PNC Bank 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

G

LOBAL

I

NVESTMENT

S

ERVICING

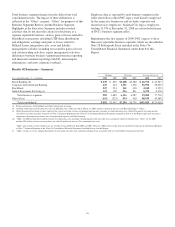

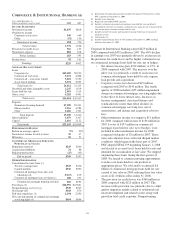

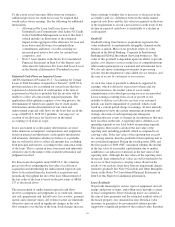

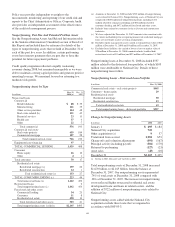

Year ended December 31

Dollars in millions except as noted 2008 2007

I

NCOME

S

TATEMENT

Servicing revenue (a) $947 $863

Operating expense (a) 728 637

Operating income 219 226

Debt financing 34 38

Nonoperating income (b) 36

Pretax earnings 188 194

Income taxes 66 66

Earnings $122 $128

P

ERIOD

-

END

B

ALANCE

S

HEET

Goodwill and other intangible assets $1,301 $1,315

Other assets 3,977 1,161

Total assets $5,278 $2,476

Debt financing $850 $989

Other liabilities 3,737 865

Shareholder’s equity 691 622

Total funds $5,278 $2,476

P

ERFORMANCE

R

ATIOS

Return on average equity 18% 23%

Operating margin (c) 23 26

S

ERVICING

S

TATISTICS

(at December 31)

Accounting/administration net fund assets

(in billions) (d)

Domestic $764 $869

Offshore 75 121

Total $839 $990

Asset type (in billions)

Money market $431 $373

Equity 227 390

Fixed income 103 123

Other 78 104

Total $839 $990

Custody fund assets (in billions) $379 $500

Shareholder accounts (in millions)

Transfer agency 14 19

Subaccounting 58 53

Total 72 72

O

THER INFORMATION

Full-time employees (at December 31) 4,934 4,784

(a) Certain out-of-pocket expense items which are then client billable are included in

both servicing revenue and operating expense above, but offset each other entirely

and therefore have no effect on operating income. Distribution revenue and expenses

which relate to 12b-1 fees that are received from certain fund clients for payment of

marketing, sales and service expenses also entirely offset each other, but are netted

for presentation purposes above.

(b) Net of nonoperating expense.

(c) Total operating income divided by total servicing revenue.

(d) Includes alternative investment net assets serviced.

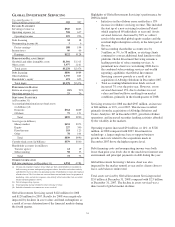

Global Investment Servicing earned $122 million for 2008

and $128 million for 2007. Results for 2008 were negatively

impacted by declines in asset values and fund redemptions as

a result of severe deterioration of the financial markets during

the fourth quarter.

Highlights of Global Investment Servicing’s performance for

2008 included:

• Initiatives in the offshore arena resulted in a 13%

increase in offshore servicing revenue. This included

the start up of a new servicing location in Poland

which employed 69 individuals at year end. Assets

serviced, however, decreased by 38% as a direct

result of the unsettled global equity markets and the

resultant high redemption activity in the latter part of

the year.

• Subaccounting shareholder accounts rose by

5 million, or 9%, to 58 million, as existing clients

continued to convert additional fund families to this

platform. Global Investment Servicing remains a

leading provider of subaccounting services. A

prominent new client was won during 2008 due to

the combined subaccounting services and wealth

reporting capabilities that Global Investment

Servicing can now provide as a result of its

acquisition of Albridge Solutions in December 2007.

• Total accounting/administration funds serviced

increased 7% over the prior year. However, assets

serviced decreased 15% due to declines in asset

values and fund outflows resulting from market

conditions, primarily in the fourth quarter of 2008.

Servicing revenue for 2008 reached $947 million, an increase

of $84 million, or 10%, over 2007. This increase resulted

primarily from the acquisitions of Albridge Solutions and

Coates Analytics, LP in December 2007, growth in offshore

operations, and increased securities lending activities afforded

by the volatility in the markets.

Operating expense increased $91 million, or 14%, to $728

million, in 2008 compared with 2007. Investments in

technology, a larger employee base to support business

growth, and costs related to the acquisitions made in

December 2007 drove the higher expense level.

Debt financing costs and nonoperating income were both

lower than prior year levels due to the much lower interest rate

environment and principal payments on debt during the year.

Global Investment Servicing’s balance sheet was also

impacted by the market turmoil at year end as clients chose to

leave cash balances uninvested.

Total assets serviced by Global Investment Servicing totaled

$2.0 trillion at December 31, 2008 compared with $2.5 trillion

at December 31, 2007. The decline in assets serviced was a

direct result of global market declines.

54