PNC Bank 2008 Annual Report Download - page 34

Download and view the complete annual report

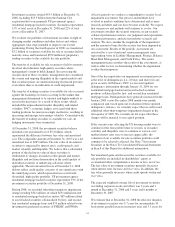

Please find page 34 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Commercial mortgage banking activities resulted in revenue

of $65 million in 2008 compared with $252 million in 2007.

Revenue for 2008 reflected losses of $197 million on

commercial mortgage loans held for sale, net of hedges, due to

the impact of an illiquid market during most of 2008. The

comparable amount for 2007 was a gain of $3 million.

Revenue for 2007 also reflected significant securitization

activity. In addition, commercial mortgage servicing revenue

declined $53 million primarily due to a $35 million

impairment charge on commercial mortgage servicing rights

while net interest income from commercial mortgage loans

held for sale increased $61 million in 2008 compared with

2007 due to higher loans held for sale balances.

P

ROVISION

F

OR

C

REDIT

L

OSSES

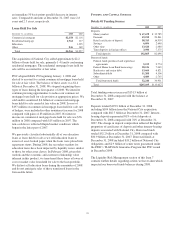

The provision for credit losses totaled $1.517 billion for 2008

compared with $315 million for 2007. Of the total 2008

provision, $990 million was recorded in the fourth quarter,

including $504 million of additional provision recorded on

December 31, 2008 to conform the National City loan

reserving methodology with ours. The differences in

methodology include granularity of loss computations,

statistical and quantitative factors rather than qualitative

assessment, and the extent of current appraisals and risk

assessments.

In addition to the impact of National City, the higher provision

in 2008 compared with the prior year was driven by general

credit quality migration, including residential real estate

development and commercial real estate exposure, an increase

in net charge-offs, and growth in nonperforming loans.

Growth in our total credit exposure also contributed to the

higher provision amounts in both comparisons.

With a deteriorating economy, we expect credit migration will

continue throughout 2009 as credit quality improvements will

lag any economic turnaround. The Credit Risk Management

portion of the Risk Management section of this Item 7

includes additional information regarding factors impacting

the provision for credit losses.

See also Item 1A Risk Factors and the Cautionary Statement

Regarding Forward-Looking Information section of Item 7 of

this Report.

N

ONINTEREST

E

XPENSE

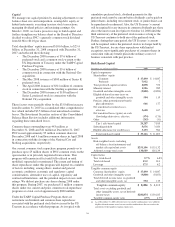

Total noninterest expense was $4.430 billion for 2008 and

$4.296 billion for 2007, an increase of $134 million, or 3%.

Higher noninterest expense in 2008 compared with 2007

primarily resulted from investments in growth initiatives,

including acquisitions, partially offset by the impact of the

sale of Hilliard Lyons and disciplined expense management.

Integration costs included in noninterest expense totaled $122

million for 2008, including $81 million in the fourth quarter,

and $102 million for 2007. Integration costs for the fourth

quarter of 2008 included $71 million related to our National

City acquisition.

Noninterest expense for 2008 included the benefit of the

reversal of $46 million of the $82 million Visa

indemnification liability that we established in the fourth

quarter of 2007. Additional information regarding our

transactions related to Visa is included in Note 25

Commitments And Guarantees in the Notes To Consolidated

Financial Statements included in Item 8 of this Report.

Expense management will be a key driver in 2009 as we

intend to maintain our focus on continuous improvement and

to achieve cost savings targets associated with our National

City integration. We currently expect FDIC deposit insurance

costs to increase significantly in 2009.

E

FFECTIVE

T

AX

R

ATE

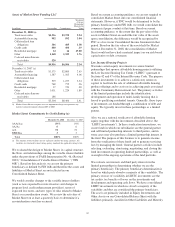

Our effective tax rate was 29.1% for 2008 and 29.9% for

2007.

30