PNC Bank 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

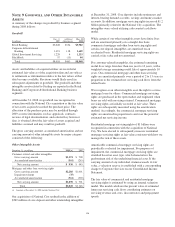

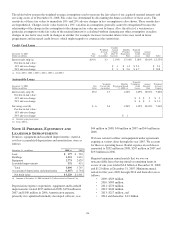

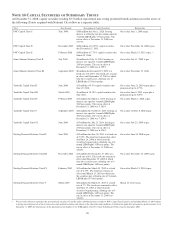

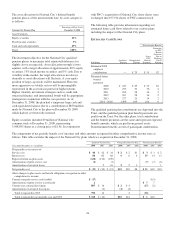

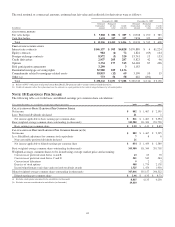

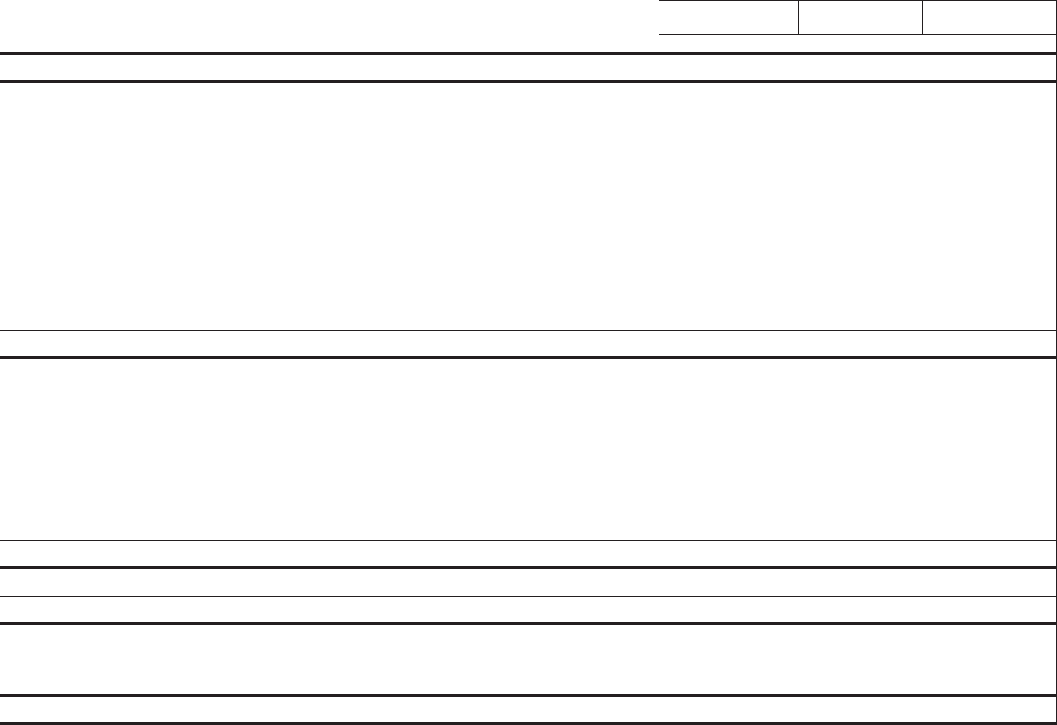

We use a measurement date of December 31 for plan assets and benefit obligations. A reconciliation of the changes in the

projected benefit obligation for qualified pension, nonqualified pension and postretirement benefit plans as well as the change in

plan assets for the qualified pension plan follows:

Qualified

Pension

Nonqualified

Pension

Postretirement

Benefits

December 31 (Measurement Date) – in millions 2008 2007 2008 2007 2008 2007

Accumulated benefit obligation at end of year $3,493 $1,436 $ 253 $ 109

Projected benefit obligation at beginning of year $1,507 $1,245 $ 113 $76 $ 243 $ 235

National City acquisition 2,109 145 105

Other acquisitions (a) 247 534 318

Service cost 44 42 2233

Interest cost 86 82 6615 14

Amendments (17) (5)

Actuarial losses (gains) and changes in assumptions (18) (11) 24(17) (2)

EITF 06-4 adoption 29

Participant contributions 98

Federal Medicare subsidy on benefits paid 22

Benefits paid (94) (98) (10) (9) (33) (30)

Projected benefit obligation at end of year $3,617 $1,507 $ 263 $ 113 $ 359 $ 243

Fair value of plan assets at beginning of year $2,019 $1,746

National City acquisition 2,032

Other acquisitions (a) 242

Actual return on plan assets (665) 129

Employer contribution $10 $9$22 $20

Participant contributions 98

Federal Medicare subsidy on benefits paid 22

Benefits paid (94) (98) (10) (9) (33) (30)

Fair value of plan assets at end of year $3,292 $2,019

Funded status $ (325) $ 512 $(263) $(113) $(359) $(243)

Net amount recognized on the balance sheet $ (325) $ 512 $(263) $(113) $(359) $(243)

Amounts recognized in accumulated other comprehensive income consist of:

Prior service cost (credit) (12) 2(22) (29)

Net actuarial loss 1,004 198 30 30 14 31

Amount recognized in AOCI $ 992 $ 200 $30 $30 $ (8) $2

(a) Sterling in 2008; Mercantile and Yardville in 2007.

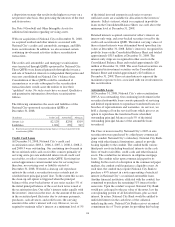

The fair value of the qualified pension plan assets is less than

both the accumulated benefit obligation and the projected

benefit obligation. The nonqualified pension plan, which

contains several individual plans that are accounted for

together, is unfunded. Contributions from us and, in the case

of postretirement benefit plans, participant contributions cover

all benefits paid under the nonqualified pension plan and

postretirement benefit plans. The postretirement plan provides

benefits to certain retirees that are at least actuarially

equivalent to those provided by Medicare Part D and

accordingly, we receive a federal subsidy as shown in the

table.

PNC P

ENSION

P

LAN

A

SSETS

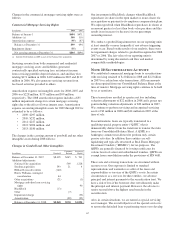

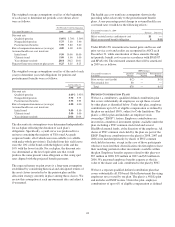

Assets related to our qualified pension plan (the “Plan”) are

held in trust (the “Trust”). The trustee is PNC Bank, N.A. The

Trust is exempt from tax pursuant to section 501(a) of the

Internal Revenue Code (the “Code”). The Plan is qualified

under section 401(a) of the Code. Plan assets consist primarily

of listed domestic and international equity securities and US

government, agency, and corporate debt securities and real

estate investments. Plan assets do not include common stock,

preferred stock or debt of PNC.

The Pension Plan Administrative Committee (the

“Committee”) adopted the current Pension Plan Investment

Policy Statement, including the updated target allocations and

allowable ranges shown below, on August 13, 2008.

The long-term investment strategy for pension plan assets is

to:

• Meet present and future benefit obligations to all

participants and beneficiaries,

• Cover reasonable expenses incurred to provide such

benefits, including expense incurred in the

administration of the Trust and the Plan,

• Provide sufficient liquidity to meet benefit and

expense payment requirements on a timely basis, and

• Provide a total return that, over the long term,

maximizes the ratio of trust assets to liabilities by

maximizing investment return, at an appropriate level

of risk.

126