PNC Bank 2008 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

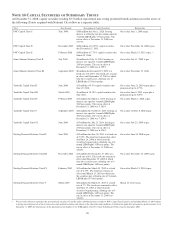

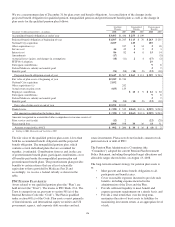

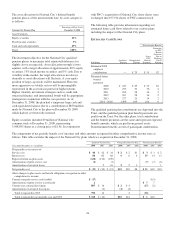

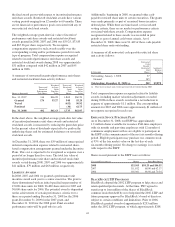

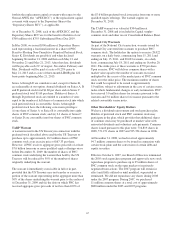

A summary of stock option activity follows:

Year ended December 31, 2008

In thousands, except

weighted-average data Shares

Weighted-

average

exercise

price

Weighted-

average

remaining

contractual

life

Aggregate

intrinsic

value

Outstanding, January 1 14,326 $ 62.15

Granted 3,308 60.35

Sterling acquisition 325 63.94

Exercised (3,175) 55.11

Cancelled (247) 57.97

Prior to National City

acquisition 14,537 63.39

National City acquisition 1,744 636.31

Outstanding, December 31 16,281 $124.75 5.6 years $4,909

Vested and expected to

vest, December 31 (a) 15,971 $125.90 5.6 years $4,909

Exercisable, December 31 11,373 $151.03 4.3 years $4,909

(a) Adjusted for estimated forfeitures on unvested options.

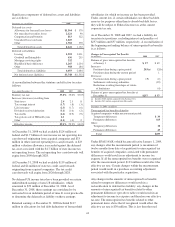

The weighted-average grant-date fair value of options granted

in 2008, 2007 and 2006 was $7.27, $11.37 and $10.75 per

option, respectively. To determine stock-based compensation

expense under SFAS 123R, the grant-date fair value is applied

to the options granted with a reduction made for estimated

forfeitures.

At December 31, 2007 and 2006, options for 10,496,000 and

10,743,000 shares of common stock, respectively, were

exercisable at a weighted-average price of $59.95 and $58.38,

respectively. The total intrinsic value of options exercised

during 2008, 2007 and 2006 was $59 million, $52 million and

$111 million, respectively.

Cash received from option exercises under all Incentive Plans

for 2008, 2007 and 2006 was approximately $167 million,

$111 million and $233 million, respectively. The actual tax

benefit realized for tax deduction purposes from option

exercises under all Incentive Plans for 2008, 2007 and 2006

was approximately $58 million, $39 million and $82 million,

respectively.

There were no options granted in excess of market value in

2008, 2007 or 2006. Shares of common stock available during

the next year for the granting of options and other awards

under the Incentive Plans were 36,307,172 at December 31,

2008. Total shares of PNC common stock authorized for

future issuance under equity compensation plans totaled

37,842,957 shares at December 31, 2008, which includes

shares available for issuance under the Incentive Plans, the

Employee Stock Purchase Plan as described below, and a

director plan.

During 2008, we issued approximately 3.1 million shares from

treasury stock in connection with stock option exercise

activity. As with past exercise activity, we intend to utilize

treasury stock for future stock option exercises.

As permitted under SFAS 123R, we recognized compensation

expense for stock options on a straight-line basis over the pro

rata vesting period. Total compensation expense recognized

related to PNC stock options in 2008 was $22 million

compared with $29 million in 2007 and $31 million in 2006.

Awards granted to non-employee directors in 2008 and 2007

include 25,381 and 20,944 deferred stock units, respectively,

awarded under the Outside Directors Deferred Stock Unit

Plan. A deferred stock unit is a phantom share of our common

stock, which requires liability accounting treatment under

SFAS 123R until such awards are paid to the participants as

cash. As there are no vesting or service requirements on these

awards, total compensation expense is recognized in full on all

awarded units on the date of grant.

O

PTION

P

RICING

A

SSUMPTIONS

For purposes of computing stock option expense, we

estimated the fair value of stock options primarily by using the

Black-Scholes option-pricing model. Option pricing models

require the use of numerous assumptions, many of which are

very subjective.

We used the following assumptions in the option pricing

models to determine 2008, 2007 and 2006 stock option

expense:

• The risk-free interest rate is based on the US

Treasury yield curve,

• The dividend yield represents average yields over the

previous three-year period,

• Volatility is measured using the fluctuation in

month-end closing stock prices over a period which

corresponds with the average expected option life,

but in no case less than a five-year period, and

• The expected life assumption represents the period of

time that options granted are expected to be

outstanding and is based on a weighted average of

historical option activity.

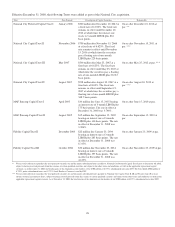

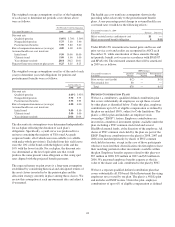

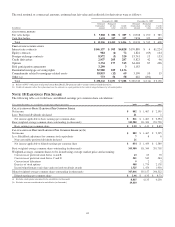

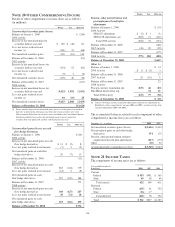

Weighted-average for the year ended

December 31 2008 2007 2006

Risk-free interest rate 3.1% 4.8% 4.5%

Dividend yield 3.3 3.4 3.7

Volatility 18.5 18.8 20.5

Expected life 5.7 yrs. 4.3 yrs. 5.1 yrs.

I

NCENTIVE

/P

ERFORMANCE

U

NIT

S

HARE

A

WARDS AND

R

ESTRICTED

S

TOCK

/U

NIT

A

WARDS

The fair value of nonvested incentive/performance unit share

awards and restricted stock/unit awards is initially determined

based on prices not less than the market value of our common

stock price on the date of grant. Incentive/performance unit

share awards are subsequently valued subject to the

achievement of one or more financial and other performance

goals over a three-year period. The Personnel and

Compensation Committee of the Board of Directors approves

131