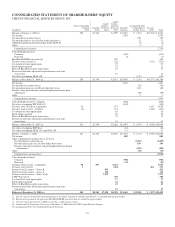

Shareholders’ Equity

Total shareholders’ equity increased $4.1 billion, to $14.9

billion, at December 31, 2007 compared with December 31,

2006. In addition to the net impact of earnings and dividends

in 2007, this increase reflected a $2.5 billion reduction in

treasury stock and a $1.0 billion increase in capital surplus,

largely due to the issuance of PNC common shares for the

Mercantile and Yardville acquisitions.

Regulatory capital ratios at December 31, 2007 were 6.2% for

leverage, 6.8% for Tier 1 risk-based and 10.3% for total risk-

based capital. At December 31, 2006, the regulatory capital

ratios were 9.3% for leverage, 10.4% for Tier 1 risk-based and

13.5% for total risk-based capital.

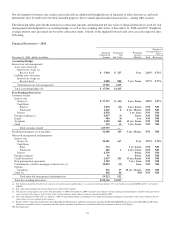

Glossary of Terms

Accounting/administration net fund assets - Net domestic and

foreign fund investment assets for which we provide

accounting and administration services. We do not include

these assets on our Consolidated Balance Sheet.

Adjusted average total assets - Primarily comprised of total

average quarterly (or annual) assets plus (less) unrealized

losses (gains) on investment securities, less goodwill and

certain other intangible assets (net of eligible deferred taxes).

Annualized - Adjusted to reflect a full year of activity.

Assets under management - Assets over which we have sole or

shared investment authority for our customers/clients. We do

not include these assets on our Consolidated Balance Sheet.

Basis point - One hundredth of a percentage point.

Charge-off - Process of removing a loan or portion of a loan

from our balance sheet because it is considered uncollectible.

We also record a charge-off when a loan is transferred to held

for sale by reducing the carrying amount by the allowance for

loan losses associated with such loan or, if the market value is

less than its carrying amount, by the amount of that difference.

Common shareholders’ equity to total assets - Common

shareholders’ equity divided by total assets. Common

shareholders’ equity equals total shareholders’ equity less the

liquidation value of preferred stock.

Credit derivatives - Contractual agreements, primarily credit

default swaps, that provide protection against a credit event of

one or more referenced credits. The nature of a credit event is

established by the protection buyer and protection seller at the

inception of a transaction, and such events include

bankruptcy, insolvency and failure to meet payment

obligations when due. The buyer of the credit derivative pays

a periodic fee in return for a payment by the protection seller

upon the occurrence, if any, of a credit event.

74