PNC Bank 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Private Equity Investments

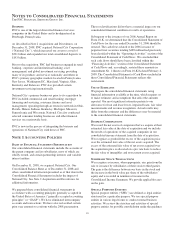

We report private equity investments, which include direct

investments in companies, affiliated partnership interests and

indirect investments in private equity funds, at estimated fair

value. These estimates are based on available information and

may not necessarily represent amounts that we will ultimately

realize through distribution, sale or liquidation of the

investments. Fair value of publicly traded direct investments

are determined using quoted market prices and are subject to

various discount factors for sales restrictions, when

appropriate. The valuation procedures applied to direct

investments in private companies include techniques such as

multiples of adjusted earnings of the entity, independent

appraisals, anticipated financing and sale transactions with

third parties, or the pricing used to value the entity in a recent

financing transaction. We value affiliated partnership interests

based on the underlying investments of the partnership using

procedures consistent with those applied to direct investments.

Indirect investments in private equity funds are valued based

on the financial statements that we receive from their

managers. Due to the time lag in our receipt of the financial

information and based on a review of investments and

valuation techniques applied, adjustments to the manager

provided value are made when available recent portfolio

company information or market information indicates a

significant change in value from that provided by the manager

of the fund. We include all private equity investments on the

Consolidated Balance Sheet in the caption Equity investments.

Changes in the fair value of private equity investments are

recognized in noninterest income.

We consolidate private equity investments when we are the

general partner in a limited partnership and have determined

that we have control of the partnership. The portion we do not

own is reflected in the caption Minority and noncontrolling

interests in consolidated entities on the Consolidated Balance

Sheet.

Investment in BlackRock, Inc.

We deconsolidated the assets and liabilities of BlackRock,

Inc. (“BlackRock”) from our Consolidated Balance Sheet

effective September 29, 2006 and now account for our

investment in BlackRock under the equity method of

accounting. The investment in BlackRock is reflected on our

Consolidated Balance Sheet in the caption Equity investments,

while our equity in earnings of BlackRock is reported on our

Consolidated Income Statement in the caption Asset

management.

We mark to market our obligation to transfer BlackRock

shares related to certain BlackRock long-term incentive plan

(“LTIP”) programs. This obligation is classified as a free

standing derivative as disclosed in Note 17 Financial

Derivatives. As we transfer the shares for payouts under such

LTIP programs, we recognize a gain or loss on those shares.

The impact of those transactions is shown on a net basis on

our Consolidated Income Statement in Other noninterest

income. Our obligation to transfer BlackRock shares related to

the LTIP programs and the resulting accounting are described

in more detail in Note 2 Acquisitions and Divestitures.

L

OANS AND

L

EASES

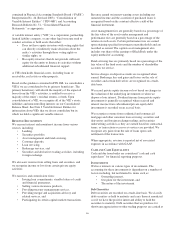

Loans are classified as held for investment when management

has both the intent and ability to hold the loan for the

foreseeable future, or until maturity or payoff. In conjunction

with the acquisition of National City, management designated

all acquired loans and leases as either held for investment or

held for sale based on its current intent and view of the

foreseeable future. Management’s intent and view of the

foreseeable future may change based on changes in business

strategies, the economic environment and market conditions.

Except as described below, loans held for investment are

stated at the principal amounts outstanding, net of unearned

income, unamortized deferred fees and costs on originated

loans, and premiums or discounts on loans purchased. Interest

on performing loans is accrued based on the principal amount

outstanding and recorded in interest income as earned using

the constant effective yield method. Loan origination fees,

direct loan origination costs, and loan premiums and discounts

are deferred and accreted or amortized into net interest

income, over periods not exceeding the contractual life of the

loan.

Certain loans are accounted for at fair value in accordance

with Statement of Financial Accounting Standards No.

(“SFAS”) 155, “Accounting for Certain Hybrid Financial

Instruments – an amendment of FASB Statements No. 133

and 140,” with changes in the fair value reported in other

noninterest income. The fair value of these loans was $43

million, or less than .5% of the total loan portfolio, at

December 31, 2008.

In addition to originating loans, we also acquire loans through

portfolio purchases or acquisitions of other financial services

companies. For certain acquired loans that have experienced a

deterioration of credit quality at the time of acquisition, we

follow the guidance contained in AICPA Statement of

Position 03-3, “Accounting for Certain Loans or Debt

Securities Acquired in a Transfer” (“SOP 03-3”). Under SOP

03-3, acquired loans are to be recorded at fair value absent the

carry over of any existing valuation allowances. Evidence of

credit quality deterioration as of the purchase date may

include information and statistics such as bankruptcy events,

FICO scores, past due status, current borrower credit scores,

and current loan-to-value (LTV). We review the loans

acquired for evidence of credit quality deterioration at the date

of acquisition and determine if it is probable that we will be

unable to collect all amounts due, including both principal and

interest, according to the loan’s contractual terms. When both

conditions exist, we estimate the amount and timing of

undiscounted expected cash flows for each loan either

individually or on a pool basis. We estimate the cash flows

expected to be collected at acquisition using internal and third

88