PNC Bank 2008 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

9G

OODWILL AND

O

THER

I

NTANGIBLE

A

SSETS

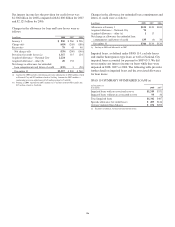

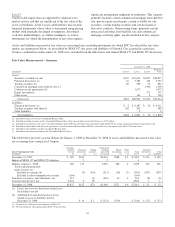

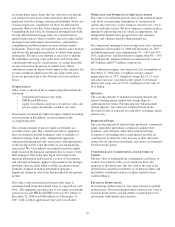

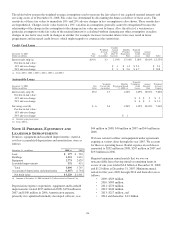

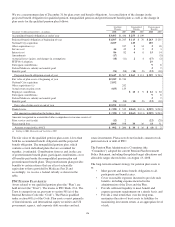

A summary of the changes in goodwill by business segment

during 2008 follows:

Goodwill

In millions

Dec. 31

2007

Additions/

Adjustments

Dec. 31

2008

Retail Banking $5,628 $354 $5,982

Corporate & Institutional

Banking 1,491 118 1,609

Global Investment Servicing 1,229 4 1,233

BlackRock 57 (13) 44

Total $8,405 $463 $8,868

Assets and liabilities of acquired entities are recorded at

estimated fair value as of the acquisition date and are subject

to refinement as information relative to the fair values at that

date becomes available. Revisions would likely result in

subsequent adjustments to goodwill. The goodwill and other

intangible assets related to Sterling are reported in the Retail

Banking and Corporate & Institutional Banking business

segments.

At December 31, 2008, no goodwill was recognized in

connection with the National City acquisition as the fair value

of net assets acquired exceeded the purchase price. The

allocation of the purchase price may be modified through

2009 as more information, such as appraisals, contracts,

reviews of legal documentation, and selected key borrower

data, is obtained about the fair value of assets acquired and

liabilities assumed and may result in goodwill.

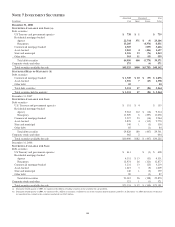

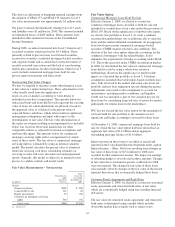

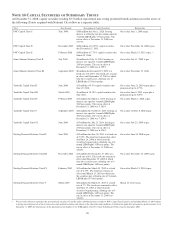

The gross carrying amount, accumulated amortization and net

carrying amount of other intangible assets by major category

consisted of the following:

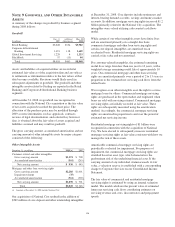

Other Intangible Assets

December 31 - in millions 2008 (a) 2007

Customer-related and other intangibles

Gross carrying amount $1,291 $ 708

Accumulated amortization (361) (263)

Net carrying amount $ 930 $ 445

Mortgage and other loan servicing rights

Gross carrying amount $2,286 $1,001

Impairment charge (35)

Accumulated amortization (361) (300)

Net carrying amount $1,890 $ 701

Total $2,820 $1,146

(a) Amounts at December 31, 2008 include National City.

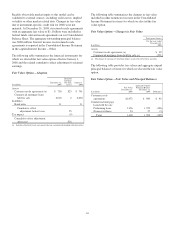

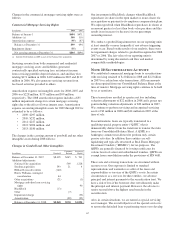

Our acquisition of National City resulted in the addition of

$569 million of core deposit and other relationship intangibles

at December 31, 2008. Core deposits include noninterest and

interest-bearing demand accounts, savings and money market

accounts. In addition, mortgage servicing rights increased $1.2

billion primarily related to the National City acquisition. The

intangibles were valued utilizing a discounted cash flows

model.

While certain of our other intangible assets have finite lives

and are amortized primarily on a straight-line basis,

commercial mortgage and other loan servicing rights and

certain core deposit intangibles are amortized on an

accelerated basis. Residential mortgage servicing rights are

carried at fair value and not amortized.

For customer-related intangibles, the estimated remaining

useful lives range from less than one year to 14 years, with a

weighted-average remaining useful life of approximately 10

years. Our commercial mortgage and other loan servicing

rights are amortized primarily over a period of 2 to 13 years in

proportion to the estimated net servicing cash flows from the

related loans.

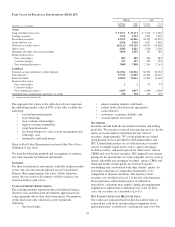

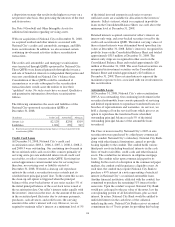

We recognize as an other intangible asset the right to service

mortgage loans for others. Commercial mortgage servicing

rights are purchased in the open market and originated when

loans are sold with servicing retained. Commercial mortgage

servicing rights are initially recorded at fair value. These

rights are subsequently measured using the amortization

method. Accordingly, the commercial mortgage servicing

rights are amortized in proportion to and over the period of

estimated net servicing income.

Residential mortgage servicing rights of $1 billion were

recognized in connection with the acquisition of National

City. We have elected to subsequently measure residential

mortgage servicing rights at fair value consistent with how we

manage the risk of these assets.

Amortizable commercial mortgage servicing rights are

periodically evaluated for impairment. For purposes of

impairment, the commercial mortgage servicing rights are

stratified based on asset type, which characterizes the

predominant risk of the underlying financial asset. If the

carrying amount of any individual stratum exceeds its fair

value, a valuation reserve is established with a corresponding

charge to Corporate Services on our Consolidated Income

Statement.

The fair value of commercial and residential mortgage

servicing rights is estimated by using an internal valuation

model. The model calculates the present value of estimated

future net servicing cash flows considering estimates on

servicing revenue and costs, discount rates and prepayment

speeds.

116