PNC Bank 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.N

OTES TO

C

ONSOLIDATED

F

INANCIAL

S

TATEMENTS

T

HE

PNC F

INANCIAL

S

ERVICES

G

ROUP

,I

NC

.

B

USINESS

PNC is one of the largest diversified financial services

companies in the United States and is headquartered in

Pittsburgh, Pennsylvania.

As described in Note 2 Acquisitions and Divestitures, on

December 31, 2008, PNC acquired National City Corporation

(“National City”), which increased our assets to a total of

$291 billion and expanded our total consolidated deposits to

$193 billion.

Prior to the acquisition, PNC had businesses engaged in retail

banking, corporate and institutional banking, asset

management, and global investment servicing, providing

many of its products and services nationally and others in

PNC’s primary geographic markets located in Pennsylvania,

New Jersey, Washington DC, Maryland, Virginia, Ohio,

Kentucky and Delaware. PNC also provided certain

investment servicing internationally.

National City’s primary businesses prior to its acquisition by

PNC included commercial and retail banking, mortgage

financing and servicing, consumer finance and asset

management, operating through an extensive network in Ohio,

Florida, Illinois, Indiana, Kentucky, Michigan, Missouri,

Pennsylvania and Wisconsin. National City also conducted

selected consumer lending businesses and other financial

services on a nationwide basis.

PNC is now in the process of integrating the business and

operations of National City with those of PNC.

N

OTE

1A

CCOUNTING

P

OLICIES

B

ASIS OF

F

INANCIAL

S

TATEMENT

P

RESENTATION

Our consolidated financial statements include the accounts of

the parent company and its subsidiaries, most of which are

wholly owned, and certain partnership interests and variable

interest entities.

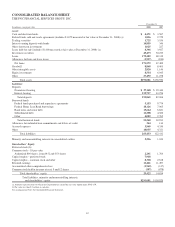

On December 31, 2008, we acquired National City. Our

Consolidated Balance Sheet as of December 31, 2008 and

other consolidated information presented as of that date in the

Consolidated Financial Statements includes the impact of

National City. See Note 2 Acquisition and Divestitures for

additional information.

We prepared these consolidated financial statements in

accordance with accounting principles generally accepted in

the United States of America (“generally accepted accounting

principles” or “GAAP”). We have eliminated intercompany

accounts and transactions. We have also reclassified certain

prior year amounts to conform with the 2008 presentation.

These reclassifications did not have a material impact on our

consolidated financial condition or results of operations.

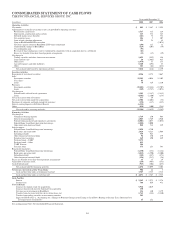

Subsequent to the issuance of our 2006 Annual Report on

Form 10-K, we determined that the Consolidated Statement of

Cash Flows for the year ended December 31, 2006 should be

restated. The cash flows related to the 2006 issuance of

perpetual trust securities totaling $489 million had previously

been classified within the “Operating Activities” section of the

Consolidated Statement of Cash Flows. We concluded that

such cash flows should have been classified within the

“Financing Activities” section of the Consolidated Statement

of Cash Flows and, accordingly, restated these amounts in

Amendment No. 1 thereto on Form 10-K/A dated February 4,

2008. The Consolidated Statement of Cash Flows included in

these Consolidated Financial Statements reflects this

restatement.

U

SE OF

E

STIMATES

We prepare the consolidated financial statements using

financial information available at the time, which requires us

to make estimates and assumptions that affect the amounts

reported. Our most significant estimates pertain to our

allowance for loan and lease losses, impaired loans, fair value

measurements and revenue recognition. Actual results may

differ from the estimates and the differences may be material

to the consolidated financial statements.

B

USINESS

C

OMBINATIONS

We record the net assets of companies that we acquire at their

estimated fair value at the date of acquisition and we include

the results of operations of the acquired companies in our

consolidated income statement from the date of acquisition.

We recognize as goodwill the excess of the acquisition price

over the estimated fair value of the net assets acquired. The

excess of the estimated fair value of net assets acquired over

the acquisition price is allocated on a pro rata basis to reduce

the fair value of intangibles and non-current assets acquired.

S

UBSIDIARY

S

TOCK

T

RANSACTIONS

We recognize as income, when appropriate, any gain from the

sale or issuance by subsidiaries of their stock to third parties.

The gain is the difference between our basis in the stock and

the increase in the book value per share of the subsidiaries’

equity and is recorded in noninterest income in the

Consolidated Income Statement. We provide applicable taxes

on the gain.

S

PECIAL

P

URPOSES

E

NTITIES

Special purpose entities (“SPEs”) are defined as legal entities

structured for a particular purpose. We use special purpose

entities in various legal forms to conduct normal business

activities. We review the structure and activities of special

purpose entities for possible consolidation under the guidance

85