PNC Bank 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

S

UMMARIZED

B

ALANCE

S

HEET

D

ATA

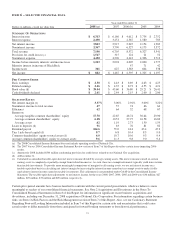

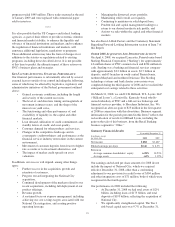

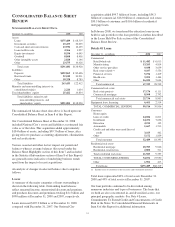

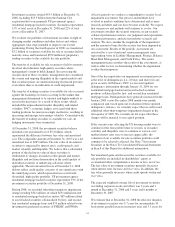

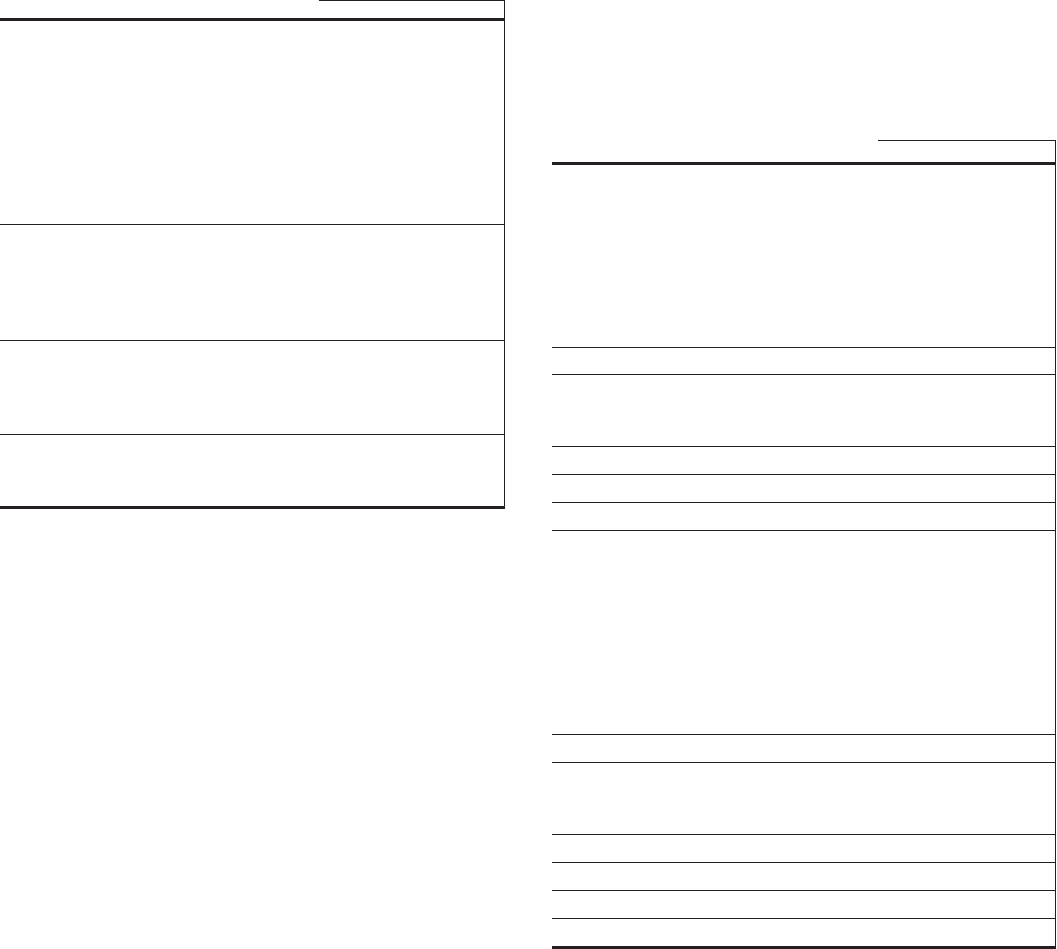

December 31 - in millions 2008 2007

Assets

Loans $175,489 $ 68,319

Investment securities 43,473 30,225

Cash and short-term investments 23,936 10,425

Loans held for sale 4,366 3,927

Equity investments 8,554 6,045

Goodwill 8,868 8,405

Other intangible assets 2,820 1,146

Other 23,575 10,428

Total assets $291,081 $138,920

Liabilities

Deposits $192,865 $ 82,696

Borrowed funds 52,240 30,931

Other 18,328 8,785

Total liabilities 263,433 122,412

Minority and noncontrolling interests in

consolidated entities 2,226 1,654

Total shareholders’ equity 25,422 14,854

Total liabilities, minority and

noncontrolling interests, and

shareholders’ equity $291,081 $138,920

The summarized balance sheet data above is based upon our

Consolidated Balance Sheet in Item 8 of this Report.

Our Consolidated Balance Sheet at December 31, 2008

included National City’s assets and liabilities at estimated fair

value as of that date. This acquisition added approximately

$134 billion of assets, including $99.7 billion of loans, after

giving effect to purchase accounting adjustments, eliminations

and reclassifications.

Various seasonal and other factors impact our period-end

balances whereas average balances (discussed under the

Balance Sheet Highlights section of this Item 7 and included

in the Statistical Information section of Item 8 of this Report)

are generally more indicative of underlying business trends

apart from the impact of recent acquisitions.

An analysis of changes in selected balance sheet categories

follows.

L

OANS

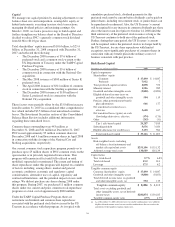

A summary of the major categories of loans outstanding is

shown in the following table. Outstanding loan balances

reflect unearned income, unamortized discount and premium,

and purchase discounts and premiums totaling $4.1 billion and

$990 million at December 31, 2008 and 2007, respectively.

Loans increased $107.2 billion as of December 31, 2008

compared with December 31, 2007. Our National City

acquisition added $99.7 billion of loans, including $34.3

billion of commercial, $16.0 billion of commercial real estate,

$30.5 billion of consumer and $10.6 billion of residential

mortgage loans.

In February 2008, we transferred the education loans in our

held for sale portfolio to the loan portfolio as further described

in the Loans Held For Sale section of this Consolidated

Balance Sheet Review.

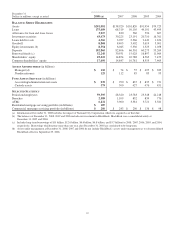

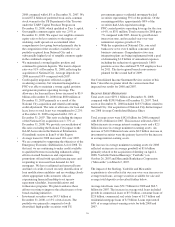

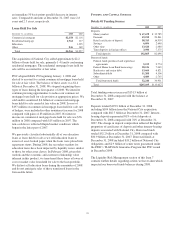

Details Of Loans

December 31 - in millions 2008 2007

Commercial

Retail/wholesale $ 11,482 $ 6,013

Manufacturing 13,263 4,814

Other service providers 9,038 3,639

Real estate related (a) 9,107 5,556

Financial services 5,194 1,419

Health care 3,201 1,464

Other 16,034 5,634

Total commercial 67,319 28,539

Commercial real estate

Real estate projects 17,176 6,111

Commercial mortgage 8,560 2,792

Total commercial real estate 25,736 8,903

Equipment lease financing 6,461 2,514

TOTAL COMMERCIAL LENDING 99,516 39,956

Consumer

Home equity

Lines of credit 24,024 6,811

Installment 14,252 7,636

Education 4,211 132

Automobile 1,667 1,513

Credit card and other unsecured lines of

credit 3,163 462

Other 5,172 1,839

Total consumer 52,489 18,393

Residential real estate

Residential mortgage 18,783 9,046

Residential construction 2,800 511

Total residential real estate 21,583 9,557

TOTAL CONSUMER LENDING 74,072 27,950

Other 1,901 413

Total loans $175,489 $68,319

(a) Includes loans to customers in the real estate and construction industries.

Total loans represented 60% of total assets December 31,

2008 and 49% of total assets at December 31, 2007.

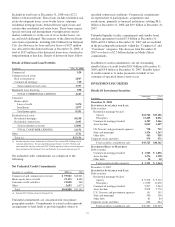

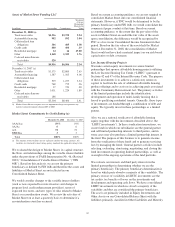

Our loan portfolio continued to be diversified among

numerous industries and types of businesses. The loans that

we hold are also concentrated in, and diversified across, our

principal geographic markets. See Note 4 Loans,

Commitments To Extend Credit and Concentrations of Credit

Risk in the Notes To Consolidated Financial Statements in

Item 8 of this Report for additional information.

31