PNC Bank 2008 Annual Report Download - page 77

Download and view the complete annual report

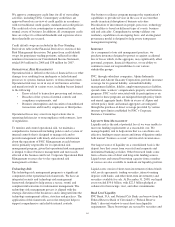

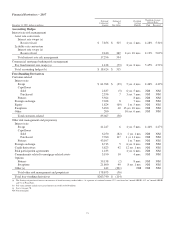

Please find page 77 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.from commercial mortgage servicing including the impact of

the ARCS acquisition, treasury management, third party

consumer loan servicing activities and the Mercantile

acquisition contributed to the increase in 2007 over the prior

year.

Service charges on deposits increased $35 million, or 11%, to

$348 million for 2007 compared with 2006. The increase was

primarily due to the impact of Mercantile.

Net securities losses totaled $5 million in 2007 and $207

million in 2006. We took actions during the third quarter of

2006 that resulted in the sale of approximately $6 billion of

investment securities at an aggregate pretax loss of $196

million during that quarter.

Other noninterest income decreased $170 million, to $423

million, in 2007 compared with 2006. Net losses of $127

million in 2007 representing the net of the mark-to-market

adjustment on our LTIP obligation and gain recognized in

connection with our transfer of shares to satisfy a portion of

our LTIP obligation, compared with a net loss of $12 million

on our LTIP shares obligation in 2006, where such obligation

was applicable in the fourth quarter. Noninterest revenue from

trading activities totaled $104 million in 2007 compared with

$183 million in 2006. While customer trading income

increased in comparison, total trading revenue declined in

2007 largely due to the lower economic hedging gains

associated with commercial mortgage loan activity and

economic hedging losses associated with structured resale

agreements. Other noninterest income for 2006 included a $48

million loss incurred in the third quarter in connection with

the rebalancing of our residential mortgage portfolio.

Noninterest income for 2006 also included the $2.078 billion

gain on the BlackRock/MLIM transaction, whereas there was

no similar transaction in 2007.

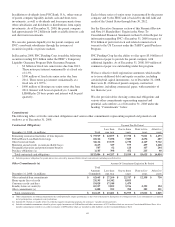

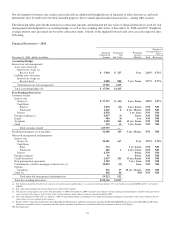

Noninterest Expense

Total noninterest expense was $4.296 billion for 2007, a

decrease of $147 million compared with $4.443 billion for

2006.

Noninterest expense for 2007 included the following:

• Acquisition integration costs of $102 million, and

• A charge of $82 million for an indemnification

obligation related to certain Visa litigation.

Noninterest expense for 2006 included the following:

• The first nine months of 2006 included $765 million

of expenses related to BlackRock, which was still

consolidated during that time, and

• BlackRock/MLIM transaction integration costs

totaling $91 million.

Apart from the impact of these items, noninterest expense

increased $525 million, or 15%, in 2007 compared with 2006.

These increases were largely a result of the acquisition of

Mercantile. Investments in growth initiatives were mitigated

by disciplined expense management.

E

FFECTIVE

T

AX

R

ATE

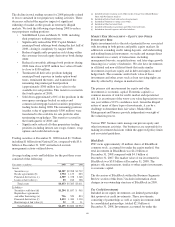

Our effective tax rate was 29.9% for 2007 and 34% for 2006.

The lower effective tax rate in 2007 compared with the prior

year reflected the impact of the following matters:

• An increase in income taxes related to the gain from,

and a $57 million cumulative adjustment to increase

deferred income taxes in connection with, the

BlackRock/MLIM transaction in 2006, and

• Lower pretax income for the fourth quarter of 2007

had the impact of reducing the effective tax rate for

the full year.

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

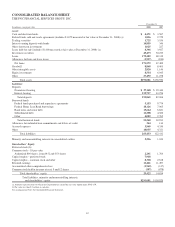

Loans

Loans increased $18.2 billion, or 36%, as of December 31,

2007 compared with December 31, 2006. Our Mercantile

acquisition added $12.4 billion of loans including $4.9 billion

of commercial, $4.8 billion of commercial real estate, $1.6

billion of consumer and $1.1 billion of residential mortgage

loans. Our Yardville acquisition added $1.9 billion of loans.

Securities

Total securities at December 31, 2007 were $30.2 billion

compared with $23.2 billion at December 31, 2006. Securities

represented 22% of total assets at December 31, 2007 and

23% of total assets at December 31, 2006. Our acquisition of

Mercantile included approximately $2 billion of securities

classified as available for sale. The increase in total securities

compared with December 31, 2006 was primarily due to

higher balances in residential mortgage-backed, commercial

mortgage-backed and asset-backed securities.

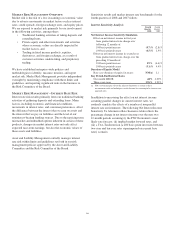

At December 31, 2007, the investment securities balance

included a net unrealized loss of $265 million, which

represented the difference between fair value and amortized

cost. The comparable amount at December 31, 2006 was a net

unrealized loss of $142 million. The expected weighted-

average life of investment securities (excluding corporate

stocks and other) was 3 years and 6 months at December 31,

2007 and 3 years and 8 months at December 31, 2006.

Loans Held For Sale

Loans held for sale totaled $3.9 billion at December 31, 2007

compared with $2.4 billion at December 31, 2006.

Loans held for sale included commercial mortgage loans

intended for securitization totaling $2.1 billion at

December 31, 2007 and $.9 billion at December 31, 2006. The

balance at December 31, 2007 increased as market conditions

were not conducive to completing securitization transactions

during the fourth quarter of 2007.

73