PNC Bank 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

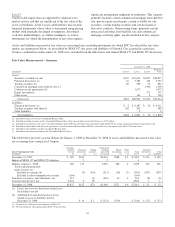

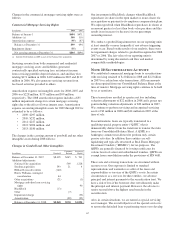

a disposition strategy that results in the highest recovery on a

net present value basis, thus protecting the interests of the trust

and its investors.

See Note 9 Goodwill and Other Intangible Assets for

additional information regarding servicing assets.

With our acquisition of National City on December 31, 2008,

we acquired residual and other interests associated with

National City’s credit card, automobile, mortgage, and SBA

loans securitizations. In addition, we also assumed certain

continuing involvement activities in these securitization

transactions.

The credit card, automobile, and mortgage securitizations

were transacted through QSPEs sponsored by National City.

These QSPEs were financed primarily through the issuance

and sale of beneficial interests to independent third parties and

were not consolidated on National City’s balance sheet.

Consolidation of these QSPEs could be considered if

circumstances or events subsequent to the securitization

transaction dates would cause the entities to lose their

“qualified” status. No such events have occurred. Qualitative

and quantitative information about these securitizations

follows.

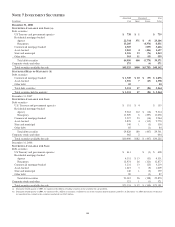

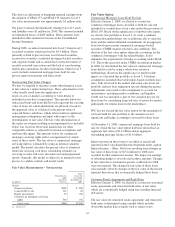

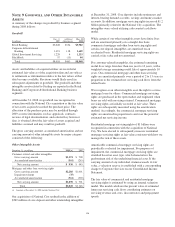

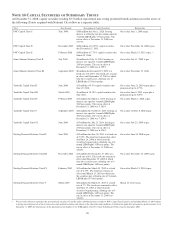

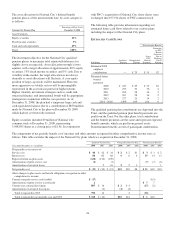

The following summarizes the assets and liabilities of the

National City-sponsored securitization QSPEs at

December 31, 2008.

(In millions) Credit Card Automobile Mortgage

Assets (a) $2,129 $250 $319

Liabilities 1,824 250 319

(a) Represents period-end outstanding principal balances of loans transferred to the

securitization QSPEs.

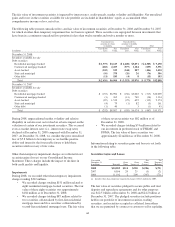

Credit Card Loans

At December 31, 2008, National City’s credit card

securitization series 2005-1, 2006-1, 2007-1, 2008-1, 2008-2,

and 2008-3 were outstanding. Our continuing involvement in

the securitized credit cards receivables consists primarily of

servicing and a pro-rata undivided interest in all credit card

receivables, or seller’s interest, in the QSPE. Servicing fees

earned approximate current market rates for servicing fees;

therefore, no servicing asset or liability existed at

December 31, 2008. We hold a clean-up call repurchase

option to the extent a securitization series extends past its

scheduled note principal payoff date. To the extent this occurs,

the clean-up call option is triggered when the principal

balance of the asset-backed notes of any series reaches 5% of

the initial principal balance of the asset-back notes issued at

the securitization date. Our seller’s interest ranks equally with

the investors’ interests in the trust. As the amount of the assets

in the securitized pool fluctuates due to customer payments,

purchases, cash advances, and credit losses, the carrying

amount of the seller’s interest will vary. However, we are

required to maintain seller’s interest at a minimum level of 5%

of the initial invested amount in each series to ensure

sufficient assets are available for allocation to the investors’

interests. Seller’s interest, which is recognized in portfolio

loans on the Consolidated Balance Sheet, was well above the

minimum level at December 31, 2008.

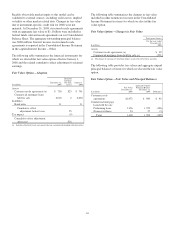

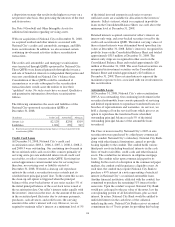

Retained interests acquired consisted of seller’s interest, an

interest-only strip, and asset-backed securities issued by the

credit card securitization QSPE. The initial carrying values of

these retained interests were determined based upon their fair

values at December 31, 2008. Seller’s interest is recognized in

portfolio loans on the Consolidated Balance Sheet and totaled

approximately $315 million at December 31, 2008. The

interest-only strips are recognized in other assets on the

Consolidated Balance Sheet and totaled approximately $20

million at December 31, 2008. The asset-backed securities are

recognized in investment securities on the Consolidated

Balance Sheet and totaled approximately $25 million at

December 31, 2008. These retained interests represent the

maximum exposure to loss associated with our involvement in

this securitization.

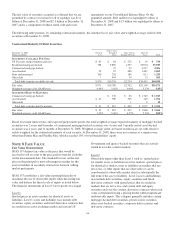

Automobile Loans

At December 31, 2008, National City’s auto securitization

2005-A was outstanding. Our continuing involvement in the

securitized automobile loans consists primarily of servicing

and limited requirements to repurchase transferred loans for

breaches of representations and warranties. As servicer, we

hold a cleanup call on the serviced loans which gives us an

option to repurchase the transferred loans when their

outstanding principal balances reach 5% of the initial

outstanding principal balance of the automobile loans

securitized.

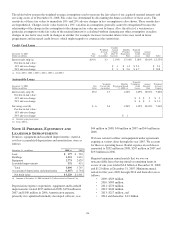

The Class A notes issued by National City’s 2005-A auto

securitization were purchased by a third-party commercial

paper conduit. National City’s subsidiary, National City Bank,

along with other financial institutions, agreed to provide

backup liquidity to the conduit. The conduit holds various

third-party assets including beneficial interests in the cash

flows of trade receivables, credit cards and other financial

assets. The conduit has no interests in subprime mortgage

loans. The conduit relies upon commercial paper for its

funding. In the event of a disruption in the commercial paper

markets, the conduit could experience a liquidity event. At

such time, the conduit may require National City Bank to

purchase a 49% interest in a note representing a beneficial

interest in National City’s securitized automobile loans.

Another financial institution, affiliated with the conduit, has

committed to purchase the remaining 51% interest in this

same note. Upon the conduit’s request, National City Bank

would pay cash equal to the par value of the notes, less the

corresponding portion of all defaulted loans, plus accrued

interest. In return, National City Bank would be entitled to

undivided interest in the cash flows of the collateral

underlying the note. National City Bank receives an annual

commitment fee of 7 basis points for providing this backup

118