PNC Bank 2008 Annual Report Download - page 49

Download and view the complete annual report

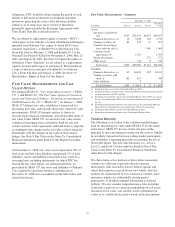

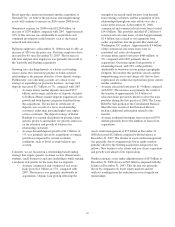

Please find page 49 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.direct and affiliated partnership interests reflect the expected

exit price and are based on various techniques including

publicly traded price, multiples of adjusted earnings of the

entity, independent appraisals, anticipated financing and sale

transactions with third parties, or the pricing used to value the

entity in a recent financing transaction. Indirect investments in

private equity funds are valued based on the financial

statements that we receive from their managers. Due to the

time lag in our receipt of the financial information and based

on a review of investments and valuation techniques applied,

adjustments to the manager provided value are made when

available recent portfolio company information or market

information indicates a significant change in value from that

provided by the manager of the fund. These investments are

classified as Level 3.

Level 3 Assets and Liabilities

Under SFAS 157, financial instruments are considered Level 3

when their values are determined using pricing models,

discounted cash flow methodologies or similar techniques and

at least one significant model assumption or input is

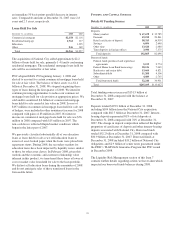

unobservable. At December 31, 2008, Level 3 fair value assets

of $7.012 billion represented 19% of total assets at fair value

and 2% of total assets. Level 3 fair value liabilities of $22

million at December 31, 2008 represented less than 1% of

total liabilities at fair value and less than 1% of total liabilities

at that date.

During 2008, securities transferred into Level 3 from Level 2

exceeded securities transferred out by $4.3 billion. These

primarily related to private issuer asset-backed securities,

auction rate securities, residential mortgage-backed securities

and corporate bonds and occurred due to reduced volume of

recently executed transactions and the lack of corroborating

market price quotations for these instruments. Other Level 3

assets include commercial mortgage loans held for sale,

private equity investments and other assets.

Total securities measured at fair value at December 31, 2008

included securities available for sale and trading securities

consisting primarily of residential and commercial mortgage-

backed securities and other asset-backed securities. Unrealized

gains and losses on available for sale securities do not impact

liquidity or risk-based capital. However, reductions in the

credit ratings of these securities would have an impact on the

determination of risk-weighted assets which could reduce our

regulatory capital ratios. In addition, other-than-temporary

impairments on available for sale securities would reduce our

regulatory capital ratios.

B

USINESS

S

EGMENTS

R

EVIEW

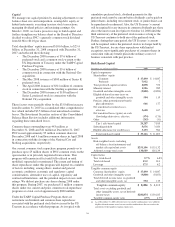

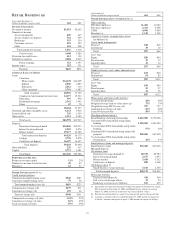

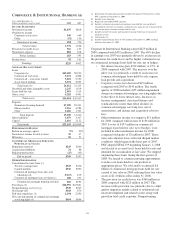

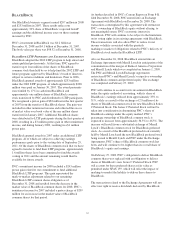

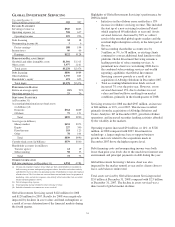

In 2008 and 2007, we had four major businesses engaged in

providing banking, asset management and global fund

processing products and services. Business segment results,

including inter-segment revenues, and a description of each

business are included in Note 27 Segment Reporting included

in the Notes To Consolidated Financial Statements under

Item 8 of this Report.

Certain revenue and expense amounts included in this

Business Segments Review differ from the amounts shown in

Note 27 due to the presentation in this Business Segments

Review of business revenue on a taxable-equivalent basis,

income statement classification differences related to Global

Investment Servicing, the inclusion of the results of Hilliard

Lyons, including the March 2008 gain on sale, in the “Other”

category, and the inclusion of 2008 Albridge Solutions and

Coates Analytics and 2007 BlackRock/MLIM transaction

integration costs in the “Other” category.

Results of individual businesses are presented based on our

management accounting practices and management structure.

There is no comprehensive, authoritative body of guidance for

management accounting equivalent to GAAP; therefore, the

financial results of our individual businesses are not

necessarily comparable with similar information for any other

company. We refine our methodologies from time to time as

our management accounting practices are enhanced and our

businesses and management structure change. Financial

results are presented, to the extent practicable, as if each

business operated on a stand-alone basis. As permitted under

GAAP, we have aggregated the business results for certain

similar operating segments for financial reporting purposes.

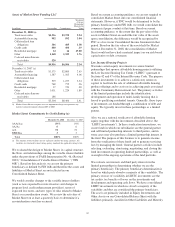

Assets receive a funding charge and liabilities and capital

receive a funding credit based on a transfer pricing

methodology that incorporates product maturities, duration

and other factors. Capital is intended to cover unexpected

losses and is assigned to the banking and servicing businesses

using our risk-based economic capital model. We have

assigned capital equal to 6% of funds to Retail Banking to

reflect the capital required for well-capitalized domestic banks

and to approximate market comparables for this business. The

capital assigned for Global Investment Servicing reflects its

legal entity shareholder’s equity.

We have allocated the allowances for loan and lease losses

and unfunded loan commitments and letters of credit based on

our assessment of risk inherent in the business segment loan

portfolios. Our allocation of the costs incurred by operations

and other shared support areas not directly aligned with the

businesses is primarily based on the use of services.

45