PNC Bank 2008 Annual Report Download - page 38

Download and view the complete annual report

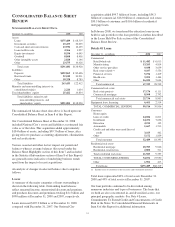

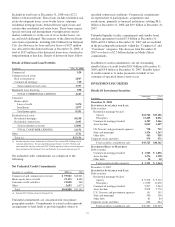

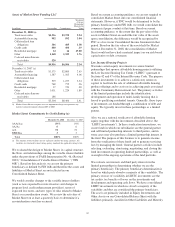

Please find page 38 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investment securities totaled $43.5 billion at December 31,

2008, including $13.3 billion from the National City

acquisition that were primarily US government agency

residential mortgage-backed securities. Securities represented

15% of total assets at December 31, 2008 and 22% of total

assets at December 31, 2007.

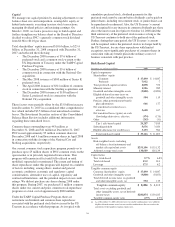

We evaluate our portfolio of investment securities in light of

changing market conditions and other factors and, where

appropriate, take steps intended to improve our overall

positioning. During the fourth quarter of 2008, we transferred

$3.2 billion of securities available for sale to securities held to

maturity status and transferred $599 million of proprietary

trading securities to the available for sale portfolio.

The transfer of available for sale securities to held to maturity

involved short-duration, high quality securities where

management’s intent to hold changed. In reassessing the

classification of these securities, management also considered

the current and ongoing illiquidity in the capital markets and

that securities prices are under increasing downward pressure,

even where there is no indication of credit impairment.

The transfer of trading securities to available for sale occurred

against the backdrop of events occurring in the market that

management determined to be unusual and highly unlikely to

recur in the near term. As a result of these events, which

included the unprecedented market illiquidity and related

volatility, PNC’s economic hedges associated with these

trading positions become increasingly ineffective, resulting in

increasing and unexpected earnings volatility. Coincident with

the transfer of trading securities to available for sale, all

hedging instruments were terminated.

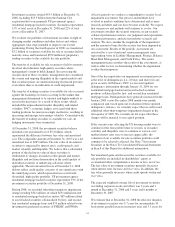

At December 31, 2008, the investment securities balance

included a net unrealized loss of $5.4 billion, which

represented the difference between fair value and amortized

cost. The comparable amount at December 31, 2007 was a net

unrealized loss of $265 million. The fair value of investment

securities is impacted by interest rates, credit spreads, and

market volatility and illiquidity. We believe that a substantial

portion of the decline in value of these securities is

attributable to changes in market credit spreads and market

illiquidity and not from deterioration in the credit quality of

individual securities or underlying collateral, where

applicable. The net unrealized losses at December 31, 2008

did not reflect credit quality concerns of any significance with

the underlying assets, which represented an overall well-

diversified, high quality portfolio. US government agency

residential mortgage-backed securities represented 53% of the

investment securities portfolio at December 31, 2008.

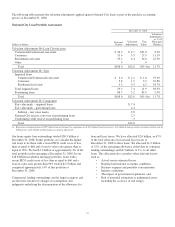

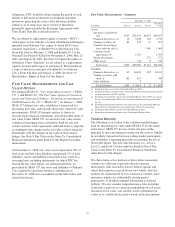

During 2008, we recorded other-than-temporary impairment

charges totaling $312 million, of which $151 million related

to residential mortgage-backed securities, $87 million related

to asset-backed securities collateralized by first- and second-

lien residential mortgage loans and $74 million related to our

investment in preferred securities of FHLMC and FNMA.

At least quarterly we conduct a comprehensive security-level

impairment assessment. Our process and methods have

evolved as market conditions have deteriorated and as more

research and other analyses have become available. We expect

that our process and methods will continue to evolve. Our

assessment considers the security structure, recent security

collateral performance metrics, our judgment and expectations

of future performance, and relevant industry research and

analysis. We also consider the magnitude of the impairment

and the amount of time that the security has been impaired in

our assessment. Results of the periodic assessment are

reviewed by a cross-functional senior management team

representing Asset & Liability Management, Finance, Balance

Sheet Risk Management, and Credit Policy. The senior

management team considers the results of the assessments, as

well as other factors, in determining whether the impairment

is other-than-temporary.

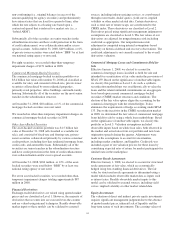

One of the key inputs into our impairment assessment process

is the level of delinquencies (i.e., 60 days and more) for any

given security. In February 2009, we received updated

delinquency information through January 31, 2009 for our

residential mortgage-backed and asset-backed securities

positions collateralized by first- and second-lien residential

mortgage loans. Delinquencies have generally increased in the

January 2009 versus December 2008 month-over-month

comparison and, based upon our evaluation of these updated

delinquency statistics, we currently expect that we will record

additional other-than-temporary impairment charges in the

first quarter of 2009. We currently do not expect that these

charges will be material to our capital position.

If the current issues affecting the US housing market were to

continue for the foreseeable future or worsen, or if market

volatility and illiquidity were to continue or worsen, or if

market interest rates were to increase appreciably, the

valuation of our available for sale securities portfolio could

continue to be adversely affected. See Note 7 Investment

Securities in the Notes To Consolidated Financial Statements

in Item 8 of this Report for additional information.

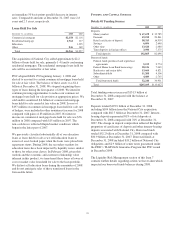

Net unrealized gains and losses in the securities available for

sale portfolio are included in shareholders’ equity as

accumulated other comprehensive income or loss, net of tax.

The fair value of investment securities generally decreases

when interest rates increase and vice versa. In addition, the

fair value generally decreases when credit spreads widen and

vice versa.

The expected weighted-average life of investment securities

(excluding corporate stocks and other) was 3 years and 1

month at December 31, 2008 and 3 years and 6 months at

December 31, 2007.

We estimate that at December 31, 2008 the effective duration

of investment securities was 3.7 years for an immediate 50

basis points parallel increase in interest rates and 3.1 years for

34