PNC Bank 2008 Annual Report Download - page 44

Download and view the complete annual report

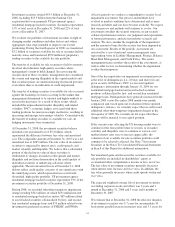

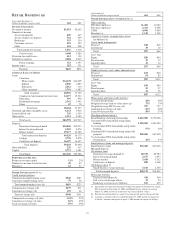

Please find page 44 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interest. Neither creditors nor equity investors in the LIHTC

investments have any recourse to our general credit. The

consolidated aggregate assets and liabilities of these LIHTC

investments are provided in the Consolidated VIEs – PNC Is

Primary Beneficiary table and reflected in the “Other”

business segment.

We also have LIHTC investments in which we are not the

primary beneficiary, but are considered to have a significant

variable interest based on our interests in the partnership.

These investments are disclosed in the Non-Consolidated

VIEs – Significant Variable Interests table. The table also

reflects our maximum exposure to loss. Our maximum

exposure to loss is equal to our legally binding equity

commitments adjusted for recorded impairment and

partnership results. We use the equity and cost methods to

account for our investment in these entities with the

investments reflected in Equity Investments on our

Consolidated Balance Sheet. In addition, we increase our

recognized investments and recognize a liability for all legally

binding unfunded equity commitments. These liabilities are

reflected in Other Liabilities on our Consolidated Balance

Sheet.

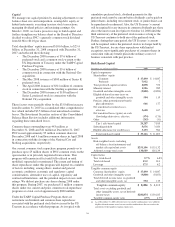

Credit Risk Transfer Transaction

National City Bank (“NCB”) sponsored a special purpose

entity (“SPE”) trust and concurrently entered into a credit risk

transfer agreement with an independent third-party to mitigate

credit losses on a pool of nonconforming mortgage loans

originated by its former First Franklin business unit. The SPE

was formed with a small contribution from NCB and was

structured as a bankruptcy-remote entity so that its creditors

have no recourse to NCB. In exchange for a perfected security

interest in the cash flows of the nonconforming mortgage

loans, the SPE issued to NCB asset-backed securities in the

form of senior, mezzanine, and subordinated equity notes.

NCB has incurred credit losses equal to the subordinated

equity notes. NCB currently holds the right to put the

mezzanine notes to the independent third-party at par. As of

December 31, 2008, the value of the mezzanine notes was

$169 million. NCB holds the senior notes and will be

responsible for credit losses in excess of this amount.

The SPE was deemed to be a VIE as its equity was not

sufficient to finance its activities. NCB was determined to be

the primary beneficiary of the SPE as it would absorb the

majority of the expected losses of the SPE through its holding

of all of the asset-backed securities. Accordingly, this SPE

was consolidated and all of the entity’s assets, liabilities, and

equity are intercompany balances and are eliminated in

consolidation. Nonconforming mortgage loans, including

foreclosed properties, pledged as collateral to the SPE remain

on the balance sheet and totaled $719 million at December 31,

2008 reflecting the impact of fair value adjustments recorded

by PNC in conjunction with the acquisition.

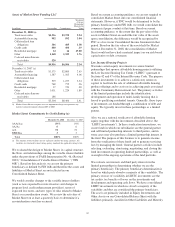

In January 2009, cumulative credit losses in the mortgage loan

pool surpassed the principal balance of subordinated equity

notes, giving PNC the right to put the first mezzanine note to

the independent third party in accordance with the credit risk

transfer agreement. In February 2009, PNC exercised its put

option and received $16 million for the mezzanine note. Prior

to this reconsideration event, management evaluated what

impact this transaction would have on determining whether

we would remain the primary beneficiary of the SPE.

Management concluded, through reassessment of the expected

losses and residual returns of the SPE, that we would remain

the primary beneficiary and accordingly should continue to

consolidate the SPE.

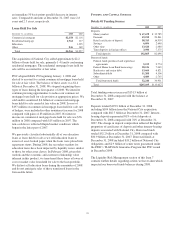

Perpetual Trust Securities

We issue certain hybrid capital vehicles that qualify as capital

for regulatory and rating agency purposes.

In February 2008, PNC Preferred Funding LLC (the “LLC”),

one of our indirect subsidiaries, sold $375 million of 8.700%

Fixed-to-Floating Rate Non-Cumulative Exchangeable

Perpetual Trust Securities of PNC Preferred Funding Trust III

(“Trust III”) to third parties in a private placement. In

connection with the private placement, Trust III acquired $375

million of Fixed-to-Floating Rate Non-Cumulative Perpetual

Preferred Securities of the LLC (the “LLC Preferred

Securities”). The sale was similar to the March 2007 private

placement by the LLC of $500 million of 6.113%

Fixed-to-Floating Rate Non-Cumulative Exchangeable Trust

Securities (the “Trust II Securities”) of PNC Preferred

Funding Trust II (“Trust II”) in which Trust II acquired $500

million of LLC Preferred Securities and to the December 2006

private placement by PNC REIT Corp. of $500 million of

6.517% Fixed-to-Floating Rate Non-Cumulative

Exchangeable Perpetual Trust Securities (the “Trust I

Securities”) of PNC Preferred Funding Trust I (“Trust I”) in

which Trust I acquired $500 million of LLC Preferred

Securities.

Each Trust III Security is automatically exchangeable into a

share of Series J Non-Cumulative Perpetual Preferred Stock of

PNC, each Trust II Security is automatically exchangeable

into a share of Series I Non-Cumulative Perpetual Preferred

Stock of PNC (“Series I Preferred Stock”), and each Trust I

Security is automatically exchangeable into a share of Series F

Non-Cumulative Perpetual Preferred Stock of PNC Bank,

N.A. (“PNC Bank Preferred Stock”), in each case under

certain conditions relating to the capitalization or the financial

condition of PNC Bank, N.A. and upon the direction of the

Office of the Comptroller of the Currency.

We entered into a replacement capital covenant in connection

with the closing of the Trust I Securities sale (the “Trust

RCC”) whereby we agreed that neither we nor our subsidiaries

(other than PNC Bank, N.A. and its subsidiaries) would

40