PNC Bank 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184

|

|

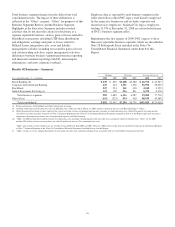

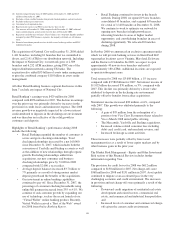

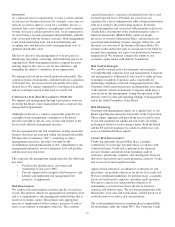

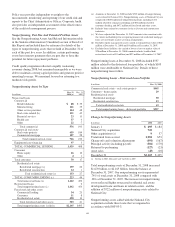

assets increased $506 million in the comparison. The

largest component of the increase was in commercial

real estate and commercial real estate related loans.

Based upon the current environment and the

acquisition of National City, we believe the provision

will continue to increase in 2009 versus 2008 levels.

• Noninterest expense increased $64 million, or 8%,

compared with 2007. The increase was primarily due

to the impact of the 2007 ARCS Commercial

Mortgage and Mercantile acquisitions, expenses

associated with revenue-related activities, growth

initiatives mainly in treasury management, higher

passive losses associated with low income housing

tax credit investments, and write-downs of other real

estate owned.

• Average loan balances increased $5.1 billion, or

24%, compared with 2007. The increase in corporate

and commercial real estate loans resulted from higher

utilization of credit facilities, organic growth from

new and existing clients, and the impact of the

Mercantile and Yardville acquisitions.

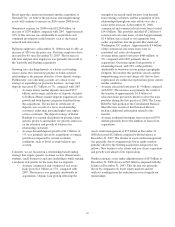

• Average deposit balances increased $1.7 billion, or

13%, compared with 2007. The increase resulted

primarily from higher time deposits and the impact of

acquisitions.

• The commercial mortgage servicing portfolio was

$249 billion at December 31, 2008, an increase of $6

billion from December 31, 2007. Servicing portfolio

additions were modest during 2008 due to the

declining volumes in the commercial mortgage

securitization market.

• Average other assets and other liabilities increased

$1.8 billion and $2.1 billion, respectively. These

increases were due to customer driven trading and

related hedging transactions. In addition, an increase

in customer driven money management activities

contributed to the higher other liabilities balance.

See the additional revenue discussion regarding treasury

management, capital markets-related products and services,

and commercial mortgage banking activities on pages 29 and

30.

51