PNC Bank 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

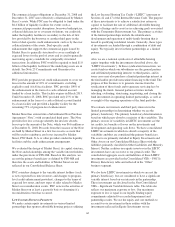

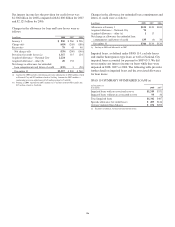

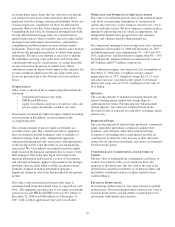

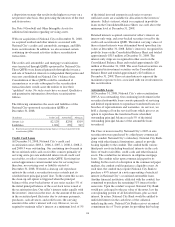

The fair value of securities accepted as collateral that we are

permitted by contract or custom to sell or repledge was $1.6

billion at December 31, 2008 and $2.3 billion at December 31,

2007 and is a component of federal funds sold and resale

agreements on our Consolidated Balance Sheet. Of the

permitted amount, $461 million was repledged to others at

December 31, 2008 and $1.5 billion was repledged to others at

December 31, 2007.

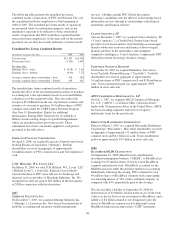

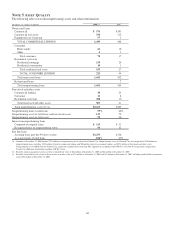

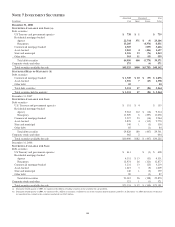

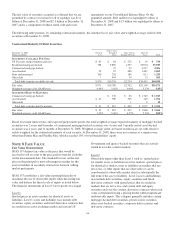

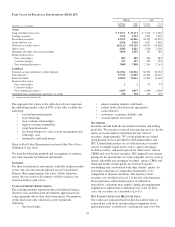

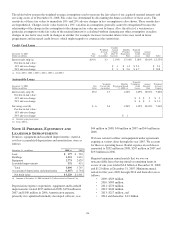

The following table presents, by remaining contractual maturity, the amortized cost, fair value and weighted-average yield of debt

securities at December 31, 2008.

Contractual Maturity Of Debt Securities

December 31, 2008

Dollars in millions

1 Year or

Less

After 1 Year

through 5

Years

After 5 Years

through 10 Years

After 10

Years Total

S

ECURITIES

A

VAILABLE

F

OR

S

ALE

US Treasury and government agencies $ 83 $ 84 $ 552 $ 19 $ 738

Residential mortgage-backed 758 9,890 1,397 23,904 35,949

Commercial mortgage-backed 37 52 4,217 4,306

Asset-backed 22 92 488 1,467 2,069

State and municipal 100 226 186 813 1,325

Other debt 7 464 59 33 563

Total debt securities available for sale $ 970 $10,793 $2,734 $30,453 $44,950

Fair value $ 971 $10,789 $2,702 $25,109 $39,571

Weighted-average yield, GAAP basis 6.09% 5.02% 6.06% 5.53% 5.45%

S

ECURITIES

H

ELD TO

M

ATURITY

Commercial mortgage-backed $ 130 $ 66 $ 1,749 $ 1,945

Asset-backed $ 43 789 395 149 1,376

Other debt 1910

Total debt securities held to maturity $ 43 $ 919 $ 462 $ 1,907 $ 3,331

Fair value $ 42 $ 907 $ 455 $ 1,860 $ 3,264

Weighted-average yield, GAAP basis 5.35% 5.00% 4.27% 5.20% 5.02%

Based on current interest rates and expected prepayment speeds, the total weighted-average expected maturity of mortgage-backed

securities was 2 years and 9 months, of commercial mortgage-backed securities was 4 years and 5 months and of asset-backed

securities was 4 years and 11 months at December 31, 2008. Weighted-average yields are based on historical cost with effective

yields weighted for the contractual maturity of each security. At December 31, 2008, there were no securities of a single issuer,

other than Fannie Mae and Freddie Mac, which exceeded 10% of total shareholders’ equity.

N

OTE

8F

AIR

V

ALUE

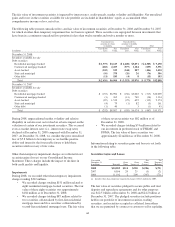

Fair Value Measurement

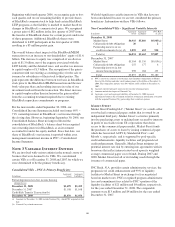

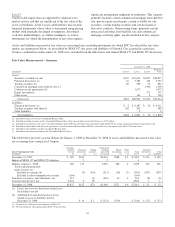

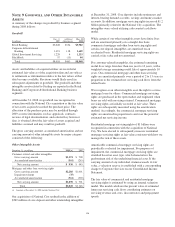

SFAS 157 defines fair value as the price that would be

received to sell an asset or the price paid to transfer a liability

on the measurement date. The standard focuses on the exit

price in the principal or most advantageous market for the

asset or liability in an orderly transaction between willing

market participants.

SFAS 157 establishes a fair value reporting hierarchy to

maximize the use of observable inputs when measuring fair

value and defines the three levels of inputs as noted below.

The financial instruments in Level 3 are typically less liquid.

Level 1

Quoted prices in active markets for identical assets or

liabilities. Level 1 assets and liabilities may include debt

securities, equity securities and listed derivative contracts that

are traded in an active exchange market and certain US

Government and agency-backed securities that are actively

traded in over-the-counter markets.

Level 2

Observable inputs other than Level 1 such as: quoted prices

for similar assets or liabilities in active markets, quoted prices

for identical or similar assets or liabilities in markets that are

not active, or other inputs that are observable or can be

corroborated to observable market data for substantially the

full term of the asset or liability. Level 2 assets and liabilities

may include debt securities, equity securities and listed

derivative contracts with quoted prices that are traded in

markets that are not active, and certain debt and equity

securities and over-the-counter derivative contracts whose fair

value is determined using a pricing model without significant

unobservable inputs. This category generally includes certain

mortgage-backed debt securities, private-issuer securities,

other asset-backed securities, corporate debt securities and

derivative contracts.

110