PNC Bank 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

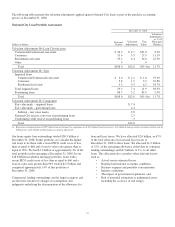

Capital

We manage our capital position by making adjustments to our

balance sheet size and composition, issuing debt, equity or

hybrid instruments, executing treasury stock transactions,

managing dividend policies and retaining earnings. On

March 1, 2009, we took a proactive step to build capital and

further strengthen our balance sheet as the Board of Directors

decided to reduce PNC’s quarterly common stock dividend

from $0.66 to $0.10 per share.

Total shareholders’ equity increased $10.6 billion, to $25.4

billion, at December 31, 2008 compared with December 31,

2007 and reflected the following:

• The December 2008 issuance of $7.6 billion of

preferred stock and a common stock warrant to the

US Department of Treasury under the TARP Capital

Purchase Program,

• The December 2008 issuance of $5.6 billion of

common stock in connection with the National City

acquisition,

• The May 2008 issuance of $500 million of Series K

preferred stock,

• The April 2008 issuance of $312 million of common

stock in connection with the Sterling acquisition, and

• The December 2008 issuance of $150 million of

Series L preferred stock in connection with the

National City acquisition.

These factors were partially offset by the $3.8 billion increase

from December 31, 2007 in accumulated other comprehensive

loss which included $3.5 billion of net unrealized securities

losses. The Investment Securities section of this Consolidated

Balance Sheet Review includes additional information

regarding these unrealized losses.

Common shares outstanding were 443 million at

December 31, 2008 and 341 million at December 31, 2007.

PNC issued approximately 95 million common shares in

December 2008 and 4.6 million common shares in April 2008

in connection with the closings of the National City and

Sterling acquisitions, respectively.

Our current common stock repurchase program permits us to

purchase up to 25 million shares of PNC common stock on the

open market or in privately negotiated transactions. This

program will remain in effect until fully utilized or until

modified, superseded or terminated. The extent and timing of

share repurchases under this program will depend on a number

of factors including, among others, market and general

economic conditions, economic and regulatory capital

considerations, alternative uses of capital, regulatory and

contractual limitations, and the potential impact on our credit

ratings. We did not purchase any shares during 2008 under

this program. During 2007, we purchased 11 million common

shares under our current and prior common stock repurchase

programs at a total cost of approximately $800 million.

Under the TARP Capital Purchase Program, there are

restrictions on dividends and common share repurchases

associated with the preferred stock that we issued to the US

Treasury in accordance with that program. As is typical with

cumulative preferred stock, dividend payments for this

preferred stock must be current before dividends can be paid on

junior shares, including our common stock, or junior shares can

be repurchased or redeemed. Also, the US Treasury’s consent

will be required for any increase in common dividends per share

above the most recent level prior to October 14, 2008 until the

third anniversary of the preferred stock issuance as long as the

US Treasury continues to hold any of the preferred stock.

Further, during that same period, the US Treasury’s consent

will be required, unless the preferred stock is no longer held by

the US Treasury, for any share repurchases with limited

exceptions, most significantly purchases of common shares in

connection with any benefit plan in the ordinary course of

business consistent with past practice.

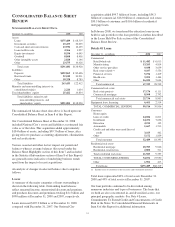

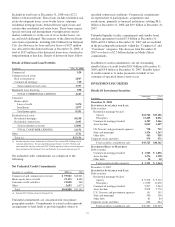

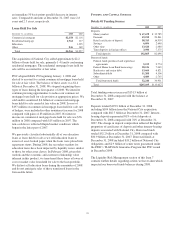

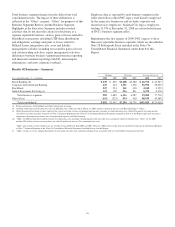

Risk-Based Capital

December 31 - dollars in millions 2008 2007

Capital components

Shareholders’ equity

Common $ 17,490 $ 14,847

Preferred 7,932 7

Trust preferred capital securities 2,898 572

Minority interest 1,506 985

Goodwill and other intangible assets (9,800) (8,853)

Eligible deferred income taxes on

goodwill and other intangible assets 594 119

Pension, other postretirement benefit

plan adjustments 666 177

Net unrealized securities losses,

after-tax 3,618 167

Net unrealized losses (gains) on cash

flow hedge derivatives, after-tax (374) (175)

Other (243) (31)

Tier 1 risk-based capital 24,287 7,815

Subordinated debt 5,676 3,024

Eligible allowance for credit losses 3,153 964

Total risk-based capital $ 33,116 $ 11,803

Assets

Risk-weighted assets, including

off-balance sheet instruments and

market risk equivalent assets $251,106 $115,132

Adjusted average total assets 138,689 126,139

Capital ratios

Tier 1 risk-based 9.7% 6.8%

Total risk-based 13.2 10.3

Leverage 17.5 6.2

Tangible common equity

Common shareholders’ equity $ 17,490 $ 14,847

Goodwill and other intangible assets (9,800) (8,853)

Total deferred income taxes on goodwill

and other intangible assets (a) 594 119

Tangible common equity $ 8,284 $ 6,113

Total assets excluding goodwill and

other intangible assets, net of deferred

income taxes $281,874 $130,185

Tangible common equity ratio 2.9% 4.7%

(a) As of December 31, 2008, deferred taxes on taxable combinations were added to

eligible deferred income taxes for non-taxable combinations that are used in the

calculation of the tangible common equity ratio.

36