PNC Bank 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184

|

|

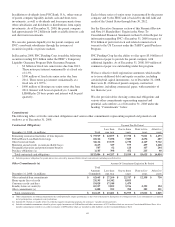

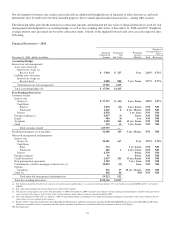

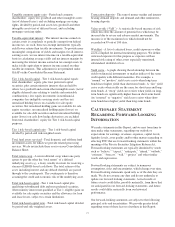

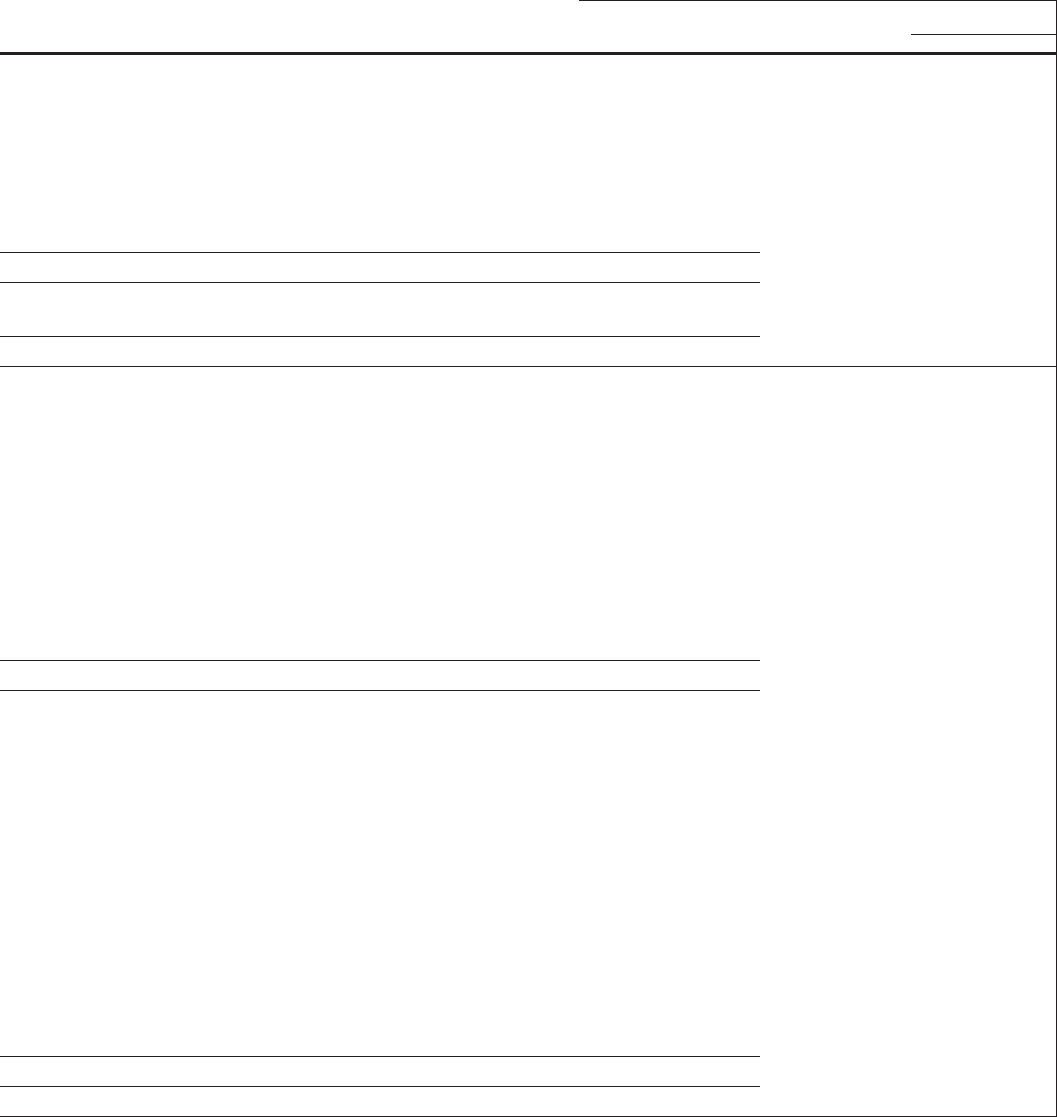

Financial Derivatives – 2007

December 31, 2007- dollars in millions

Notional/

Contractual

Amount

Estimated

Net

Fair Value

Weighted

Average

Maturity

Weighted-Average

Interest Rates

Paid Received

Accounting Hedges

Interest rate risk management

Asset rate conversion

Interest rate swaps (a)

Receive fixed $ 7,856 $ 325 4 yrs. 2 mos. 4.28% 5.34%

Liability rate conversion

Interest rate swaps (a)

Receive fixed 9,440 269 4 yrs. 10 mos. 4.12% 5.09%

Total interest rate risk management 17,296 594

Commercial mortgage banking risk management

Pay fixed interest rate swaps (a) 1,128 (79) 8 yrs. 8 mos. 5.45% 4.52%

Total accounting hedges (b) $ 18,424 $ 515

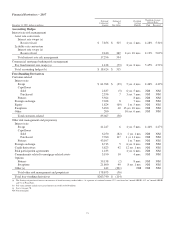

Free-Standing Derivatives

Customer-related

Interest rate

Swaps $ 61,768 $ (39) 5 yrs. 4 mos. 4.46% 4.49%

Caps/floors

Sold 2,837 (5) 6 yrs. 5 mos. NM NM

Purchased 2,356 7 3 yrs. 7 mos. NM NM

Futures 5,564 8 mos. NM NM

Foreign exchange 7,028 8 7 mos. NM NM

Equity 1,824 (69) 1 yr. 5 mos. NM NM

Swaptions 3,490 40 13 yrs. 10 mos. NM NM

Other 200 10 yrs. 6 mos. NM NM

Total customer-related 85,067 (58)

Other risk management and proprietary

Interest rate

Swaps 41,247 6 4 yrs. 5 mos. 4.44% 4.47%

Caps/floors

Sold 6,250 (82) 2 yrs. 1 mo. NM NM

Purchased 7,760 117 1 yr. 11 mos. NM NM

Futures 43,107 1 yr. 7 mos. NM NM

Foreign exchange 8,713 5 6 yrs. 8 mos. NM NM

Credit derivatives 5,823 42 12 yrs. 1 mo. NM NM

Risk participation agreements 1,183 4 yrs. 6 mos. NM NM

Commitments related to mortgage-related assets 3,190 10 4 mos. NM NM

Options

Futures 39,158 (2) 8 mos. NM NM

Swaptions 21,800 49 8 yrs. 1 mo. NM NM

Other (c) 442 (201) NM NM NM

Total other risk management and proprietary 178,673 (56)

Total free-standing derivatives $263,740 $ (114)

(a) The floating rate portion of interest rate contracts is based on money-market indices. As a percent of a notional amount, 52% were based on 1-month LIBOR, 43% on 3-month LIBOR

and 5% on Prime Rate.

(b) Fair value amounts include net accrued interest receivable of $130 million.

(c) See (e) on page 70.

NM Not meaningful

71