PNC Bank 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

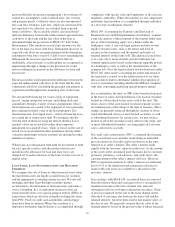

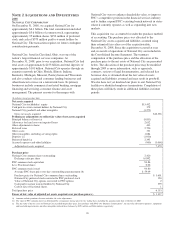

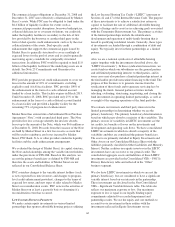

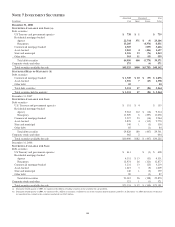

Condensed Statement of National City Net Assets

Acquired

The following condensed statement of net assets reflects the

preliminary value assigned to National City net assets as of

the December 31, 2008 acquisition date. The values are net of

the reallocation of the excess value of net assets acquired over

the purchase price ($1.337 billion), and the cash paid by

National City to its warrant holders ($379 million).

(In millions)

Assets

Cash and due from banks $ 2,144

Federal funds sold and resale agreements 7,335

Trading assets, interest-earning deposits with banks, and

other short-term investments 9,249

Loans held for sale 2,185

Investment securities 13,327

Net loans 97,435

Other intangible assets 1,797

Equity investments 2,060

Other assets 12,651

Total assets $148,183

Liabilities

Deposits $103,639

Federal funds purchased and repurchase agreements 3,501

Other borrowed funds 21,919

Other liabilities 13,370

Total liabilities 142,429

Net assets acquired $ 5,754

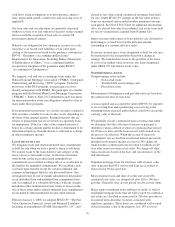

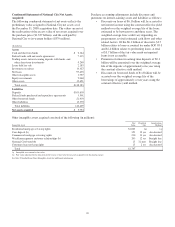

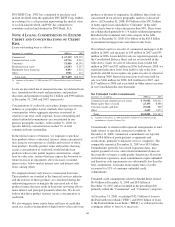

Purchase accounting adjustments include discounts and

premiums on interest-earning assets and liabilities as follows:

•Discounts on loans of $6.1 billion will be accreted to

net interest income using the constant effective yield

method over the weighted average life of the loans,

estimated to be between two and three years. The

weighted average lives could vary depending on

prepayments, revised estimated cash flows and other

related factors. Of the $6.1 billion of discounts, $3.7

billion relates to loans accounted for under SOP 03-3

and $2.4 billion relates to performing loans. A total

of $3.7 billion of the fair value mark on impaired

loans is not accretable.

• Premiums on interest-earning time deposits of $2.1

billion will be amortized over the weighted average

life of the deposits of approximately one year using

the constant effective yield method.

• Discounts on borrowed funds of $1.8 billion will be

accreted over the weighted average life of the

borrowings of approximately seven years using the

constant effective yield method.

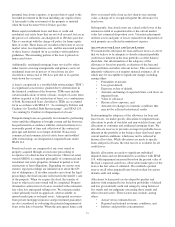

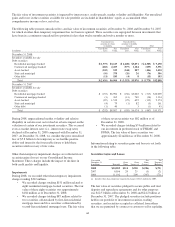

Other intangible assets acquired consisted of the following (in millions):

Intangible Asset

Fair

Value

Weighted

Life

Amortization

Method

Residential mortgage servicing rights $1,003 (a) (a)

Core deposit (b) 351 12 yrs Accelerated

Commercial mortgage servicing rights 210 13 yrs Accelerated

Wealth management customer relationships (b) 203 12 yrs Straight line

National City brand (b) 15 21 mos Straight line

Consumer loan servicing rights 15 2 yrs Accelerated

Total $1,797

(a) Intangible asset carried at fair value.

(b) Fair value adjusted for the allocation of the excess of fair value of net assets acquired over the purchase price.

See Note 9 Goodwill and Other Intangible Assets for additional information.

99