PNC Bank 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

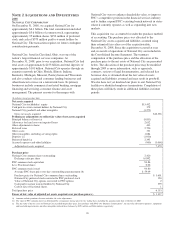

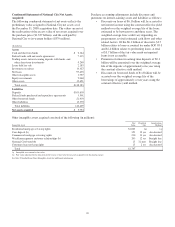

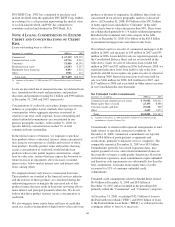

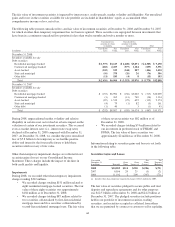

The following table presents the unaudited pro forma

combined results of operations of PNC and National City as if

the acquisition had been completed as of the beginning of

2008 or 2007. The unaudited pro forma results of operations

are presented solely for information purposes and are not

intended to represent or be indicative of the consolidated

results of operations that PNC would have reported had this

transaction been completed as of the dates and for the periods

presented, nor are they necessarily indicative of future results.

Unaudited Pro Forma Combined Results

(In millions, except per share data) 2008 2007

Total revenue $15,397 $16,709

Net income (loss) (3,742) 3,695

Per share data

Earnings (loss) – basic $ (9.58) $ 7.66

Earnings (loss) – diluted (9.60) 7.55

Average common shares outstanding – basic 439 426

Average common shares outstanding – diluted 439 431

The unaudited pro forma combined results of operations

include the effect of the net amortization/accretion of purchase

accounting fair value adjustments based on asset and liability

valuations as of the acquisition date. They also reflect the

receipt of $7.6 billion from the sale of preferred securities and

issuance of a warrant to purchase 16.9 million shares of PNC

common stock under the TARP Capital Purchase Program

(See Note 19 Shareholders’ Equity for additional

information). During 2008, National City recorded $2.4

billion of nonrecurring charges for goodwill impairments

which are included in these pro forma results. These

adjustments have been consistently applied to each period

presented in the table above.

S

TERLING

F

INANCIAL

C

ORPORATION

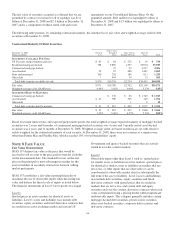

On April 4, 2008, we acquired Lancaster, Pennsylvania-based

Sterling Financial Corporation (“Sterling”). Sterling

shareholders received an aggregate of approximately

4.6 million shares of PNC common stock and $224 million of

cash.

J.J.B. H

ILLIARD

, W.L. L

YONS

, LLC

On March 31, 2008, we sold J.J.B. Hilliard, W.L. Lyons, LLC

(“Hilliard Lyons”), a Louisville, Kentucky-based wholly-

owned subsidiary of PNC and a full-service brokerage and

financial services provider, to Houchens Industries, Inc. We

recognized an after-tax gain of $23 million in the first quarter

of 2008 in connection with this divestiture.

2007

A

LBRIDGE

S

OLUTIONS

I

NC

.

On December 7, 2007, we acquired Albridge Solutions Inc.

(“Albridge”), a Lawrenceville, New Jersey-based provider of

portfolio accounting and enterprise wealth management

services. Albridge extends PNC Global Investment

Servicing’s capabilities into the delivery of knowledge-based

information services through its relationships with financial

institutions and financial advisors.

C

OATES

A

NALYTICS

,LP

Also on December 7, 2007, we acquired Coates Analytics, LP

(“Coates Analytics”), a Chadds Ford, Pennsylvania-based

provider of web-based analytic tools that help asset managers

identify wholesaler territories and financial advisor targets,

promote products in the marketplace and strengthen

competitive intelligence. Coates Analytics complements PNC

Global Investment Servicing’s business strategy.

Y

ARDVILLE

N

ATIONAL

B

ANCORP

On October 26, 2007 we acquired Hamilton, New Jersey-

based Yardville National Bancorp (“Yardville”). Yardville

shareholders received an aggregate of approximately

3.4 million shares of PNC common stock and $156 million in

cash. Total consideration paid was approximately $399

million in stock and cash.

ARCS C

OMMERCIAL

M

ORTGAGE

C

O

., L.P.

On July 2, 2007, we acquired ARCS Commercial Mortgage

Co., L.P. (“ARCS”), a Calabasas Hills, California-based

lender with 10 origination offices in the United States. ARCS

has been a leading originator and servicer of agency

multifamily loans for the past decade.

M

ERCANTILE

B

ANKSHARES

C

ORPORATION

Effective March 2, 2007, we acquired Mercantile Bankshares

Corporation (“Mercantile”). Mercantile shareholders received

an aggregate of approximately 53 million shares of PNC

common stock and $2.1 billion in cash. Total consideration

paid was approximately $5.9 billion in stock and cash.

2006

B

LACK

R

OCK

/MLIM T

RANSACTION

On September 29, 2006, Merrill Lynch contributed its

investment management business (“MLIM”) to BlackRock in

exchange for 65 million shares of newly issued BlackRock

common and preferred stock. BlackRock accounted for the

MLIM transaction under the purchase method of accounting.

Immediately following the closing, PNC continued to own

44 million shares of BlackRock common stock representing

an ownership interest of 34% of the combined company (as

compared with 69% immediately prior to the closing).

We also recorded a liability at September 30, 2006 for

deferred taxes of $.9 billion, related to the excess of the book

value over the tax basis of our investment in BlackRock, and a

liability of $.6 billion related to our obligation to provide

shares of BlackRock common stock to help fund certain

BlackRock long-term incentive plan (“LTIP”) programs.

100