PNC Bank 2008 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National City sold residential mortgage loans and home equity

lines of credit (collectively, loans) in the normal course of

business. These agreements usually require certain

representations concerning credit information, loan

documentation, collateral, and insurability. On a regular basis,

investors may request PNC to indemnify them against losses

on certain loans or to repurchase loans which the investors

believe do not comply with applicable representations. Upon

completion of its own investigation as to the validity of the

claim, PNC will repurchase or provide indemnification on

such loans. Indemnification requests are generally received

within two years subsequent to the date of sale.

Management maintains a liability for estimated losses on

loans expected to be repurchased, or on which indemnification

is expected to be provided, and regularly evaluates the

adequacy of this recourse liability based on trends in

repurchase and indemnification requests, actual loss

experience, known and inherent risks in the loans, and current

economic conditions. At December 31, 2008 the liability for

estimated losses on repurchase and indemnification claims

was $406 million.

O

THER

G

UARANTEES

We write caps and floors for customers, risk management and

proprietary trading purposes. At December 31, 2008, the fair

value of the written caps and floors liability on our

Consolidated Balance Sheet was $12 million. Our ultimate

obligation under written options is based on future market

conditions and is only quantifiable at settlement. We manage

our market risk exposure from customer positions through

transactions with third-party dealers.

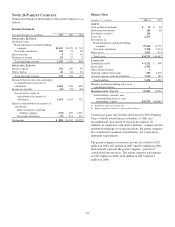

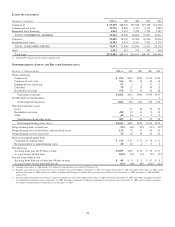

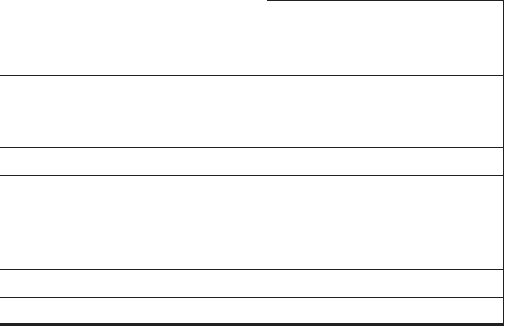

CREDIT DEFAULT SWAPS

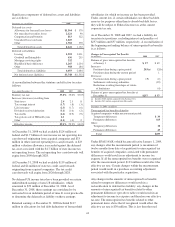

December 31, 2008

Dollars in millions

Notional

amount

Estimated

net fair

value

Weighted-

Average

Remaining

Maturity

In Years

Credit Default Swaps – Guarantees

Single name $ 278 $ (38) 3.84

Index traded 677 (42) 4.84

Total (a) $ 955 $ (80) 4.54

Credit Default Swaps –

Beneficiaries

Single name $ 974 $ 84 3.82

Index traded 1,008 201 31.82

Total (b) $1,982 $285 18.06

Total (c) $2,937 $205 13.67

(a) Includes $883 million of investment grade credit default swaps with a rating of Baa3

or above and $72 million of subinvestment grade based on published rating agency

information.

(b) Includes $1.7 billion of investment grade credit default swaps with a rating of Baa3

or above and $263 million of subinvestment grade based on published rating agency

information.

(c) The referenced/underlying assets for these credit default swaps is approximately

70% corporate debt, 27% commercial mortgage backed securities and 3% related to

loans.

We enter into credit default swaps under which we buy loss

protection from or sell loss protection to a counterparty for the

occurrence of a credit event of a reference entity. The fair

value of the contracts sold on our Consolidated Balance Sheet

was a net liability of $80 million at December 31, 2008. The

maximum amount we would be required to pay under the

credit default swaps in which we sold protection, assuming all

reference obligations experience a credit event at a total loss,

without recoveries, was $955 million at December 31, 2008.

We have also entered into various contingent performance

guarantees through credit risk participation arrangements with

terms ranging from less than one year to 23 years. As of

December 31, 2008 the notional amount of risk participations

agreements was $1.9 billion with a weighted-average

remaining maturity of 3 years. The fair value of these

agreements on our Consolidated Balance Sheet was a net

liability of $3 million. Based on the Corporation’s internal risk

rating process, 98% of the notional amount of the risk

participations agreements outstanding had underlying swap

counterparties with internal credit ratings of pass, indicating

the expected risk of loss is currently low, while 2% had

underlying swap counterparties with internal risk ratings

below pass, indicating a higher degree of risk of default. We

will be required to make payments under these guarantees if a

customer defaults on its obligation to perform under certain

credit agreements with third parties. Assuming all underlying

swap counterparties defaulted, the maximum potential

exposure from these agreements as of December 31, 2008

would be $128 million based on the fair value of the

underlying swaps.

C

ONTINGENT

P

AYMENTS

I

N

C

ONNECTION

W

ITH

C

ERTAIN

A

CQUISITIONS

A number of the acquisition agreements to which we are a

party and under which we have purchased various types of

assets, including the purchase of entire businesses, partial

interests in companies, or other types of assets, require us to

make additional payments in future years if certain

predetermined goals are achieved or not achieved within a

specific time period. Due to the nature of the contract

provisions, we cannot quantify our total exposure that may

result from these agreements.

149