PNC Bank 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

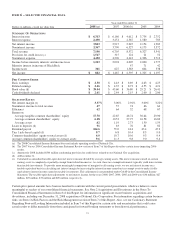

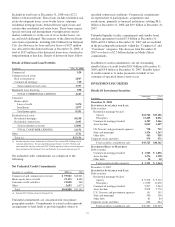

Average investment securities totaled $32.7 billion for 2008

and $26.5 billion for 2007. Average residential and

commercial mortgage-backed securities increased $4.5 billion

on a combined basis in the comparison. Average investment

securities for 2008 included $.4 billion of held to maturity

securities that we transferred from available for sale status

during the fourth quarter of 2008. Investment securities

comprised 29% of average interest-earning assets for 2008

and 27% for 2007.

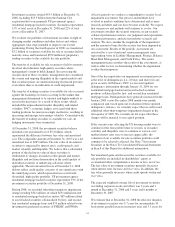

Average total deposits were $84.5 billion for 2008, an increase

of $7.7 billion over 2007. Average deposits grew from the

prior year period primarily as a result of increases in money

market balances and other time deposits.

Average total deposits represented 60% of average total assets

for 2008 and 62% for 2007. Average transaction deposits were

$55.7 billion for 2008 compared with $50.7 billion for 2007.

Average borrowed funds were $31.3 billion for 2008 and

$23.0 billion for 2007. Increases of $7.1 billion in Federal

Home Loan Bank borrowings and $1.4 billion in other

borrowed funds drove the increase compared with 2007.

Shareholders’ equity totaled $25.4 billion at December 31,

2008 compared with $14.9 billion at December 31, 2007 and

reflected the issuance of securities under the TARP Capital

Purchase Program and the impact of National City. See the

Consolidated Balance Sheet Review section of this Item 7 for

additional information.

L

INE OF

B

USINESS

H

IGHLIGHTS

We refer you to Item 1 of this Report under the captions

Business Overview and Review of Lines of Business for an

overview of our business segments and to the Business

Segments Review section of this Item 7 for a Results Of

Businesses – Summary table and further analysis of business

segment results for 2008 and 2007, including presentation

differences from Note 27 Segment Reporting in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

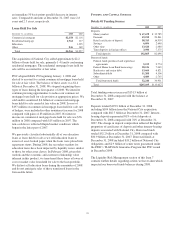

Total business segment earnings were $983 million for 2008

and $1.7 billion for 2007. We provide a reconciliation of total

business segment earnings to total PNC consolidated net

income as reported on a GAAP basis in Note 27.

Retail Banking

Retail Banking’s earnings were $429 million for 2008

compared with $876 million for 2007. The decline in earnings

over the prior year was primarily driven by increases in the

provision for credit losses and noninterest expense. The 2008

revenue growth was negatively impacted by a lower interest

credit attributed to deposits in the declining rate environment

and was therefore not reflective of the solid growth in

customers and deposits.

Corporate & Institutional Banking

Corporate & Institutional Banking earned $225 million in

2008 compared with $432 million in 2007. The 48% decline

in earnings over 2007 was primarily driven by an increase in

the provision for credit losses and by higher valuation losses

on commercial mortgage loans held for sale, net of hedges.

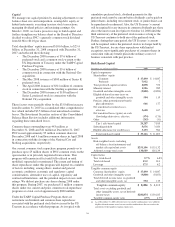

BlackRock

Our BlackRock business segment earned $207 million in 2008

and $253 million in 2007. These results reflect our

approximately 33% share of BlackRock’s reported GAAP

earnings during both periods and the additional income taxes

on these earnings incurred by PNC.

Global Investment Servicing

Global Investment Servicing earned $122 million for 2008

and $128 million for 2007. Results for 2008 were negatively

impacted by declines in asset values and fund redemptions as

a result of severe deterioration of the financial markets during

the fourth quarter.

Other

“Other” incurred a loss of $101 million in 2008 and a loss of

$222 million in 2007.

“Other” for 2008 included the impact of integration costs,

including the National City conforming provision for credit

losses, totaling $422 million after taxes, of which $380 million

after taxes were recognized in the fourth quarter of 2008. In

addition, net securities losses in 2008 totaled $134 million

after taxes. These factors were partially offset by strong

growth in net interest income related to asset and liability

management activities in 2008, and the after-tax impact of the

following:

• After-tax gains totaling $160 million from PNC’s

remaining BlackRock long-term incentive plan

programs (“LTIP”) shares obligation,

• The $23 million after-tax gain on the sale of Hilliard

Lyons in the first quarter,

• The $40 million after-tax third quarter reversal of a

legal contingency reserve established in connection

with an acquisition due to a settlement, and

• The $30 million after-tax partial reversal of the Visa

indemnification liability.

“Other” for 2007 included the after-tax impact of the

following:

• Integration costs totaling $99 million after taxes,

• A net after-tax charge of $83 million representing the

net mark-to-market adjustment on our remaining

BlackRock LTIP shares obligation partially offset by

the gain recognized in connection with PNC’s first

quarter transfer of BlackRock shares to satisfy a

portion of our BlackRock LTIP shares obligation,

and

• A $53 million after-tax charge for an indemnification

obligation related to certain Visa litigation.

27