PNC Bank 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.B

LACK

R

OCK

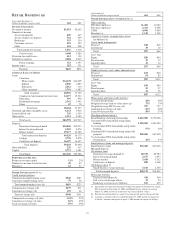

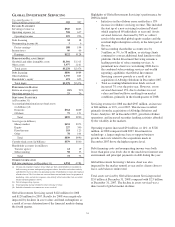

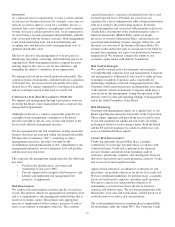

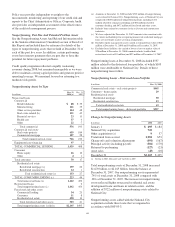

Our BlackRock business segment earned $207 million in 2008

and $253 million in 2007. These results reflect our

approximately 33% share of BlackRock’s reported GAAP

earnings and the additional income taxes on these earnings

incurred by PNC.

PNC’s investment in BlackRock was $4.2 billion at

December 31, 2008 and $4.1 billion at December 31, 2007.

The book value per share was $98.32 at December 31, 2008.

B

LACK

R

OCK

LTIP P

ROGRAMS AND

E

XCHANGE

A

GREEMENTS

BlackRock adopted the 2002 LTIP program to help attract and

retain qualified professionals. At that time, PNC agreed to

transfer up to four million of the shares of BlackRock

common stock then held by us to help fund the 2002 LTIP and

future programs approved by BlackRock’s board of directors,

subject to certain conditions and limitations. Prior to 2006,

BlackRock granted awards of approximately $233 million

under the 2002 LTIP program, of which approximately $208

million were paid on January 30, 2007. The award payments

were funded by 17% in cash from BlackRock and

approximately one million shares of BlackRock common

stock transferred by PNC and distributed to LTIP participants.

We recognized a pretax gain of $82 million in the first quarter

of 2007 from the transfer of BlackRock shares. The gain was

included in other noninterest income and reflected the excess

of market value over book value of the one million shares

transferred in January 2007. Additional BlackRock shares

were distributed to LTIP participants during the first quarter of

2008, resulting in a $3 million pretax gain in other noninterest

income, and during January 2009, resulting in a $1 million

pretax gain.

BlackRock granted awards in 2007 under an additional LTIP

program, all of which are subject to achieving earnings

performance goals prior to the vesting date of September 29,

2011. Of the shares of BlackRock common stock that we have

agreed to transfer to fund their LTIP programs, approximately

1.6 million shares have been committed to fund the awards

vesting in 2011 and the amount remaining would then be

available for future awards.

PNC’s noninterest income for 2008 included a $243 million

pretax gain related to our commitment to fund additional

BlackRock LTIP programs. This gain represented the

mark-to-market adjustment related to our remaining

BlackRock LTIP common shares obligation as of

December 31, 2008 and resulted from the decrease in the

market value of BlackRock common shares for 2008. PNC’s

noninterest income for 2007 included a pretax charge of $209

million for an increase in the market value of BlackRock

common shares for that period.

As further described in PNC’s Current Report on Form 8-K

filed December 30, 2008, PNC entered into an Exchange

Agreement with BlackRock on December 26, 2008. The

transactions contemplated by this agreement will restructure

PNC’s ownership of BlackRock equity without altering, to

any meaningful extent, PNC’s economic interest in

BlackRock. PNC will continue to be subject to the limitations

on its voting rights in its existing agreements with BlackRock.

These transactions will also allow PNC to reduce its net

income volatility associated with the quarterly

marking-to-market of obligations related to PNC’s delivery of

BlackRock stock under the BlackRock LTIP.

Also on December 26, 2008, BlackRock entered into an

Exchange Agreement with Merrill Lynch in anticipation of the

consummation of the merger of Bank of America Corporation

and Merrill Lynch which was completed on January 1, 2009.

The PNC and Merrill Lynch Exchange Agreements

restructured PNC’s and Merrill Lynch’s respective ownership

of BlackRock common and preferred equity. The exchange

was completed on February 27, 2009.

PNC will continue to account for its investment in BlackRock

under the equity method of accounting, with its share of

BlackRock’s earnings reduced from approximately 33% to

31%, solely as a result of the exchange of 2.9 million of its

shares of BlackRock common stock for new BlackRock Series

C Preferred Stock. The Series C Preferred Stock will not be

taken into consideration in determining PNC’s share of

BlackRock earnings under the equity method. PNC’s

percentage ownership of BlackRock common stock is

expected to increase from approximately 36.5% to 46.5%. The

increase will result from a substantial exchange of Merrill

Lynch’s BlackRock common stock for BlackRock preferred

stock. As a result of the BlackRock preferred stock currently

held by Merrill Lynch and the new BlackRock preferred stock

being issued to Merrill Lynch and PNC under the Exchange

Agreements, PNC’s share of BlackRock common stock has

been, and will continue to be, higher than its overall share of

BlackRock’s equity and earnings.

On February 27, 2009, PNC’s obligation to deliver BlackRock

common shares was replaced with an obligation to deliver

shares of BlackRock’s new Series C Preferred Stock. PNC

will account for these preferred shares at fair value as

permitted under SFAS 159, which will offset the impact of

marking-to-market the liability to deliver these shares to

BlackRock.

The transactions related to the Exchange Agreements will not

affect our right to receive dividends declared by BlackRock.

52