PNC Bank 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

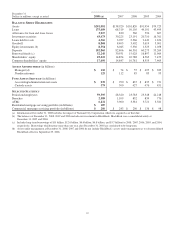

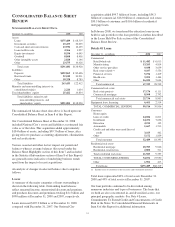

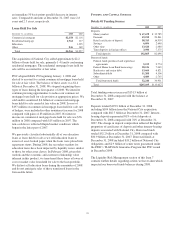

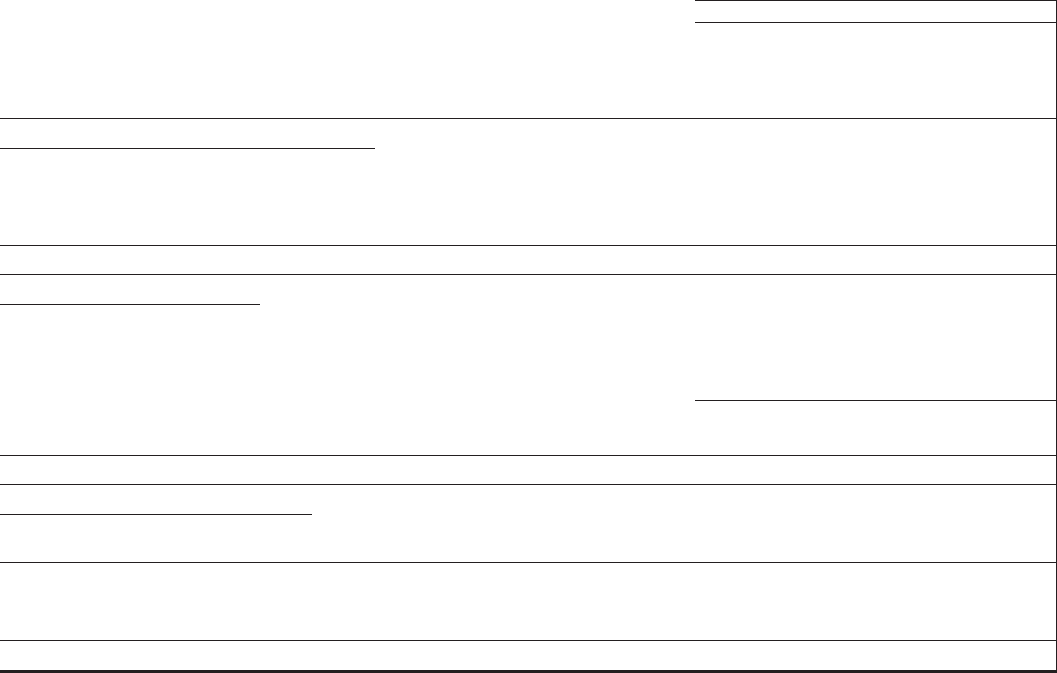

The following table presents the valuation adjustments applied against National City loans as part of the purchase accounting

process at December 31, 2008.

National City Loan Portfolio Assessment

Dollars in billions

December 31, 2008

Principal

Balance

Valuation

Adjustment

Fair

Value

Valuation

Adjustment

as%of

Principal

Balance

Valuation Adjustments By Loan Classification

Commercial/Commercial real estate $ 56.5 $ 4.7 $51.8 8.3%

Consumer 31.4 3.5 27.9 11.1%

Residential real estate 19.2 4.4 14.8 22.9%

Other .9 .9

Total $108.0 $12.6 $95.4(a) 11.7%

Valuation Adjustments By Type

Impaired loans

Commercial/Commercial real estate $ 4.0 $ 2.2 $ 1.8 55.0%

Consumer 5.8 1.9 3.9 32.8%

Residential real estate 9.5 3.3 6.2 34.7%

Total impaired loans 19.3 7.4 11.9 38.3%

Performing loans 88.7 5.2 83.5 5.9%

Total $108.0 $12.6 $95.4(a) 11.7%

Valuation Adjustments By Component

Fair value mark – impaired loans $ 7.4

Fair value mark – performing loans 2.4

Subtotal – fair value marks 9.8

National City reserve carryover on performing loans 2.3

Conforming credit reserve on performing loans .5

Total $12.6

(a) Represents total adjusted loans of $99.7 billion from the National City acquisition, net of $2.8 billion of loan loss reserves, $1.1 billion of loans previously classified as held for sale by

National City, and $.4 billion of other purchase accounting adjustments.

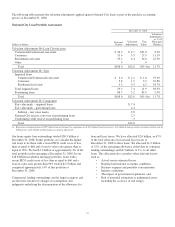

Our home equity loan outstandings totaled $38.3 billion at

December 31, 2008. In this portfolio, we consider the higher

risk loans to be those with a recent FICO credit score of less

than or equal to 660 and a loan-to-value ratio greater than or

equal to 90%. We had $1.2 billion or approximately 3% of the

total portfolio in this grouping at December 31, 2008. In our

$18.8 billion residential mortgage portfolio, loans with a

recent FICO credit score of less than or equal to 660 and a

loan-to-value ratio greater than 90% totaled $2.5 billion and

comprised approximately 14% of this portfolio at

December 31, 2008.

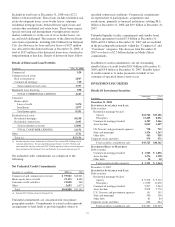

Commercial lending outstandings are the largest category and

are the most sensitive to changes in assumptions and

judgments underlying the determination of the allowance for

loan and lease losses. We have allocated $2.6 billion, or 67%,

of the total allowance for loan and lease losses at

December 31, 2008 to these loans. We allocated $1.2 billion,

or 32%, of the remaining allowance at that date to consumer

lending outstandings and $47 million, or 1%, to all other

loans. This allocation also considers other relevant factors

such as:

• Actual versus estimated losses,

• Regional and national economic conditions,

• Business segment and portfolio concentrations,

• Industry conditions,

• The impact of government regulations, and

• Risk of potential estimation or judgmental errors,

including the accuracy of risk ratings.

32