PNC Bank 2008 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

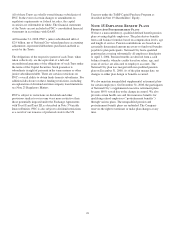

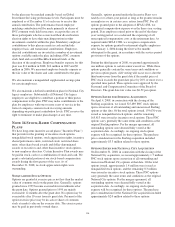

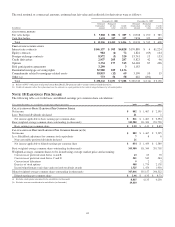

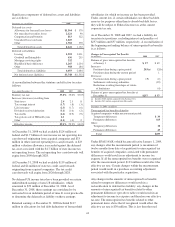

The total notional or contractual amounts, estimated net fair value and credit risk for derivatives were as follows:

December 31, 2008 December 31, 2007

In millions

Notional/

Contractual

amount

Estimated

net fair

value

Credit

risk (b)

Notional/

Contractual

amount

Estimated

net fair

value

Credit

risk (b)

A

CCOUNTING HEDGES

Fair value hedges $ 9,888 $ 888 $ 889 $ 10,568 $ 190 $ 283

Cash flow hedges 5,618 527 527 7,856 325 325

Total $ 15,506 $1,415 $ 1,416 $ 18,424 $ 515 $ 608

F

REE

-

STANDING DERIVATIVES

Interest rate contracts $146,137 $ 503 $4,828 $170,889 $ 4 $1,224

Equity contracts 984 (4) 72 1,824 (69) 144

Foreign exchange contracts 8,972 (3) 320 15,741 13 153

Credit derivatives 2,937 205 287 5,823 42 96

Options 3,334 177 315 64,448 87 496

Risk participation agreements 3,290 3 1,183

Residential mortgage servicing rights 52,980 109 1,136

Commitments related to mortgage-related assets 18,853 (12) 69 3,190 10 15

Other (a) 773 56 58 642 (201)

Total $ 238,260 $1,031 $ 7,088 $ 263,740 $ (114) $ 2,128

(a) Relates to PNC’s obligation to help fund certain BlackRock LTIP programs and to certain customer-related derivatives.

(b) Credit risk amounts reflect the replacement cost for contracts in a gain position in the event of nonperformance by all counterparties.

N

OTE

18 E

ARNINGS

P

ER

S

HARE

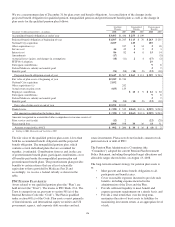

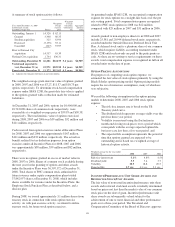

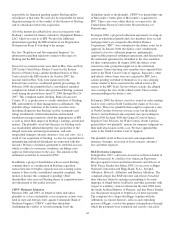

The following table sets forth basic and diluted earnings per common share calculations:

Year ended December 31 - in millions, except share and per share data 2008 2007 2006

C

ALCULATION OF

B

ASIC

E

ARNINGS

P

ER

C

OMMON

S

HARE

Net income $ 882 $ 1,467 $ 2,595

Less: Preferred dividends declared 21 1

Net income applicable to basic earnings per common share $ 861 $ 1,467 $ 2,594

Basic weighted-average common shares outstanding (in thousands) 343,980 331,300 291,758

Basic earnings per common share $ 2.50 $ 4.43 $ 8.89

C

ALCULATION OF

D

ILUTED

E

ARNINGS

P

ER

C

OMMON

S

HARE

(a) (b)

Net income $ 882 $ 1,467 $ 2,595

Less: BlackRock adjustment for common stock equivalents 786

Non-convertible preferred dividends declared 21

Net income applicable to diluted earnings per common share $ 854 $ 1,459 $ 2,589

Basic weighted-average common shares outstanding (in thousands) 343,980 331,300 291,758

Weighted-average common shares to be issued using average market price and assuming:

Conversion of preferred stock Series A and B 63 65 70

Conversion of preferred stock Series C and D 501 542 584

Conversion of debentures 922

Exercise of stock options 988 1,774 2,178

Incentive/performance unit share and restricted stock/unit awards 1,525 1,474 1,930

Diluted weighted-average common shares outstanding (in thousands) 347,066 335,157 296,522

Diluted earnings per common share $ 2.46 $ 4.35 $ 8.73

(a) Excludes stock options considered to be anti-dilutive (in thousands) 8,815 4,135 4,230

(b) Excludes warrants considered to be anti-dilutive (in thousands) 19,410

135