PNC Bank 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184

|

|

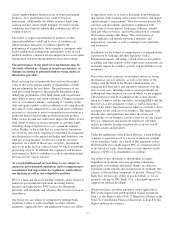

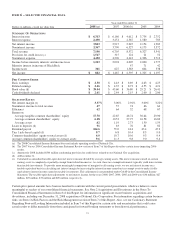

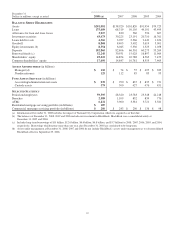

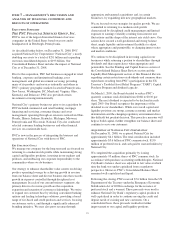

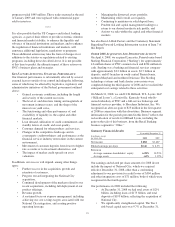

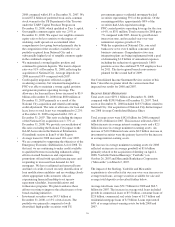

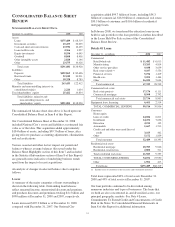

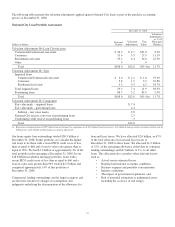

December 31

Dollars in millions, except as noted 2008 (a) 2007 2006 2005 2004

B

ALANCE

S

HEET

H

IGHLIGHTS

Assets $291,081 $138,920 $101,820 $91,954 $79,723

Loans 175,489 68,319 50,105 49,101 43,495

Allowance for loan and lease losses 3,917 830 560 596 607

Investment securities 43,473 30,225 23,191 20,710 16,761

Loans held for sale 4,366 3,927 2,366 2,449 1,670

Goodwill 8,868 8,405 3,402 3,619 3,001

Equity investments (b) 8,554 6,045 5,330 1,323 1,058

Deposits 192,865 82,696 66,301 60,275 53,269

Borrowed funds (c) 52,240 30,931 15,028 16,897 11,964

Shareholders’ equity 25,422 14,854 10,788 8,563 7,473

Common shareholders’ equity 17,490 14,847 10,781 8,555 7,465

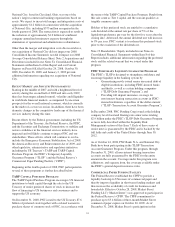

A

SSETS

A

DMINISTERED

(in billions)

Managed (d) $ 110 $ 74 $ 55 $ 495 $ 383

Nondiscretionary 125 112 85 83 93

F

UND

A

SSETS

S

ERVICED

(in billions)

Accounting/administration net assets $ 839 $ 990 $ 837 $ 835 $ 721

Custody assets 379 500 427 476 451

S

ELECTED

S

TATISTICS

Period-end employees 59,595 28,320 23,783 25,348 24,218

Branches 2,589 1,109 852 839 776

ATMs 6,232 3,900 3,581 3,721 3,581

Residential mortgage servicing portfolio (in billions) $ 187

Commercial mortgage servicing portfolio (in billions) $ 286 $ 243 $ 200 $ 136 $ 98

(a) Information at December 31, 2008 includes the impact of National City Corporation, which we acquired as of that date.

(b) The balances at December 31, 2008, 2007 and 2006 include our investment in BlackRock. BlackRock was a consolidated entity at

December 31, 2005 and 2004.

(c) Includes long-term borrowings of $35 billion, $12.6 billion, $6.6 billion, $6.8 billion, and $5.7 billion for 2008, 2007, 2006, 2005, and 2004,

respectively. Borrowings which mature more than one year after December 31, 2008 are considered to be long-term.

(d) Assets under management at December 31, 2008, 2007 and 2006 do not include BlackRock’s assets under management as we deconsolidated

BlackRock effective September 29, 2006.

22