PNC Bank 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

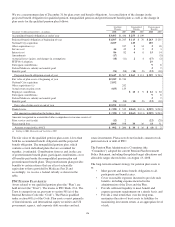

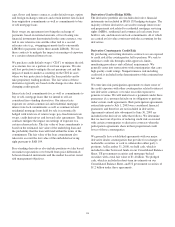

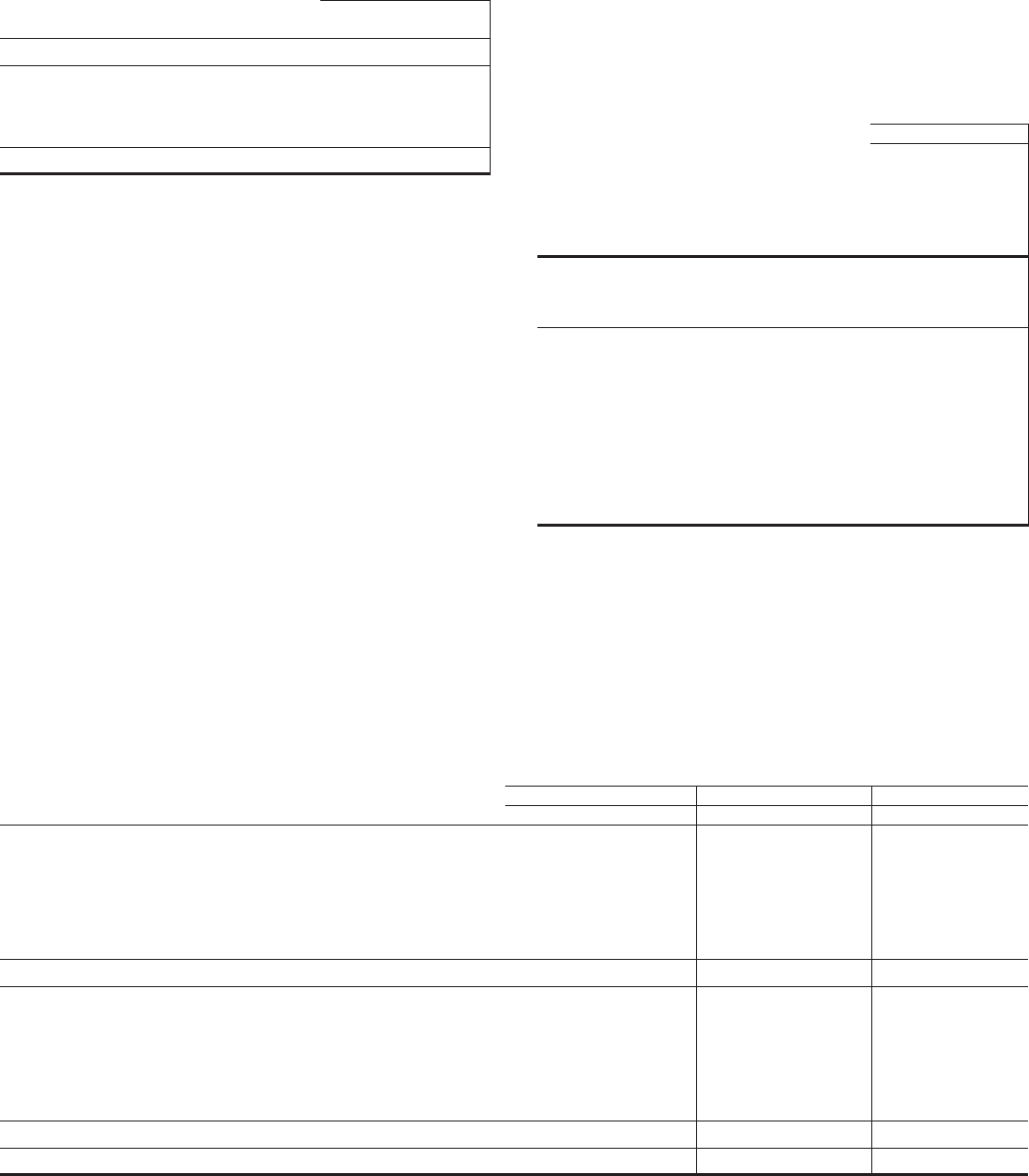

The asset allocation for National City’s defined benefit

pension plan as of the measurement date, by asset category is

as follows:

Percentage of Plan Assets

National City Pension Plan December 31 2008

Asset Category

Equity securities 42%

Fixed income securities 9%

Cash and cash equivalents 49%

Total 100%

The investment objective for the National City qualified

pension plan is to maximize total return with tolerance for

slightly above average risk. Asset allocation strongly favors

equities, with a target allocation of approximately 80% equity

securities, 15% fixed income securities, and 5% cash. Due to

volatility in the market, the target allocation is not always

desirable as asset allocations will fluctuate. A core equity

position of large cap stocks will be maintained. However,

more aggressive or volatile sectors will be meaningfully

represented in the asset mix in pursuit of higher returns.

Higher volatility investment strategies such as credit risk,

structured finance, and international bonds will be appropriate

strategies in conjunction with the core position. As of

December 31, 2008, the plan had a temporary large cash and

cash equivalents balance due to a contribution of $850 million

made by National City to the plan on December 30, 2008

which had not yet been fully invested.

Equity securities included $9 million of National City

common stock at December 31, 2008, representing

5,048,833 shares at a closing price of $1.81. In conjunction

with PNC’s acquisition of National City, these shares were

exchanged into 197,914 shares of PNC common stock.

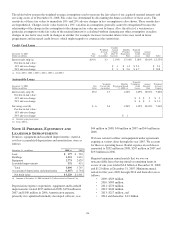

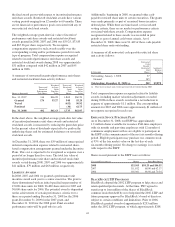

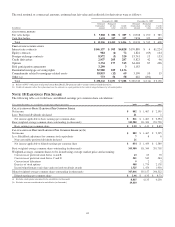

The following table provides information regarding our

estimated future cash flows related to our various plans,

including the impact of the National City plans:

E

STIMATED

C

ASH

F

LOWS

Postretirement Benefits

In millions

Qualified

Pension

Nonqualified

Pension

Gross

PNC

Benefit

Payments

Reduction

in PNC

Benefit

Payments

Due to

Medicare

Part D

Subsidy

Estimated 2009

employer

contributions — $ 29 $ 35 $2

Estimated future

benefit

payments

2009 $ 247 $ 29 $ 35 $2

2010 253 30 36 2

2011 262 28 34 2

2012 267 28 34 2

2013 277 25 34 2

2014 – 2018 1,499 109 164 9

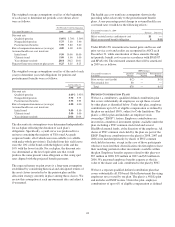

The qualified pension plan contributions are deposited into the

Trust, and the qualified pension plan benefit payments are

paid from the Trust. For the other plans, total contributions

and the benefit payments are the same and represent expected

benefit amounts, which are paid from general assets.

Postretirement benefits are net of participant contributions.

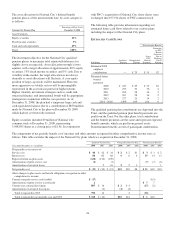

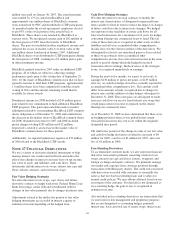

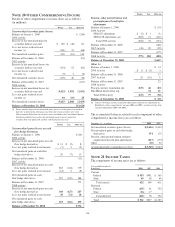

The components of net periodic benefit cost/ (income) and other amounts recognized in other comprehensive income were as

follows. This table excludes the impact of the National City plans which we acquired on December 31, 2008.

Qualified Pension Plan Nonqualified Pension Plan Postretirement Benefits

Year ended December 31 – in millions 2008 2007 2006 2008 2007 2006 2008 2007 2006

Net periodic cost consists of:

Service cost $44 $42 $34 $2 $2 $1 $3 $3 $2

Interest cost 86 82 68 664 15 14 13

Expected return on plan assets (160) (156) (129)

Amortization of prior service cost (2) (1) (7) (7) (6)

Amortization of actuarial losses 2 16 223 1

Net periodic cost $ (32) $ (30) $ (12) $10 $10 $8 $11 $10 $10

Other changes in plan assets and benefit obligations recognized in other

comprehensive income:

Current year prior service cost/(credit) $ (17) $ (5)

Amortization of prior service (cost)/credit 2$77

Current year actuarial loss/(gain) 807 $16 $2 $4 (17) (2)

Amortization of actuarial (loss)/gain (2) (2) (2)

Total recognized in OCI 792 14 2 (10)

Total recognized in net periodic cost and OCI $ 760 $ (16) $10 $12 $1 $10

128