PNC Bank 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

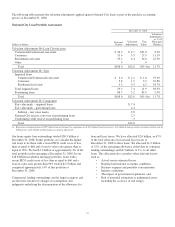

PNC’s Tier 1 risk-based capital ratio was 9.7% at

December 31, 2008 compared with 6.8% at December 31,

2007. The increase in the ratio from December 31, 2007

included the issuance of Tier 1 eligible securities during the

first half of 2008 totaling $1.3 billion, including REIT

preferred, noncumulative perpetual preferred, and trust

preferred securities. The “Perpetual Trust Securities” and

“PNC Capital Trust E Trust Preferred Securities” portions of

the Off-Balance Sheet Arrangements and VIEs section of this

Item 7 and Note 19 Shareholders’ Equity in Item 8 of this

Report have additional information regarding these securities.

In addition, $7.6 billion of preferred stock and a common

stock warrant was issued to the US Department of the

Treasury under the TARP Capital Purchase Program on

December 31, 2008. Tier 1 risk-based capital further increased

as a result of $5.6 billion of common stock issued in the

National City acquisition and PNC’s assumption of $2.6

billion of Tier 1 qualifying capital securities previously issued

by National City. These increases in capital were partially

offset by the deduction of higher acquisition-related intangible

assets. The positive effect on the Tier 1 ratio of the net

increase in capital was somewhat offset by an increase in risk-

weighted assets primarily related to acquisitions, including

National City.

The leverage ratio at December 31, 2008 reflected the

favorable impact on Tier 1 risk-based capital from the

issuance of securities under TARP and the issuance of PNC

common stock in connection with the National City

acquisition, both of which occurred on December 31, 2008. In

addition, the ratio as of that date did not reflect any impact of

National City on PNC’s adjusted average total assets.

PNC’s tangible common equity ratio was 2.9% at

December 31, 2008 compared with 4.7% at December 31,

2007. The decrease in the ratio from the prior year was the

result of the decline in the value of the securities available for

sale portfolio and the value of assets in our pension plan. We

expect PNC’s tangible common equity ratio to be less

sensitive to the impact of widening credit spreads on

accumulated other comprehensive loss going forward

primarily due to the composition of the securities available for

sale portfolio acquired from National City and a substantially

higher level of common equity in the combined company.

The access to, and cost of, funding new business initiatives

including acquisitions, the ability to engage in expanded

business activities, the ability to pay dividends, the level of

deposit insurance costs, and the level and nature of regulatory

oversight depend, in part, on a financial institution’s capital

strength.

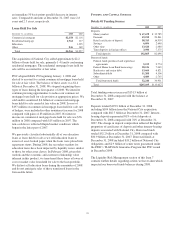

At December 31, 2008 and December 31, 2007, each of our

domestic bank subsidiaries was considered “well capitalized”

based on US regulatory capital ratio requirements. See the

Supervision And Regulation section of Item 1 of this Report

and Note 23 Regulatory Matters in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information. We believe our bank subsidiaries will continue to

meet these requirements in 2009.

O

FF

-B

ALANCE

S

HEET

A

RRANGEMENTS

A

ND

VIE

S

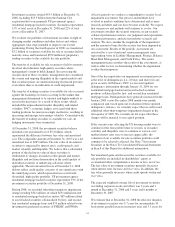

We engage in a variety of activities that involve

unconsolidated entities or that are otherwise not reflected in

our Consolidated Balance Sheet that are generally referred to

as “off-balance sheet arrangements.” The following sections

of this Report provide further information on these types of

activities:

• Commitments, including contractual obligations and

other commitments, included within the Risk

Management section of this Item 7, and

• Note 10 Securitization Activity and Note 25

Commitments and Guarantees in the Notes To

Consolidated Financial Statements included in Item 8

of this Report.

The following provides a summary of variable interest entities

(“VIEs”), including those that we have consolidated and those

in which we hold a significant variable interest but have not

consolidated into our financial statements as of December 31,

2008 and December 31, 2007.

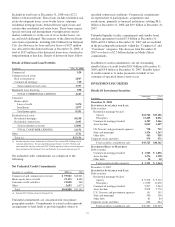

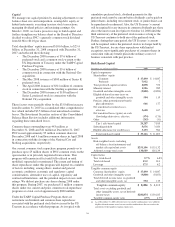

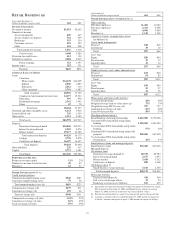

Consolidated VIEs – PNC Is Primary Beneficiary

In millions

Aggregate

Assets

Aggregate

Liabilities

Partnership interests in low

income housing projects (a)

December 31, 2008 $1,499 $1,455

December 31, 2007 $1,108 $1,108

Credit Risk Transfer Transaction (b)

December 31, 2008 $1,070 $1,070

(a) Amounts for December 31, 2008 include National City, which PNC acquired on that

date.

(b) National City-related transaction.

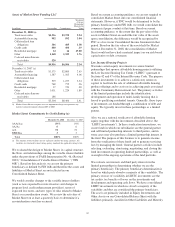

Non-Consolidated VIEs – Significant Variable Interests

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC Risk

of Loss

December 31, 2008

Market Street $4,916 $5,010 $6,965(a)

Collateralized debt obligations 20 2

Partnership interests in tax

credit investments (b) (c) (d) 1,095 652 920

Total (c) $6,031 $5,662 $7,887

December 31, 2007

Market Street $5,304 $5,330 $9,019(a)

Collateralized debt obligations 255 177 6

Partnership interests in low

income housing projects 298 184 155

Total $5,857 $5,691 $9,180

37