PNC Bank 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

below are subject to review and independent testing as part of

our model validation and internal control testing processes.

Significant models are tested by our Model Validation

Committee on at least an annual basis. In addition, we have

teams, independent of the traders, verify marks and

assumptions used for valuations at each period end.

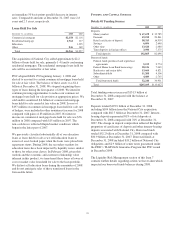

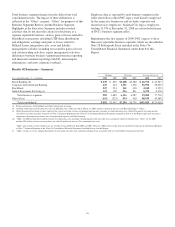

Securities

Securities include both the available for sale and trading

portfolios. We use prices sourced from pricing services, dealer

quotes or recent trades to determine the fair value of

securities. Approximately 75% of our positions are valued

using pricing services provided by the Lehman Index and

IDC. Lehman Index prices are set with reference to market

activity for highly liquid assets such as agency mortgage-

backed securities, and matrix priced for other assets, such as

CMBS and asset-backed securities. IDC primarily uses matrix

pricing for the instruments we value using this service, such as

agency adjustable rate mortgage securities, agency CMOs and

municipal bonds. Dealer quotes received are typically

non-binding and corroborated with other dealers’ quotes, by

reviewing valuations of comparable instruments, or by

comparison to internal valuations. The majority of our

securities are classified as Level 2 in the fair value hierarchy.

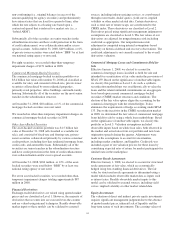

In circumstances where market prices are limited or

unavailable, valuations may require significant management

judgments or adjustments to determine fair value. In these

cases, the securities are classified as Level 3.

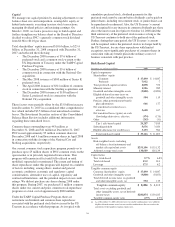

The primary valuation technique for securities classified as

Level 3 is to identify a proxy security, market transaction or

index. The proxy selected generally has similar credit, tenor,

duration, pricing and structuring attributes to the PNC

position. The price, market spread, or yield on the proxy is

then used to calculate an indicative market price for the

security. Depending on the nature of the PNC position and its

attributes relative to the proxy, management may make

additional adjustments to account for market conditions,

liquidity, and nonperformance risk, based on various inputs

including recent trades of similar assets, single dealer quotes,

and/or other observable and unobservable inputs.

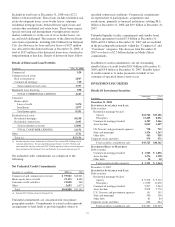

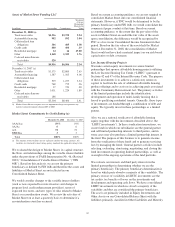

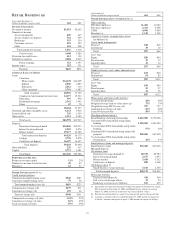

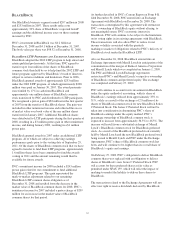

December 31, 2008

Agency Non-Agency

Dollars in millions

Residential

Mortgage-

Backed

Securities

Residential

Mortgage-

Backed

Securities

Commercial

Mortgage-

Backed

Securities

Other

Asset-

Back

Securities

Fair Value $12,742 $7,420 $3,419 $1,492

% of Fair Value:

By Vintage

2008 36% 1%

2007 24% 15% 10% 15%

2006 23% 23% 31% 30%

2005 5% 35% 12% 31%

2004 and earlier 12% 26% 47% 24%

Total 100% 100% 100% 100%

By Credit rating

Agency 100% 1%

AAA 82% 98% 71%

AA 4% 1% 7%

A5%2%

BBB 2% 8%

BB 3% 6%

B1%2%

Lower than B 2% 4%

No rating 1%

Total 100% 100% 100% 100%

By FICO Score

>720 68% 13%

<720 or >660 30% 47%

<660 1%

No FICO score 100% 2% 100% 39%

Total 100% 100% 100% 100%

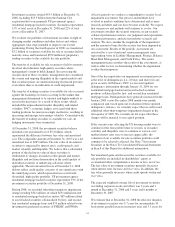

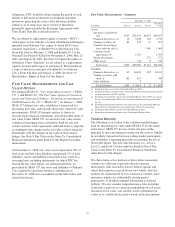

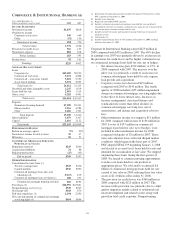

Residential Mortgage-Backed Securities

At December 31, 2008, our residential mortgage-backed

securities portfolio was comprised of $12.7 billion fair value

of US government agency-backed securities (substantially all

classified as available for sale) and $7.4 billion fair value of

private-issuer securities (all classified as available for sale).

The agency securities are generally collateralized by 1-4

family, conforming, fixed-rate residential mortgages.The

private-issuer securities are also generally collateralized by

1-4 family residential mortgages. The mortgage loans

underlying the private-issuer securities are generally

43