PNC Bank 2008 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

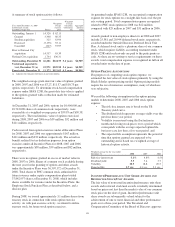

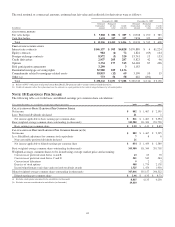

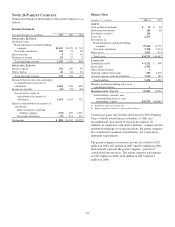

The following table sets forth regulatory capital ratios for

PNC and its significant bank subsidiaries, PNC Bank, N.A.

and National City Bank.

Regulatory Capital

Amount Ratios

December 31 Dollars in millions 2008 2007 2008 2007

Risk-based capital

Tier 1

PNC $24,287 $ 7,815 9.7% 6.8%

PNC Bank, N.A. 8,338 7,851 7.1 7.6

National City Bank (a) 12,567 10.1

Total

PNC 33,116 11,803 13.2 10.3

PNC Bank, N.A. 12,104 10,616 10.3 10.2

National City Bank (a) 17,208 13.8

Leverage

PNC NM NM 17.5 6.2

PNC Bank, N.A. NM NM 6.3 6.8

National City Bank (a) NM 8.8

(a) Acquired on December 31, 2008.

NM—Not meaningful.

The principal source of parent company cash flow is the

dividends it receives from its subsidiary banks, which may be

impacted by the following:

• Capital needs,

• Laws and regulations,

• Corporate policies,

• Contractual restrictions, and

• Other factors.

Also, there are statutory and regulatory limitations on the

ability of national banks to pay dividends or make other

capital distributions. The amount available for dividend

payments to the parent company by PNC Bank, N.A. without

prior regulatory approval was approximately $351 million at

December 31, 2008. National City Bank had no statutory

dividend capacity as of December 31, 2008.

Under federal law, bank subsidiaries generally may not extend

credit to the parent company or its non-bank subsidiaries on

terms and under circumstances that are not substantially the

same as comparable extensions of credit to nonaffiliates. No

extension of credit may be made to the parent company or a

non-bank subsidiary which is in excess of 10% of the capital

stock and surplus of such bank subsidiary or in excess of 20%

of the capital and surplus of such bank subsidiary as to

aggregate extensions of credit to the parent company and its

non-bank subsidiaries. Such extensions of credit, with limited

exceptions, must be fully collateralized by certain specified

assets. In certain circumstances, federal regulatory authorities

may impose more restrictive limitations.

Federal Reserve Board regulations require depository

institutions to maintain cash reserves with the Federal Reserve

Bank (“FRB”). At December 31, 2008, the balance

outstanding at the FRB was $14 billion.

N

OTE

24 L

EGAL

P

ROCEEDINGS

National City Matters

In December 2008, we completed the acquisition of National

City through the merger of National City into The PNC

Financial Services Group, Inc. As a result, we are now

responsible for litigation pending against National City and its

subsidiaries at that time. We will also be responsible for future

litigation arising out of the conduct of the business of National

City and its subsidiaries before the acquisition.

The lawsuits and other matters described below arise from

National City’s business prior to the merger. We may be

responsible for indemnifying individual defendants in these

lawsuits and other matters.

See also “National City Acquisition-Related Litigation” below

for information regarding litigation filed against PNC and

National City relating to the merger and “Regulatory and

Governmental Inquiries” for information regarding regulatory

matters with respect to National City.

Visa. Beginning in June 2005, a series of antitrust lawsuits

were filed against Visa®, MasterCard®, and several major

financial institutions, including cases naming National City

(since merged into PNC) and its subsidiary, National City

Bank of Kentucky, since merged into National City Bank. The

cases, which were brought as class actions on behalf of all

persons or business entities who have accepted Visa®or

MasterCard®, have been consolidated for pretrial proceedings

in the United States District Court for the Eastern District of

New York. The plaintiffs, merchants operating commercial

businesses throughout the U.S. and trade associations, allege

that the defendants conspired to fix the prices for general

purpose card network services, resulting in the payment of

inflated interchange fees, in violation of the antitrust laws. In

January 2009, the plaintiffs filed amended and supplemental

complaints adding, among other things, allegations that the

restructuring of Visa and MasterCard, each of which included

an initial public offering, violated the antitrust laws. The

plaintiffs seek injunctive relief, actual and treble damages and

attorneys’ fees. National City and National City Bank entered

into judgment and loss sharing agreements with Visa and

other financial institutions with respect to this litigation. On

January 8, 2008, the district court dismissed plaintiffs’ claims

for damages incurred prior to January 1, 2004. This litigation

is also subject to the indemnification obligations described in

Note 25 Commitments and Guarantees. PNC Bank, N.A. is

not named a defendant in any of this litigation nor is it a party

to the judgment or loss sharing agreements but is subject to

these indemnification obligations.

Merrill Lynch. In December 2006, National City Bank

completed the sale of its First Franklin nonprime mortgage

origination and servicing platform to Merrill Lynch Bank &

Trust Co., FSB. By letters dated April 10, 2008 and June 16,

2008, Merrill Lynch notified National City Bank of its

indemnification claim pursuant to the purchase agreement.

141