PNC Bank 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

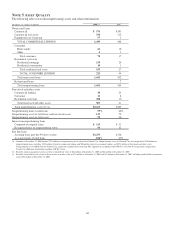

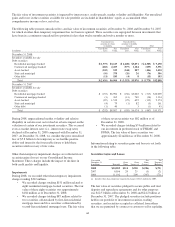

Level 3

Unobservable inputs that are supported by minimal or no

market activity and that are significant to the fair value of the

assets or liabilities. Level 3 assets and liabilities may include

financial instruments whose value is determined using pricing

models with internally developed assumptions, discounted

cash flow methodologies, or similar techniques, as well as

instruments for which the determination of fair value requires

significant management judgment or estimation. This category

generally includes certain commercial mortgage loans held for

sale, private equity investments, certain available for sale

securities, certain trading securities and certain financial

derivative contracts. Nonrecurring items, primarily certain

nonaccrual and other loans held for sale and commercial

mortgage servicing rights, are also included in this category.

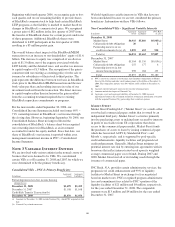

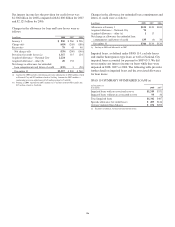

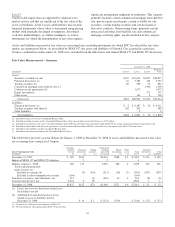

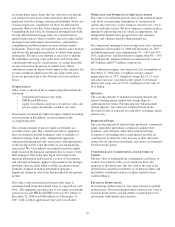

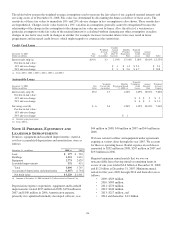

Assets and liabilities measured at fair value on a recurring basis, including instruments for which PNC has elected the fair value

option, are summarized below. As prescribed by SFAS 157, the assets and liabilities of National City acquired in a purchase

business combination on December 31, 2008 were excluded from the table below and related SFAS 157 and SFAS 159 disclosures.

Fair Value Measurements – Summary

December 31, 2008

In millions Level 1 Level 2 Level 3

Total Fair

Value

Assets

Securities available for sale $347 $21,633 $4,837 $26,817

Financial derivatives (a) 16 5,582 125 5,723

Trading securities (b) 89 529 73 691

Commercial mortgage loans held for sale (c) 1,400 1,400

Customer resale agreements (d) 1,072 1,072

Equity investments 571 571

Other assets 144 6 150

Total assets $452 $28,960 $7,012 $36,424

Liabilities

Financial derivatives (e) $ 2 $ 4,387 $ 22 $ 4,411

Trading securities sold short (f) 182 207 389

Other liabilities 99

Total liabilities $184 $ 4,603 $ 22 $ 4,809

(a) Included in other assets on the Consolidated Balance Sheet.

(b) Included in trading securities on the Consolidated Balance Sheet. Fair value includes net unrealized losses of $27.5 million.

(c) Included in loans held for sale on the Consolidated Balance Sheet. PNC has elected the fair value option under SFAS 159 for certain commercial mortgage loans held for sale.

(d) Included in federal funds sold and resale agreements on the Consolidated Balance Sheet. PNC has elected the fair value option under SFAS 159 for this item.

(e) Included in other liabilities on the Consolidated Balance Sheet.

(f) Included in other borrowed funds on the Consolidated Balance Sheet.

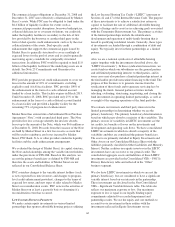

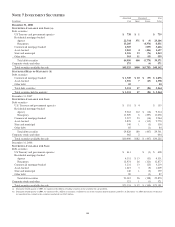

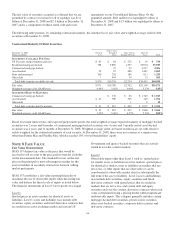

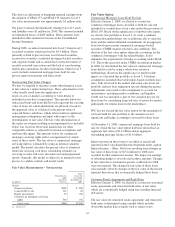

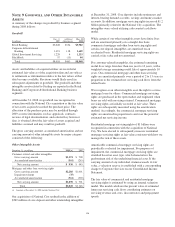

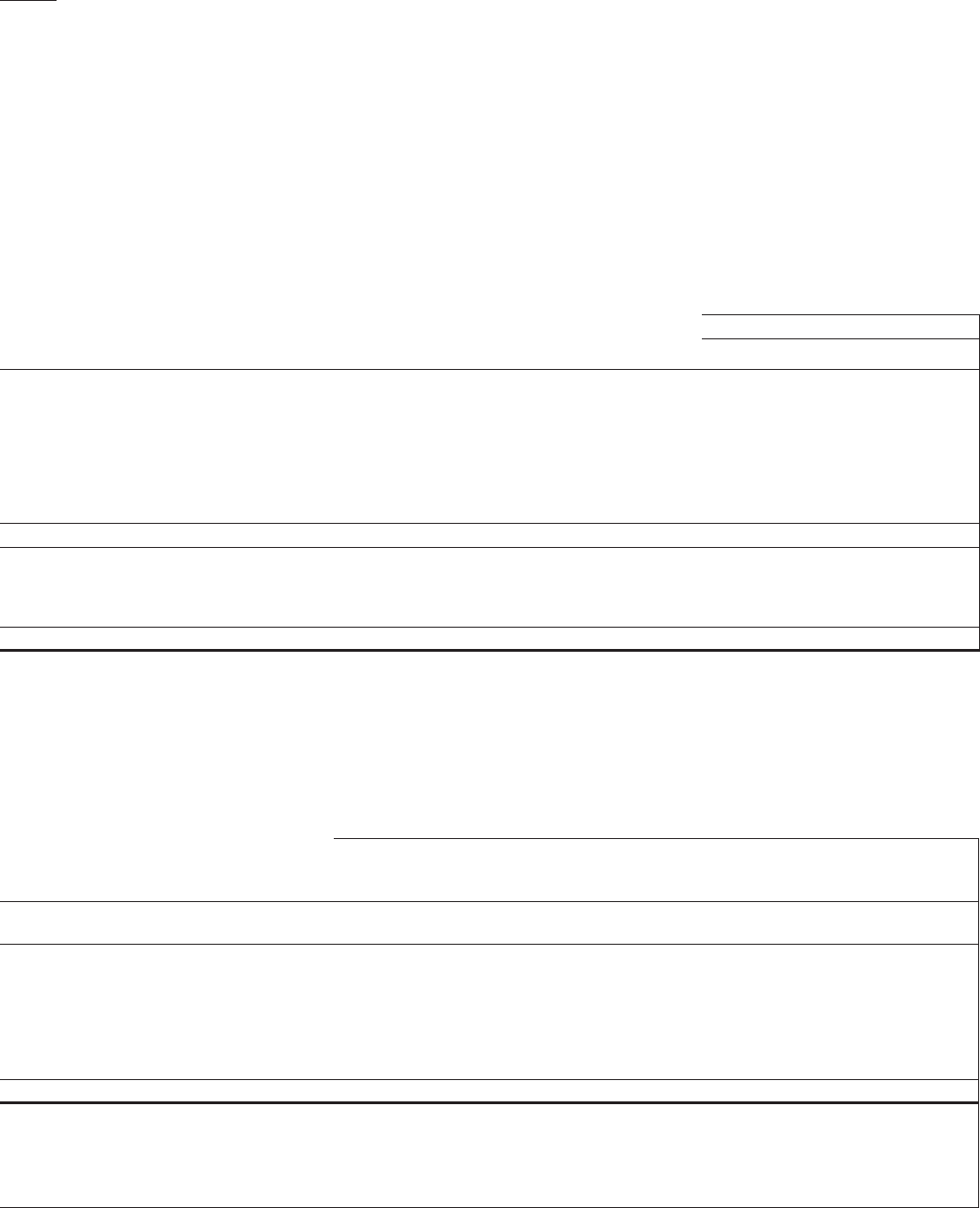

The table below presents a reconciliation for January 1, 2008 to December 31, 2008 of assets and liabilities measured at fair value

on a recurring basis using Level 3 inputs.

Level 3 Instruments Only

In millions

Securities

available

for sale

(c)

Financial

derivatives

(c)

Trading

securities

(c)

Commercial

mortgage

loans held

for sale (d)

Equity

investments

(c)

Other

assets

(c)

Total

Assets

Financial

derivatives

(c)

Total

Liabilities

December 31, 2007 $ 285 $130 $2,018 $568 $ 4 $3,005 $ 326 $ 326

Impact of SFAS 157 and SFAS 159 adoption 2 2 4

Balance, January 1, 2008 285 132 2,020 568 4 3,009 326 326

Total realized/unrealized

gains or losses (a):

Included in earnings (b) (9) $ (4) (251) (30) (2) (296) (297) (297)

Included in other comprehensive income (164) (164)

Purchases, issuances, and settlements, net 515 18 (369) 33 4 201 (8) (8)

Transfers into Level 3, net 4,201 2 59 4,262 1 1

December 31, 2008 $4,837 $125 $73 $1,400 $571 $ 6 $7,012 $ 22 $ 22

(a) Losses for assets are bracketed which losses

for liabilities are not.

(b) Attributable to unrealized gains or losses

related to assets or liabilities held at

December 31, 2008: $ 16 $ 1 $ (213) $ (50) $ (246) $ (37) $ (37)

(c) Carried at fair value prior to our adoption of SFAS 157.

(d) We elected the fair value option under SFAS 159 for this item.

111