PNC Bank 2008 Annual Report Download - page 152

Download and view the complete annual report

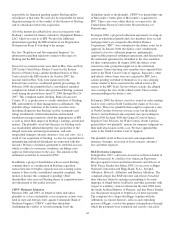

Please find page 152 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.City), had to their officers, directors and sometimes

employees and agents at the time of acquisition. We advanced

such costs on behalf of several such individuals (including

some from Riggs and Sterling) with respect to pending

litigation or investigations during 2008. It is not possible for

us to determine the aggregate potential exposure resulting

from the obligation to provide this indemnity or to advance

such costs.

In connection with the lending of securities facilitated by

Global Investment Servicing as an intermediary on behalf of

certain of its clients, we provide indemnification to those

clients against the failure of the borrowers to return the

securities. The market value of the securities lent is fully

secured on a daily basis; therefore, the exposure to us is

limited to temporary shortfalls in the collateral as a result of

short-term fluctuations in trading prices of the loaned

securities. At December 31, 2008, the total maximum

potential exposure as a result of these indemnity obligations

was $7.9 billion, although the collateral at the time exceeded

that amount.

V

ISA

I

NDEMNIFICATION

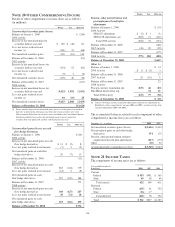

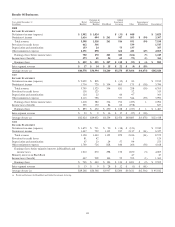

Our payment services business issues and acquires credit and

debit card transactions through Visa U.S.A. Inc. card

association or its affiliates (“Visa”).

In October 2007 Visa completed a restructuring and issued

shares of Visa Inc. common stock to its financial institution

members (“Visa Reorganization”) in contemplation of its

initial public offering (“IPO”). As part of the Visa

Reorganization, we received our proportionate share of a class

of Visa Inc. common stock allocated to the US members. Prior

to the IPO, the US members were obligated to indemnify Visa

for judgments and settlements related to specified litigation. In

accordance with GAAP, during the fourth quarter of 2007 we

recorded a liability and pretax operating expense of $82

million representing our estimate of the fair value of our

indemnification obligation for potential losses arising from

this litigation.

Visa’s IPO occurred in March 2008. Visa redeemed

2.2 million of our investment in Visa Class B common shares

for cash out of the proceeds of the IPO. Accordingly, we

recognized a pretax gain of $95 million during the first quarter

of 2008 in other noninterest income in connection with this

redemption. In addition, Visa set aside $3 billion of the IPO

proceeds in an escrow account for the benefit of the US

member financial institutions to fund the expenses of the

litigation as well as the members’ proportionate share of any

judgments or settlements that may arise out of the litigation.

Therefore, we reduced our indemnification liability

proportionately based upon the escrowed amount via a credit

to noninterest expense of $43 million pretax during the first

quarter of 2008.

In October 2008, Visa reached a settlement with Discover

Financial Services related to another of the specified litigation.

As a result, we recorded an incremental indemnification

liability of $13 million.

Based on the cumulative impact of this settlement and

previous settlements, Visa determined that additional escrow

funds were necessary and set aside an additional $1.1 billion

in cash for the remaining specified litigation cases in the

fourth quarter 2008. In connection with Visa’s cash allocation

to the escrow fund, Visa reduced the Visa B common share to

Visa A common share conversion ratio from approximately

71% to 63%. We determined that these actions effectively

settled a proportionate share of our estimated indemnification

liability for the remaining specified litigation. As a result, we

reduced our indemnification liability by $16 million with a

corresponding credit to noninterest expense.

As a result of the acquisition of National City, we became

party to judgment and loss sharing agreements with Visa and

certain other banks. The judgment and loss sharing

agreements were designed to apportion financial

responsibilities arising from any potential adverse judgment or

negotiated settlements related to the specified litigation. The

acquisition of National City resulted in the recognition of an

additional indemnification liability of $224 million. As a

result of the indemnification provision in Section 2.05j of the

Visa By-Laws and/or the indemnification provided through

the judgment and loss sharing agreements, PNC’s Visa

indemnification liability at December 31, 2008 totaled $260

million.

R

ECOURSE

A

GREEMENTS

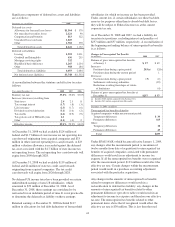

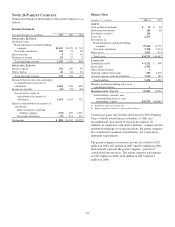

We are authorized to originate, underwrite, close to fund and

service commercial mortgage loans and then sell them to

FNMA under FNMA’s DUS program. We have similar

arrangements with FHLMC.

Under these programs, we generally assume up to one-third of

the risk of loss on unpaid principal balances through a loss

share arrangement. At December 31, 2008, the potential

exposure to loss was $5.7 billion. Accordingly, we maintain a

reserve for such potential losses which approximates the fair

value of this exposure. At December 31, 2008, the unpaid

principal balance outstanding of loans sold as a participant in

these programs was $18.6 billion. The fair value of the loss

share arrangement in the form of reserves for losses under

these programs, totaled $79 million as of December 31, 2008

and is included in other liabilities on our Consolidated

Balance Sheet. If payment is required under these programs,

we would not have a contractual interest in the collateral

underlying the mortgage loans on which losses occurred,

although the value of the collateral is taken into account in

determining our share of such losses. The serviced loans are

not included on our Consolidated Balance Sheet.

148