PNC Bank 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.This material is referenced for informational purposes

only and should not be deemed to constitute a part of this

report.

In addition, our recent acquisition of National City

Corporation (“National City”) presents us with a number of

risks and uncertainties related both to the acquisition

transaction itself and to the integration of the acquired

businesses into PNC. These risks and uncertainties include the

following:

• The transaction may be substantially more expensive to

complete (including the required divestitures and the

integration of National City’s businesses) and the

anticipated benefits, including anticipated cost savings

and strategic gains, may be significantly harder or take

longer to achieve than expected or may not be achieved

in their entirety as a result of unexpected factors or

events.

• Our ability to achieve anticipated results from this

transaction is dependent on the state going forward of the

economic and financial markets, which have been under

significant stress recently. Specifically, we may incur

more credit losses from National City’s loan portfolio

than expected. Other issues related to achieving

anticipated financial results include the possibility that

deposit attrition or attrition in key client, partner and

other relationships may be greater than expected.

• Litigation and governmental investigations currently

pending against National City, as well as others that may

be filed or commenced relating to National City’s

business and activities before the acquisition could

adversely impact our financial results.

• Our ability to achieve anticipated results is also

dependent on our ability to bring National City’s

systems, operating models, and controls into conformity

with ours and to do so on our planned time schedule. The

integration of National City’s business and operations

into PNC, which will include conversion of National

City’s different systems and procedures, may take longer

than anticipated or be more costly than anticipated or

have unanticipated adverse results relating to National

City’s or PNC’s existing businesses. PNC’s ability to

integrate National City successfully may be adversely

affected by the fact that this transaction will result in

PNC entering several markets where PNC did not

previously have any meaningful retail presence.

In addition to the National City transaction, we grow our

business from time to time by acquiring other financial

services companies. Acquisitions in general present us with

risks, in addition to those presented by the nature of the

business acquired, similar to some or all of those described

above relating to the National City acquisition.

ITEM

7A –

QUANTITATIVE AND QUALITATIVE

DISCLOSURES ABOUT MARKET RISK

This information is set forth in the Risk Management section

of Item 7 of this Report.

ITEM

8–

FINANCIAL STATEMENTS AND

SUPPLEMENTARY DATA

Included below is the report of our current independent

registered public accounting firm. The report of our previous

independent registered public accounting firm is included

under Item 15 of this Report.

R

EPORT

O

F

I

NDEPENDENT

R

EGISTERED

P

UBLIC

A

CCOUNTING

F

IRM

To the Board of Directors and Shareholders of The PNC

Financial Services Group, Inc.

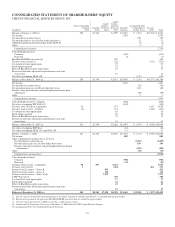

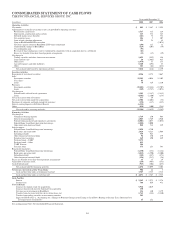

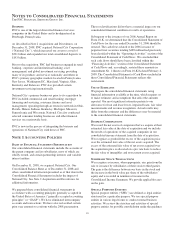

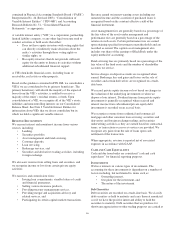

In our opinion, the accompanying consolidated balance sheets

and the related consolidated statements of income,

shareholders’ equity, and cash flows present fairly, in all

material respects, the financial position of The PNC Financial

Services Group, Inc. and its subsidiaries (the “Company”) at

December 31, 2008 and 2007, and the results of their

operations and their cash flows for the years then ended in

conformity with accounting principles generally accepted in

the United States of America. Also in our opinion, the

Company maintained, in all material respects, effective

internal control over financial reporting as of December 31,

2008, based on criteria established in Internal Control –

Integrated Framework issued by the Committee of Sponsoring

Organizations of the Treadway Commission (COSO). The

Company’s management is responsible for these financial

statements, for maintaining effective internal control over

financial reporting and for its assessment of the effectiveness

of internal control over financial reporting, included in

Management’s Report on Internal Control over Financial

Reporting appearing under Item 9A. Our responsibility is to

express opinions on these financial statements and on the

Company’s internal control over financial reporting based on

our integrated audits. We conducted our audits in accordance

with the standards of the Public Company Accounting

Oversight Board (United States). Those standards require that

we plan and perform the audits to obtain reasonable assurance

about whether the financial statements are free of material

misstatement and whether effective internal control over

financial reporting was maintained in all material respects.

Our audits of the financial statements included examining, on

a test basis, evidence supporting the amounts and disclosures

in the financial statements, assessing the accounting principles

used and significant estimates made by management, and

79