PNC Bank 2008 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

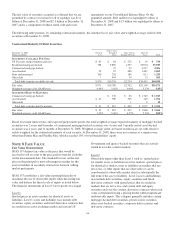

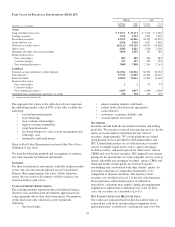

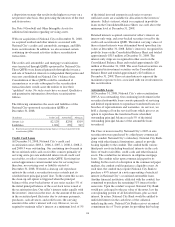

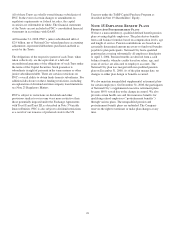

The tables below present the weighted-average assumptions used to measure the fair values of our acquired retained interests and

servicing assets as of December 31, 2008. Fair value was determined by discounting the future cash flows of these assets. The

sensitivity of these fair values to immediate 10% and 20% adverse changes in key assumptions is also shown. These sensitivities

are hypothetical. Changes in fair value based on a 10% variation in assumptions generally cannot be extrapolated because the

relationship of the change in the assumption to the change in fair value may not be linear. Also, the effect of a variation in a

particular assumption on the fair value of the retained interests is calculated without changing any other assumption; in reality,

changes in one factor may result in changes in another (for example, increases in market interest rates may result in lower

prepayments and increased credit losses), which might magnify or counteract the sensitivities.

Credit Card Loans

December 31, 2008

Dollars in millions

Fair

Value

Weighted-

Average

Life

(in months)

Variable

Annual

Coupon

Rate To

Investors

Monthly

Principal

Repayment

Rate

Expected

Annual

Credit

Losses

Annual

Discount

Rate Yield

Interest-only strip (a) $19.6 3.3 1.19% 17.54% 5.18% 15.00% 12.55%

Decline in fair value:

10% adverse change $ .1 $ 1.4 $ 2.3 $ 5.4

20% adverse change $ .3 $ 2.6 $ 4.7 $ 10.8

(a) Series 2005-1, 2006-1, 2007-1, 2008-1, 2008-2, and 2008-3.

Automobile Loans

December 31, 2008

Dollars in millions

Fair

Value

Weighted-

Average Life

(in months)

Monthly

Prepayment Speed

(% ABS) (a)

Expected

Cumulative

Credit

Losses

Annual

Discount

Rate

Weighted-

Average

Coupon

Interest-only strip (b) $9.2 1.7 1.26% 1.49% 12.00% 7.06%

Decline in fair value:

10% adverse change $.2 $ .5 $.5

20% adverse change $ .4 $ .1 $ 1.0

Servicing asset (b) $ .6 2.6 1.26% 1.49% 10.00% 7.06%

Decline in fair value:

10% adverse change

20% adverse change $.1

(a) Absolute prepayment speed.

(b) Series 2005-A.

N

OTE

11 P

REMISES

,E

QUIPMENT AND

L

EASEHOLD

I

MPROVEMENTS

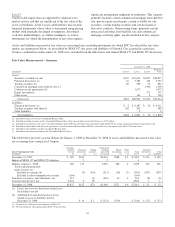

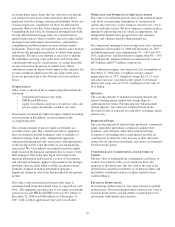

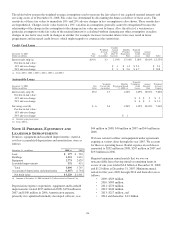

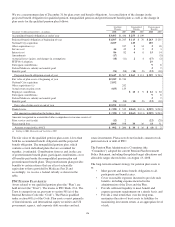

Premises, equipment and leasehold improvements, stated at

cost less accumulated depreciation and amortization, were as

follows:

December 31 - in millions 2008 (a) 2007

Land $ 577 $ 250

Buildings 1,215 1,053

Equipment 2,773 2,029

Leasehold improvements 531 433

Total 5,096 3,765

Accumulated depreciation and amortization (1,867) (1,764)

Net book value $ 3,229 $ 2,001

(a) Amounts at December 31, 2008 included $1.2 billion related to National City.

Depreciation expense on premises, equipment and leasehold

improvements totaled $225 million in 2008, $178 million in

2007 and $180 million in 2006. Amortization expense,

primarily for capitalized internally developed software, was

$44 million in 2008, $40 million in 2007 and $44 million in

2006.

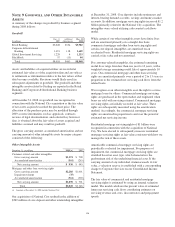

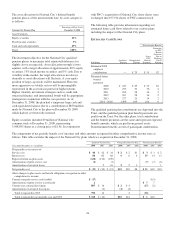

We lease certain facilities and equipment under agreements

expiring at various dates through the year 2067. We account

for these as operating leases. Rental expense on such leases

amounted to $202 million in 2008, $207 million in 2007 and

$193 million in 2006.

Required minimum annual rentals that we owe on

noncancelable leases having initial or remaining terms in

excess of one year totaled $2.6 billion at December 31, 2008

and $1.2 billion at December 31, 2007. Minimum annual

rentals for the years 2009 through 2014 and thereafter are as

follows:

• 2009: $329 million,

• 2010: $309 million,

• 2011: $270 million,

• 2012: $242 million,

• 2013: $217 million, and

• 2014 and thereafter: $1.2 billion.

120