PNC Bank 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the final award payout with respect to incentive/performance

unit share awards. Restricted stock/unit awards have various

vesting periods ranging from 12 months to 60 months. There

are no financial or performance goals associated with any of

our restricted stock/unit awards.

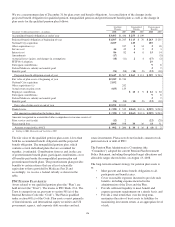

The weighted-average grant-date fair value of incentive/

performance unit share awards and restricted stock/unit

awards granted in 2008, 2007 and 2006 was $59.25, $73.83

and $67.36 per share, respectively. We recognize

compensation expense for such awards ratably over the

corresponding vesting and/or performance periods for each

type of program. Total compensation expense recognized

related to incentive/performance unit share awards and

restricted stock/unit awards during 2008 was approximately

$51 million compared with $42 million in 2007 and $45

million in 2006.

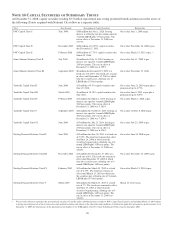

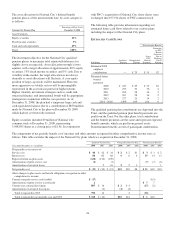

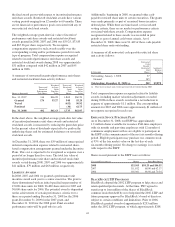

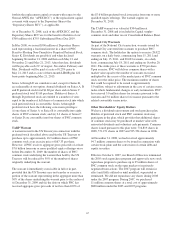

A summary of nonvested incentive/performance unit shares

and restricted stock/unit share activity follows:

Shares in thousands

Nonvested

Incentive/

Performance

Unit Shares

Weighted-

Average

Grant

Date Fair

Value

Nonvested

Restricted

Stock/

Unit

Shares

Weighted-

Average

Grant

Date Fair

Value

Dec. 31, 2007 316 $66.28 1,869 $60.20

Granted 176 53.27 548 55.20

Vested (652) 50.92

Forfeited (30) 62.75

Dec. 31, 2008 492 $61.63 1,735 $62.07

In the chart above, the weighted-average grant-date fair value

of incentive/performance unit share awards and restricted

stock/unit awards is measured by reducing the grant date price

by the present value of dividends expected to be paid on the

underlying shares and for estimated forfeitures on restricted

stock/unit awards.

At December 31, 2008, there was $39 million of unrecognized

deferred compensation expense related to nonvested share-

based compensation arrangements granted under the Incentive

Plans. This cost is expected to be recognized as expense over a

period of no longer than five years. The total fair value of

incentive/performance unit share and restricted stock /unit

awards vested during 2008, 2007 and 2006 was approximately

$41 million, $79 million and $63 million, respectively.

L

IABILITY

A

WARDS

In 2008, 2007 and 2006 we granted a performance unit

incentive award each year to a senior executive. The grant is

share-denominated with an initial specified target number of

47,000 share units for 2008, 26,400 share units for 2007 and

30,000 share units for 2006. The potential award is dependent

on the achievement of certain performance criteria over a

three-year period ending December 31, 2008 for the 2006

grant, December 31, 2009 for the 2007 grant, and

December 31, 2010 for the 2008 grant. Final awarded

performance units will be paid only in cash.

Additionally, beginning in 2008, we granted other cash-

payable restricted share units to certain executives. The grants

were made primarily as part of an annual bonus incentive

deferral plan. While there are time-based, service-related

vesting criteria, there are no market or performance criteria

associated with these awards. Compensation expense

recognized related to these awards was recorded in prior

periods as part of annual cash bonus criteria. As of

December 31, 2008, there were 91,449 of these cash-payable

restricted share units outstanding.

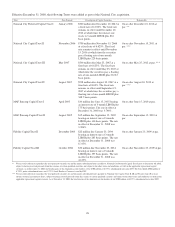

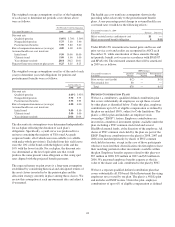

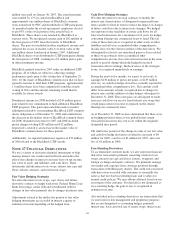

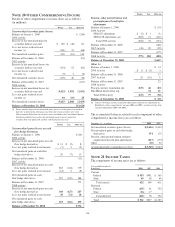

A summary of all nonvested, cash-payable restricted share

unit activity follows:

In thousands

Nonvested

Cash-

Payable

Restricted

Unit

Shares

Aggregate

Intrinsic

Value

Outstanding, January 1, 2008 57

Granted 145

Outstanding, December 31, 2008 (a) 202 $9,878

(a) There were no share units vested and received or forfeited during 2008.

Total compensation expense recognized related to liability

awards, including market valuation adjustments recorded

during 2008 on these awards, resulted in a net reduction to

expense of approximately $1.1 million. The corresponding

amounts for 2007 and 2006 were approximately $1 million of

net expense recognized in each year.

E

MPLOYEE

S

TOCK

P

URCHASE

P

LAN

As of December 31, 2008, our ESPP has approximately

1.2 million shares available for issuance. Full-time employees

with six months and part-time employees with 12 months of

continuous employment with us are eligible to participate in

the ESPP at the commencement of the next six-month offering

period. Eligible participants may purchase our common stock

at 95% of the fair market value on the last day of each

six-month offering period. No charge to earnings is recorded

with respect to the ESPP.

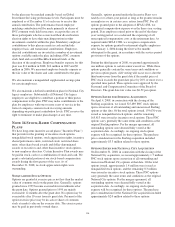

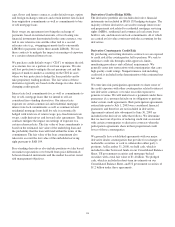

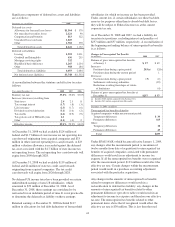

Shares issued pursuant to the ESPP were as follows:

Year ended December 31 Shares Price Per Share

2008 133,563 $54.25 and $46.55

2007 111,812 68.00 and 62.37

2006 105,041 66.66 and 70.34

B

LACK

R

OCK

LTIP P

ROGRAMS

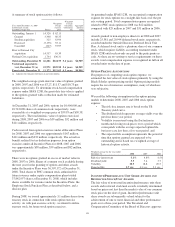

BlackRock adopted the 2002 LTIP program to help attract and

retain qualified professionals. At that time, PNC agreed to

transfer up to four million of the shares of BlackRock

common stock then held by us to help fund the 2002 LTIP and

future programs approved by BlackRock’s board of directors,

subject to certain conditions and limitations. Prior to 2006,

BlackRock granted awards of approximately $233 million

under the 2002 LTIP program, of which approximately $208

132