PNC Bank 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

program totaled $445 million. These trades matured at the end

of January 2009 and were replaced with commercial paper

sold to investors.

****

It is also possible that the US Congress and federal banking

agencies, as part of their efforts to provide economic stimulus

and financial market stability, to enhance the liquidity and

solvency of financial institutions and markets, and to enhance

the regulation of financial institutions and markets, will

announce additional legislation, regulations or programs.

These additional actions may take the form of changes in or

additions to the statutes or regulations related to existing

programs, including those described above. It is not possible

at this time to predict the ultimate impact of these actions on

PNC’s business plans and strategies.

K

EY

F

ACTORS

A

FFECTING

F

INANCIAL

P

ERFORMANCE

Our financial performance is substantially affected by several

external factors outside of our control including the following,

some of which may be affected by legislative, regulatory and

administrative initiatives of the Federal government outlined

above:

• General economic conditions, including the length

and severity of the current recession,

• The level of, and direction, timing and magnitude of

movement in interest rates, and the shape of the

interest rate yield curve,

• The functioning and other performance of, and

availability of liquidity in, the capital and other

financial markets,

• Loan demand, utilization of credit commitments and

standby letters of credit, and asset quality,

• Customer demand for other products and services,

• Changes in the competitive landscape and in

counterparty creditworthiness and performance as the

financial services industry restructures in the current

environment,

• Movement of customer deposits from lower to higher

rate accounts or to investment alternatives, and

• The impact of market credit spreads on asset

valuations.

In addition, our success will depend, among other things,

upon:

• Further success in the acquisition, growth and

retention of customers,

• Progress toward integrating the National City

acquisition,

• Continued development of the markets related to our

recent acquisitions, including full deployment of our

product offerings,

• Revenue growth,

• A sustained focus on expense management, including

achieving our cost savings targets associated with our

National City integration, and creating positive

operating leverage,

• Managing the distressed assets portfolio,

• Maintaining solid overall asset quality,

• Continuing to maintain our solid deposit base,

• Prudent risk and capital management leading to a

return to our desired moderate risk profile, and

• Actions we take within the capital and other financial

markets.

See also Item 1A Risk Factors and the Cautionary Statement

Regarding Forward-Looking Information section of Item 7 of

this Report.

O

THER

2008 A

CQUISITION

A

ND

D

IVESTITURE

A

CTIVITY

On April 4, 2008, we acquired Lancaster, Pennsylvania-based

Sterling Financial Corporation (“Sterling”) for approximately

4.6 million shares of PNC common stock and $224 million in

cash. Sterling was a banking and financial services company

with approximately $3.2 billion in assets, $2.7 billion in

deposits, and 65 branches in south-central Pennsylvania,

northern Maryland and northern Delaware. The Sterling

technology systems and bank charter conversions were

completed during the third quarter of 2008 and we realized the

anticipated cost savings related to these activities.

On March 31, 2008, we sold J.J.B. Hilliard, W.L. Lyons, LLC

(“Hilliard Lyons”), a Louisville, Kentucky-based wholly-

owned subsidiary of PNC and a full-service brokerage and

financial services provider, to Houchens Industries, Inc. We

recognized an after-tax gain of $23 million in the first quarter

of 2008 in connection with this divestiture. Business segment

information for the periods presented in this Item 7 reflects the

reclassification of results for Hilliard Lyons, including the

gain on the sale of this business, from the Retail Banking

business segment to “Other.”

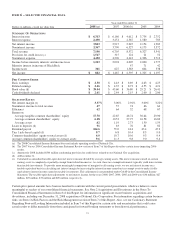

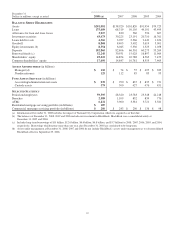

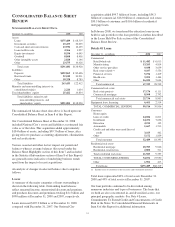

Summary Financial Results Year ended December 31

In millions, except

per share data 2008 2007

Net income $ 882 $1,467

Diluted earnings per share $2.46 $ 4.35

Return on

Average common shareholders’ equity 6.28% 10.53%

Average assets .62% 1.19%

Our earnings and related per share amounts for 2008 do not

include the impact of National City, which we acquired

effective December 31, 2008, other than a conforming

adjustment to our provision for credit losses of $504 million

and other integration costs of $71 million, both of which were

recognized in the fourth quarter.

Our performance in 2008 included the following:

• At December 31, 2008 we had total assets of $291

billion, including loans of $175 billion, and total

deposits of $193 billion, reflecting the acquisition of

National City.

• We significantly strengthened capital. The Tier 1

risk-based capital ratio was 9.7% at December 31,

25